Why expand in the UK after Brexit?

June 2023

The UK has a population of 67.9 million people, making it the third most populous country in Europe, after Russia and Germany. It is the fifth biggest economy in the world and the second biggest in Europe, with a steadily growing GDP since 1950.

In January 2020, the United Kingdom officially exited the European Union.

Brexit has undoubtedly caused a great deal of uncertainty for businesses operating in the UK. However, with uncertainty comes opportunity, and there are several business opportunities that have emerged in the wake of Brexit.

In this article, ALTIOS’ experts share how foreign companies can still grow their businesses and expand in the UK.

Attractive tax rates and business ecosystem

The U.K.’s corporation tax system is very attractive in comparison to other European destinations.

The UK corporation tax (CT) currently stands at 25%, since April 2023, which is one of the lowest corporation tax rates in the G20. The U.K. also offers a number of attractive tax credits and incentives that companies can take advantage of when expanding their business overseas.

“The UK has an ambitious policy agenda that focuses on sectors such as tech, life sciences, chemicals, AI, and renewables, explains Gus Wiseman, Deputy Director of Investment Opportunities & Propositions for the Department for International Trade.

“We are trying to attract world-leading talent and firms in these sectors and to do so we not only offer great financial incentives but also a very welcoming business environment“

Foreign companies should know that the Department has 32 clusters emerging across the country, where companies, governments, and universities have come together to create eco-systems of global prominence. For example, South Wales is one of the world’s foremost centres of excellence for semiconductors, with excellent infrastructure and supply chain for any companies that want to set up shop.

“The universities and schools in the region focus on the technical skills that are important for this sector, there are grants and incentives available, and everything is ready for SMEs to plug in and play.” Gus also points out that the UK government is always looking at policy with an investor lens and focuses on making regulation as easy as possible for foreign investors. “The UK offers major opportunities and supports businesses in achieving success“

Expand in the UK: subsidiary set-up

Brexit has not changed the opportunities of setting up a company in the U.K. in any fundamental way. It can still be a much faster and cheaper process in the U.K. than in other European countries, even for European companies.

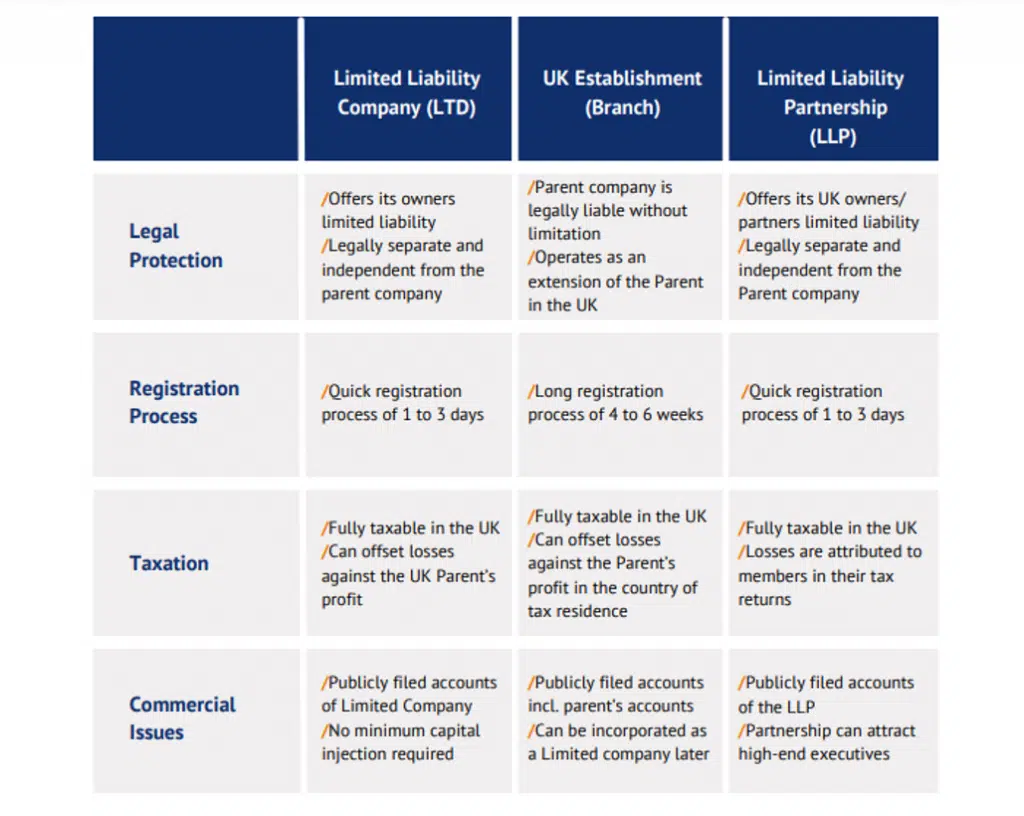

There are three types of entities foreign investors can choose from when settling in the UK: the Limited Liability Partnership (LLP), the UK Establishment (Branch) and the Limited Liability Company (LTD).

Whilst the Limited Liability Company remains the most commonly used option, each entity type carries varying advantages, as well as legal and compliance requirements.

Setting up a business in the UK is a very straightforward process. Usually, companies are incorporated electronically either on the same day or within one to three working days.

To register a limited company, an article of association is needed. This is a legal statement signed by all initial shareholders agreeing to form the company. The articles of association do not need to be written from scratch and can be amended further down the line by way of special resolution if needed.

Besides this, contact should be made with HM Revenue & Customs (HMRC) to complete the registrations for corporation tax (CT),

pay-as-you-earn (PAYE), and value-added tax (VAT) if the taxable turnover will be over £85,000 per year. Companies need to look into employer’s liability insurance, property insurance, and other areas that need to be covered.

To set up a company, the UK only requests proof of address and proof of identity of the future director(s), in order to create an electronic signature with the Registrar. It is not necessary to have a bank account while setting up the company, because this can be a time-consuming process in the UK.

Mergers and acqusitions

Until the beginning of 2022, mergers above a certain size needed to be cleared by EU authorities, because the UK remained subject to EU rules governing anticompetitive behaviour during the transition period. From January 2022 onwards, major transactions involving multinational entities active in the UK must comply with a new UK competition system as well as the existing EU one.

Larger deals involving companies with activities in the UK now need to be assessed by the European Commission and the Competition and Markets Authority in London. Even relatively small deals, which in the past would have been waved through by the EC, will need to be formally assessed by UK authorities.

At the same time, the UK government is in the process of tightening its regulation for clearing deals ,

which could lead to more deals having to be assessed by the Department for Business, Energy, and Industrial Strategy than in the past. Up to now, only one or two deals were called each year for further examination, but under the new proposal, M&A across a much broader range of sectors will now have to notify the BEIS department. This includes sectors such as energy, transport, technology, communications, data infrastructure, and computer hardware. If deals are not reported in these areas directors may face criminal charges and the deals could be declared void.

Brexit may also affect the smooth running of major debt restructuring deals. Previously, EU regulations effectively allowed court judgments in one jurisdiction of the EU to be recognized throughout the Union. No For this reason, support from our local teams can help with these updates.

The UK has also lost access to some of the benefits under EU Directives that facilitate cross-border M&A within the EU.

For example, the EU Cross Border Mergers Directive allows mergers between companies established in different European Economic Area (EEA) member states. Before the end of the UK/EU transition period, this included the UK but, following its expiry, UK companies can no longer participate in EU cross-border mergers.

Any merger between a UK and an EEA company must now take the form of a share or business transfer, followed by a dissolution/liquidation of the transferring entity.

Similarly, in a taxation context, UK companies have now lost the benefit of the EU “Parent-Subsidiary Directive” and “Interest and Royalties Directive”.

UK companies receiving dividends, interest, and royalties from companies established in the EU/EEA, will no longer be able to rely on those directives to optimize their international tax scheme (withholding taxes will now follow the domestic laws of EU/EEA member states).

Why expand in the UK through M&A?

Even though a merger with or acquisition of a UK company might require more steps and checks after Brexit, it is still one of the fastest ways for international companies to establish themselves in the mature and competitive British market.

Kaplan warns companies that are looking for M&A opportunities in the UK to not only take regulatory differences into account but to also be aware of cultural differences in the negotiation process.

“European owners are, generally speaking, less direct than Anglo-Saxons when it comes to discussing strategy or negotiating the terms of an agreement“, explains the finance director.

“It is, therefore, advisable to seek assistance from a third party with local experience and knowledge, that can help you adapt your speech and to bridge the cultural gap. Understanding the key steps of an M&A process and establishing trust between the two parties are essential elements for a successful outcome.”

ALTIOS teams can help you succeed your M&A operations, as well as guide you through the entire subsidiary set-up process. Book an appointment with one of our experts to discover our personalized offer.

Want to learn more?

If you’re looking for a more in-depth and step-to-step guide to expand in the UK after Brexit, download our whitepaper: How to expand in the UK after Brexit?