When it comes to expansion, growing your team involves several challenges. If you are looking to recruit and manage Human Resources in the UK, you need to get familiar with its recruitment practices and specific labor laws. Our article guides you through this whole process.

What are the employment laws in the UK?

The list of employment laws in the UK is extensive and very comprehensive. A few of the key relevant ones to be aware of to recruit and manage Human Resources in the UK successfully are:

1. National Minimum Wage: There is a National Minimum Wage which sets minimum hourly rates for workers split by age brackets.

2. Working Hours: Most workers in the UK are covered by the Working Time Regulations (1998) which stipulates limits to working hours, mandatory breaks and minimum annual leave entitlements.

- The limit is 48 hours a week on average over a 17 week period – unless the employee has agreed to “opt-out” of the maximum limit, agreeing to work more hours

- Most workers are legally entitled to 5.6 weeks paid holiday (20 days annual leave + 8 days public holidays)

- Discrimination: The Equality Act (2010) prohibits discrimination in the workplace on the grounds of age, disability, gender reassignment, marriage and civil partnership, pregnancy and maternity, race, religion or belief, sex and sexual orientation.

- Health and Safety: The Health and Safety at Work etc Act (1974) obliges employers to ensure the health, safety and welfare of their employees. Employers must provide a safe working environment, conduct risk assessments and provide relevant training where necessary.

- Employment Contracts: These are a legal obligation in the UK and are usually, but not always, prepared by solicitors. The contracts are comprehensive and include details on pay, working hours, holiday entitlement, notice periods and terms of dismissal.

- Dismissal and Redundancy: Employees are protected against unfair dismissal in the UK and employers must follow statutory procedures when making employees redundant.

- Maternity and Paternity Rights: The Maternity and Parental Leave etc. Regulations (1999) provides maternity leave, paternity leave and shared parental leave for eligible employees.

- Part Time Workers Regulations (2000): This regulation ensures that part time workers are entitled to receive the same “comparable treatment” as full time members.

What must be considered for foreign employees in the UK?

Since Brexit, Citizens of the European Union, the European Economic Area or Switzerland will need a visa to work in the UK.

A non-UK citizen will need a Visa and (if relevant) a separate right to work permit.

If a company wishes to employ a non-UK citizen in the UK and that individual does not already have a visa or the right to work, the employer can apply to become a sponsor. To become a sponsor, you will need, at a minimum, a legal entity in the UK (a limited company for example), a UK bank account and at least one employee already employed at company.

Becoming a sponsor can be a lengthy and expensive process, which can require specialist expertise from Visa-specialised solicitors in the UK.

Payroll

To recruit and manage Human Resources in the UK, you will need to set up a payroll scheme:

- PAYE Scheme: registration of your company with HMRC as an employer which allows you to deduct at source the relevant taxes and National Insurance (NI) which are owed to HMRC on each payroll run

- Pension Fund : It is a legal duty for employers to provide a private company pension scheme for their employees. There are a range of pension funds available to employers, each charging varying amounts for set-up and ongoing fees.

- Employment Contract: Employment contracts are a legal obligation in the UK and must be prepared and signed by both parties (employer and employee) by the time the employee begins their employment. Standard practice is to have the first contract prepared by a solicitor to ensure all key elements relating to UK employment law are covered.

- Employer’s Liability Insurance: Employer’s liability insurance is a legal requirement for employers in the UK and its purpose is to cover the costs in case employees become ill or injured at the workplace or whilst undertaking work duties.

Currency in the UK

The pound sterling (GBP) is the legal currency of the UK.

Payroll cycle

Payroll can be done on a weekly, fortnightly, monthly or four weekly basis in the UK. Payslips must denote exactly what elements are being paid, as well as include a breakdown of the PAYE (Pay as you Earn) tax and NI (National Insurance) paid.

Income tax – Employees

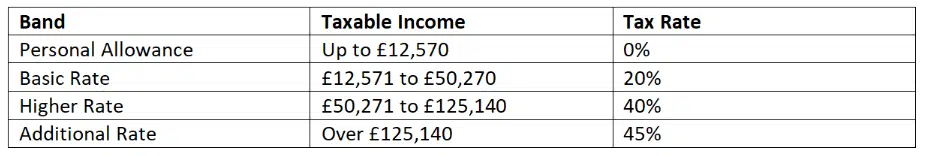

As of March 2024, the national personal income tax rates and minimum and maximum amounts of annual income for each tax bracket are as follows:

National Insurance – Social Taxes

Employees and employers contribute to the social security system, which funds services such as the NHS (National Health Service), State pensions, benefits for sick leave, maternity and parental leave; disability benefits, workers’ compensation; and unemployment benefits.

All employees earning over a certain threshold (more than £242 per week) must pay National Insurance as part of their payslip. As of the 6th April 2024, the primary rate will be 8% on monthly gross earnings between £1,048 and £4,189, and anything above £4,189 will be processed at 2%.

Employers contribute 13.8% on all earnings above a lower threshold of earnings.

PAYE and NI information from payroll is reported to HMRC every time a payroll is processed using a government programme called RTI (Real Time Information).

Pension

Employer’s are legally required to offer a private company pension scheme to their employees, even if the employees select to “opt-out” of the scheme. Employers are obliged to auto-enrol their employees, if they are eligible to join the pension scheme, though the employees can then decide to opt-out of the scheme if they wish.

Regarding contribution requirements, employers must contribute a minimum percentage of their employee’s earnings. This percentage varies depending on the contribution basis scheme selected. Employees also make contributions, with the percentage required varying depending on the contribution basis.

Holidays

The UK observes 8 national holidays, which are generally treated as paid leave for employees. The legal minimum entitlement for annual leave in the UK is 20 days + 8 days public holidays, the equivalent of 5.6 weeks.

There is no obligation to show holidays accrued or taken on the payslip in the UK, so long as these are kept track of elsewhere by the employer.