COVID-19 situation in the USA

The first signs of financial assistance from the $2.2 trillion stimulus package the U.S. federal government have trickled into the U.S. economy as millions of Americans need debt-relief options. A record-shattering 17 million Americans have had to register for unemployment since mid-March, a burst that is unprecedented.

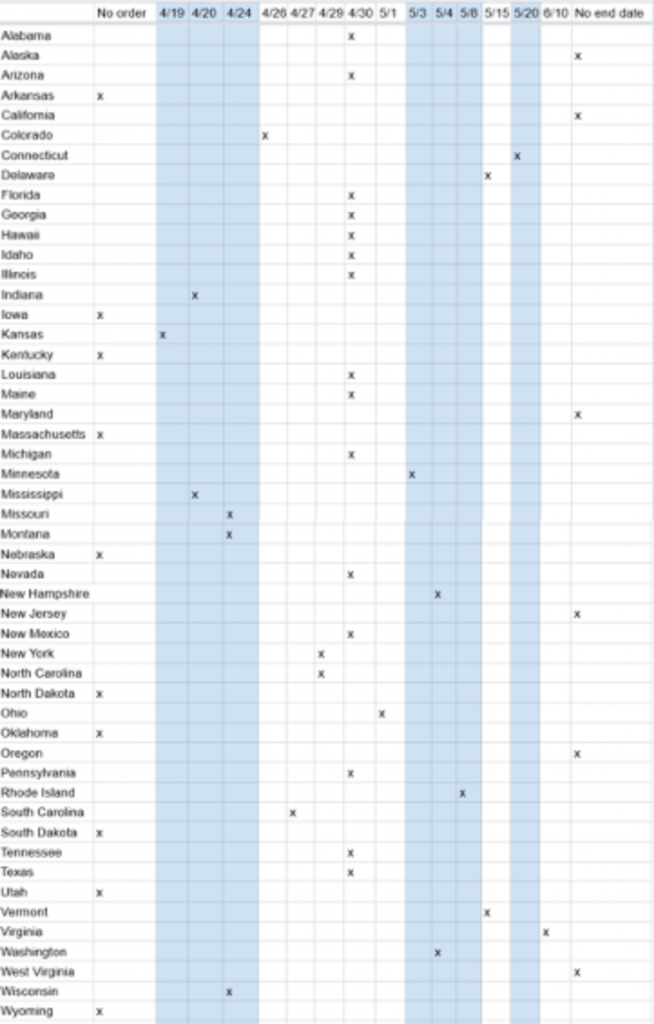

Stay-at-home orders issued by states (see table below) to stem the spread of the virus have frozen the economy and job losses will likely get worse as unemployment is expected to rise to 16% by May according to Oxford Economics’ forecasts.

The record-setting stimulus package allows the federal government to provide some financial relief to private business. Some of the financial assistance programs passed include stimulus checks, expanded unemployment benefits, 401(k) penalties waived, and small business relief.

Many taxpayers who have registered direct deposit information with the IRS recently received stimulus checks of $1,200 in their bank accounts. The IRS sent out a tweet announcing the deposits and promising to continue issuing them as fast as they can for qualified individuals.

The stimulus bill was signed into law by President Trump on March 27th. Now, more than a couple weeks later, the relief money is finally starting to make its way into all levels of the U.S. economy from individual consumers to small businesses to large corporations.

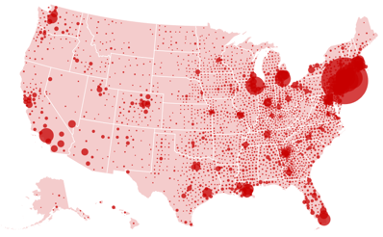

- Map of the confirmed cases of COVID-19 in the USA as of April 15, 2020 (source: Johns Hopkins CSSE):

- Overview of the stay-at-home end dates by state as of April 15, 2020 (source: CNN / The Mercury News):

On Friday, March 27, President Trump signed into the law the Coronavirus Aid, Relief, and Economic Security Act in response to the unprecedented economic disruption due to the Coronavirus (COVID-19) outbreak. This act contains $376 billion in relief for American workers and small businesses through the U.S. Small Business Administration (SBA). To learn more about the guidance and loan resources being offered to small businesses, click here.

The Paycheck Protection Program is a loan designed to provide a direct incentive for small businesses to keep their workers on the payroll. SBA will forgive loans if all employees are kept on the payroll for eight weeks and the money is used for payroll, rent, mortgage, interest, or utilities. Recently, the SBA removed the indication that if the borrower has any 20% or more owner that is not a U.S. citizen, the loan will be denied. The form can be found here and the deadline to apply is June 30, 2020.

Also, the SBA is offering Economic Injury Disaster Loans to small business owners up with up to a $10,000 advance and $2 million in working capital loans. These loans are designed to provide vital economic support to small businesses to help overcome the temporary losses in revenue that they are experiencing. The application can be found here.

In addition, the SBA is offering debt relief to small businesses. AS part of these efforts, the SBA will automatically pay the principal, interest, and fees of current 7(a), 504, and microloans for a period of six months. The SBA will also pay the same for new 7(a), 504, and microloans issued prior to September 27, 2020. Learn more about SBA debt relief here.

To find out about the criteria to apply for each program and to compare the options, click here.

- What protocol to follow should one of your employees contract COVID-19?

Should an employee contract COVID-19, they should not be required to produce any official documentation in order to be sent home. Proof can be provided at a later date, if needed. A notice should be given to all other employees in close proximity to the infected employee. Employers are not required to pay non-exempt employees for work they do not perform. However, many companies are continuing to pay their employees as to not cause financial strain on them for something outside of their control. Some employers are providing a stipend during this time that is less than the employee’s normal pay. Many states are stepping up to the plate and instituting emergency paid sick leave measures or grants to small businesses. Some states are also changing requirements for unemployment compensation to ease the widespread financial hardship. If an employee wants to return to work after contracting the virus, it is best to seek medical certification that they are no longer contagious. In addition to the Federal Emergency Paid Sick Leave Act in Response to Coronavirus, employers must follow the Family and Medical Leave Act when handling employees that need time off to care for family members with COVID-19. For employers that need to layoff portions of their workforce in the wake of the pandemic, they should look to ‘The Worker Adjustment and Retraining Notification Act’. Normally, employers must give 60 days’ notice, but the current situation very likely presents an exception to that rule.