PE: The Invisible Tax Trigger Costing Companies Millions

Expanding internationally requires adapting to foreign tax regulations, with Permanent Establishment (PE) central to determining tax liabilities. Misinterpreting PE rules can result in financial and reputational damage, making it a strategic priority for C-level executives to ensure compliance and safeguard growth.

Definition of Permanent Establishment and Why It Matters?

A Permanent Establishment usually refers to a company’s « fixed place of business » in a foreign country where the business activities are carried out, subject to local tax obligations. A PE typically includes physical locations (branches, offices, workshops, mines,…), but can also include the activities of dependent agents, representing the company abroad.

Permanent Establishment is defined in global frameworks such as the OECD Model Tax Convention on Income and Capital and the UN Model Double Taxation Convention. The OECD Model is a framework for negotiating bilateral tax treaties and helps standardize international tax rules.

Lessons from the Frontline: How Companies Manage PE Risk

Misinterpreting Permanent Establishment rules can result in severe financial and legal repercussions. Therefore, many multinational corporations have faced PE-related issues and consequences:

Dell (2016)

In 2016, Spanish tax authorities deemed Dell Ireland to have a PE through its subsidiary, Dell Spain. This decision was based on Dell Spain acting as a dependent agent, negotiating and finalizing contracts on behalf of its parent company.

Lesson: Closely monitor the activities of local agents to ensure they do not inadvertently create a PE.

Zimmer (2010)

Zimmer SAS, a French subsidiary of Zimmer Ltd (UK), was found by French tax authorities to constitute a PE. This ruling stemmed from commission agent activities carried out by Zimmer SAS, highlighting the importance of understanding the place of management.

Lesson: Clearly define operational boundaries to prevent subsidiaries from engaging in activities that could trigger PE classification.

Boston Scientific

In India, Boston Scientific successfully avoided PE designation by proving that its subsidiary’s activities were auxiliary in nature. This was achieved through detailed documentation that supported the limited scope of the subsidiary’s operations.

Lesson: Maintaining detailed and accurate documentation is essential for proving auxiliary status and avoiding PE liabilities.

Philip Morris (2002)

Italian authorities accused Philip Morris of avoiding PE designation by using local entities to manage its operations. This resulted in significant financial penalties and reputational damage.

Lesson: Operational independence between entities is crucial to mitigate both financial and reputational risks.

Roche Vitamins

Roche Vitamins avoided PE classification in Spain by demonstrating that its subsidiary operated autonomously, with independent decision-making authority. This governance structure was critical in preventing additional tax liabilities.

Lesson: Establishing robust governance structures helps reinforce operational autonomy and avoids PE disputes.

Triggering a PE? Here’s What Every Executive Must Know

Expanding into global markets brings both opportunities and tax implications. A permanent establishment (PE) arises when certain business activities create a taxable presence in a foreign jurisdiction. This diagram illustrates how key operational activities can trigger PEs and lead to tax liabilities.

Core PE triggers include:

- Fixed Place of Business: A fixed place of business constitutes a tangible, physical location where a company operates.

- Dependent Agents: Representatives negotiating or concluding contracts tie the company to local markets.

- Service Provision: Long-term engagements, often exceeding six to twelve months, create local obligations.

- Construction Projects: Infrastructure projects of significant duration embed the company within the local economy.

Once a PE is triggered, businesses face corporate taxes, potential double taxation, compliance costs, and penalties. This underscores the importance of aligning operations with robust tax planning to mitigate risks and optimize international growth.

New Triggers in a Digital Economy

Traditional triggers like fixed offices or dependent agents are being supplemented by digital PEs, where businesses with significant online sales or services face tax obligations without a physical presence. Jurisdictions like India have implemented Significant Economic Presence (SEP) rules to address this trend, targeting companies with substantial economic activity through digital platforms.

Similarly, remote work trends post-COVID are reshaping PE risks. Employees working across borders for extended periods may inadvertently trigger PEs, requiring businesses to reassess employment structures and tax liabilities.

How Does Permanent Establishment Work ?

Once a company officially establishes a Permanent Establishment in a foreign country, it becomes liable for corporate taxes on the income generated by its activities there. Determining how to allocate profits between the parent company and the PE poses a challenge ; profit attribution requires meticulous analysis to avoid double taxation and ensure that the foreign entity pays its fair share of taxes.

Tax treaties often include double taxation relief provisions. These measures allow companies to claim a credit for taxes paid in foreign jurisdiction, and prevent the same income from being taxed twice (in two different jurisdictions).

With the rise of digital platforms and remote workforces, profit attribution has become more complex. Countries are revising tax treaties to include rules for digital PEs, ensuring income generated online is taxed fairly. Companies must assess how these changes impact their global tax strategies and use updated treaties to avoid double taxation.

Types of Permanent Establishments and Examples

Understanding the nuances of permanent establishments (PEs) is critical for businesses expanding across borders. A PE signifies a taxable presence of a business in a foreign jurisdiction and is a cornerstone concept in international taxation. Here, we explore the four primary types of permanent establishments and their practical implications.

1. Fixed Place of Business

- Factories producing goods for distribution.

- Offices hosting managerial or operational staff.

- Branches providing customer support or regional management.

- Mines extracting valuable resources.

- Oil Wells driving the energy sector.

- Workshops performing specialized tasks.

Example: A multinational manufacturing firm with a factory in Germany will likely trigger a PE in that country, subjecting its operations to local taxation.

2. Dependent Agents

- Sales Agents closing deals in international markets.

- OESL Instructors delivering specialized training programs abroad.

- Financial Representatives facilitating transactions or investment opportunities.

Example: If a financial institution employs local agents in Canada to promote and sell financial products, those agents’ activities could constitute a PE for the institution in Canada.

3. Construction or Project PE

Projects that extend over a specified duration, typically 6 to 12 months, may also establish a PE. This category often applies to infrastructure or large-scale installation projects.

Example: A construction firm engaged in a year-long project to build a bridge in Brazil may establish a PE, necessitating compliance with local tax obligations.

4. Service PE

- Talent Acquisition services offered to local businesses.

- Payroll Management for employees working overseas.

- Financial Services provided on a prolonged basis.

Example: A consulting firm offering strategic advice over an 18-month engagement with a client in Australia would likely establish a PE in that country.

Exemptions to Permanent Establishment Status

Some business activities, even if conducted in a foreign jurisdiction, can be exempt from triggering a PE under international tax rules. These exemptions, outlined in tax treaties, typically cover activities that are considered preparatory or auxialiary to the company’s core business, such as:

- The storage or display of goods – when the company is storing, displaying or delivering goods in a foreign location without engaging in sales or contract negotiations

- The purchase of goods or collection of information – when the company’s activities are strictly limited to purchasing goods for the company or gathering market or operational information

- The combination of exempt activities – when the company conducts one or multiple exempt activities in a foreign jurisdiction

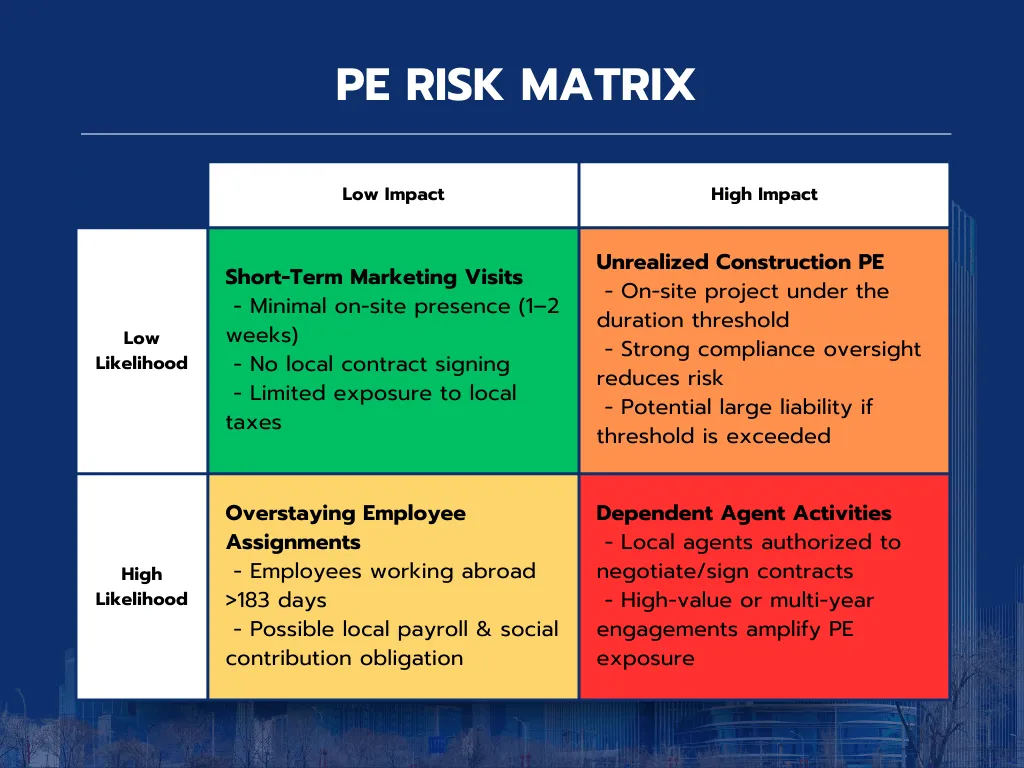

Avoiding Pitfalls: What Every Executive Needs to Know About PE Risks

Associated risks

• Tax Penalties: Non-compliance can lead to significant fines and interest, often exceeding millions in cumulative penalties (Source: PwC Global Tax Report, 2022).

• Double Taxation: Poor planning results in income being taxed in multiple jurisdictions, eroding profitability (Source: KPMG Tax Dispute Survey, 2020).

• Employer Liabilities: Local labor laws often include payroll taxes and social security contributions, potentially increasing employee costs by 30% (Source: Deloitte Global Payroll Compliance Study, 2021).

• Reputational Damage: Tax disputes can harm stakeholder confidence and brand equity, impacting stock prices by up to 5% in extreme cases (Source: Ernst & Young Global Compliance Report, 2019).

Risk Management Strategies

In order to mitigate PE-related risks, companies should adopt a proactive approach. This strategy consists in:

- Seek expert advice, such as ALTIOS, to navigate complex PE regulations, assess tax liability, and address risks related to BEPS before entering new markets.

- Engaging professional services for compliance and strategic planning

- Use software tools for tracking business activities and conducting PE risk assessments

- Establish internal governance structures such as PE compliance checklists, to ensure the reviewing and monitoring of all activities in foreign jurisdictions.

- Use an EOR (Employer of Record) service to manage the complexities of hiring and managing employees in a foreign country.

Optimizing Profit Allocation

• Maintain detailed records to support profit attribution between the parent company and PE.

• Use double taxation treaties to minimize tax burdens.

• Design operational structures to reduce PE exposure

Proper profit attribution can reduce effective tax rates by up to 20%, enhancing margins for global operations (Source: OECD Tax Database, 2021).

PE in a Global Context: What Every Market Requires

Permanent Establishment (PE) Rules Around the World

Companies establishing a Permanent Establishment in a foreign country often face varying local tax regulations. Indeed, while many countries adhere to the OECD Model Tax Convention, others adopt their own rules.

| Country Name | Notable Differences |

|---|---|

| Canada | Defines PE as a fixed place of business, including office, branch, mine, oil well, farm, timberland, factory, workshop, or warehouse. Canada follows the OECD guidelines but has some unique distinctions in PE definitions for different provinces. Canada Revenue Agency |

| USA | Follows the OECD model treaty closely but includes specific provisions for services and construction projects. A significant aspect is the “effectively connected income” rule, which broadens the PE scope beyond physical presence. IRS Guidelines |

| Brazil | Brazil does not have general PE rules under its domestic laws. Instead, specific agency PEs and double tax treaties define tax liabilities, making the regulatory landscape complex. Non-resident entities providing services may create a PE depending on the nature and duration of activities. Taxes and obligations in Brazil |

| Singapore | Singapore has an innovative approach, including digital presence and specific rules for service-based businesses. Activities such as using a server to conduct business or employing an agent with decision-making authority can trigger a PE. Inland Revenue Authority of Singapore |

| Thailand | PE is triggered by activities like having an employee or agent authorized to conclude contracts, but there’s a 6-month threshold for construction and service projects. Thailand also follows treaties that determine PE conditions. Thailand Revenue Department |

| China | China applies strict rules for PEs involving construction and service provision, with a 183-day threshold for service activities. Transfer pricing and related party transactions often come under scrutiny if a PE is established. Tax Residency of Companies in China |

| Vietnam | Fixed place of business, construction projects lasting over 183 days, or service provisions exceeding certain durations create a PE. Vietnam’s tax authorities may impose corporate income tax on profits attributable to the PE. Vietnam General Department of Taxation |

| India | India has adopted the OECD’s PE concept but expanded its scope with the Significant Economic Presence (SEP) rule, which addresses digital businesses and non-resident companies with considerable economic activities without physical presence. Income Tax Department of India |

| Germany | Follows the OECD guidelines but extends PE definitions to include dependent agents and digital sales platforms. Germany has a highly structured PE attribution system, which is especially significant for manufacturing and export-oriented businesses. Taxation of Permanent Establishment in Germany |

| Europe (EU) | PE definitions vary across EU member states, though there is a move toward harmonization, especially for SMEs through the Head Office Tax System initiative. PE rules can differ drastically between high-tax and low-tax jurisdictions within the EU. EU Commission Directives |

Adapting to Post-COVID and Digital Tax Trends

Countries like India and Singapore have introduced rules to capture digital economic activity, taxing companies based on significant digital presence rather than physical operations. Meanwhile, EU member states are working on harmonized digital taxation frameworks, signaling a shift toward taxing businesses in jurisdictions where they generate value, regardless of physical presence.

Similarly, the rise of remote work has pushed countries to reconsider thresholds for employee presence. Businesses must monitor how local authorities define PEs in this new environment.

Key Considerations by Country

- The definition of Permanent Establishment: Each country has its own rules for what constitutes a PE. While physical presence such as a factory or an office is often a key factor, some countries, like India, also take digital presence and economic activity into consideration.

- The thresholds and timeframes: Many countries use a 183-day threshold for determining whether service or construction projects constitute a PE. Short-term activities may not result in PE establishment, but prolonged operations likely will.

- Some countries, including Singapore and India, are modernizing their PE rules to address the rise of digital businesses. Companies that sell or provide services online need to be particularly careful in these jurisdictions.

- Regional harmonization efforts: The European Union is working to harmonize PE rules, particularly for small and medium-sized enterprises (SMEs). However, differences still exist between member states.

- Importance of local knowledge: Given the complexity and variations in PE rules across different jurisdictions, companies need localized expertise when planning their international activities to navigate the domestic tax laws effectively. Not only does this help avoid unexpected tax liabilities, but it also ensures compliance with local regulations.

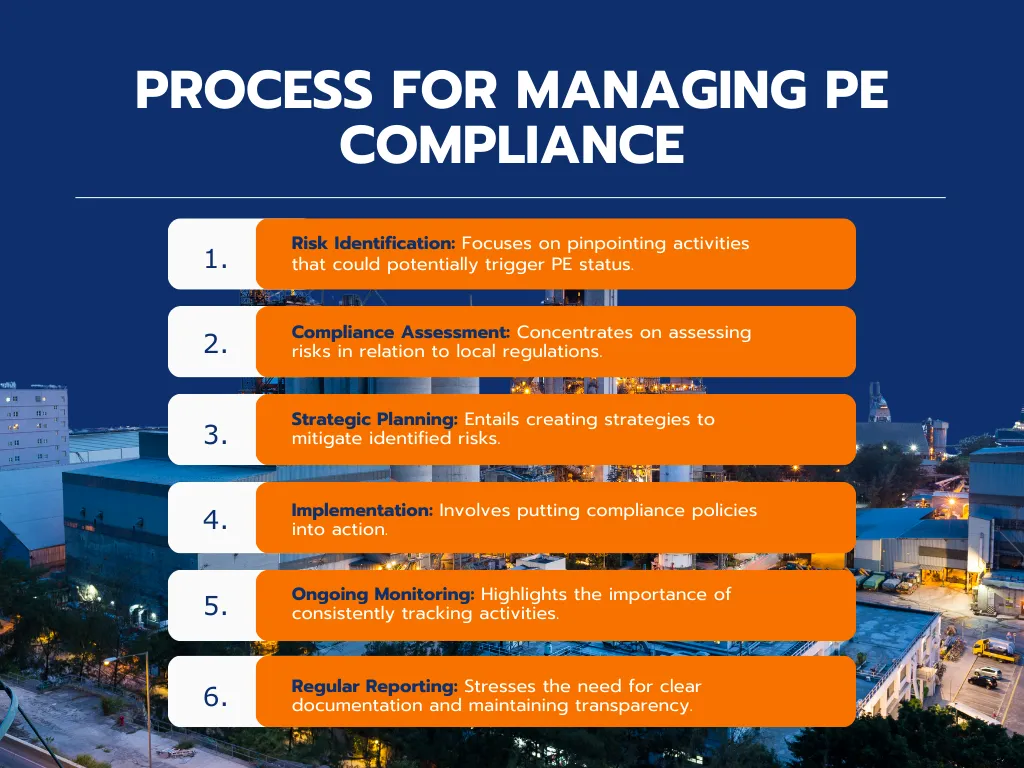

Analysis and Support for Managing Permanent Establishment

Importance of Professional advice

Dealing with the complexities of Permanent Establishments requires expert advise, given the variations in tax regulations across jurisdictions. At ALTIOS, we can help you navigate PE-related challenges thanks to our services designed to mitigate risks, ensure compliance and optimize tax positions. Our dedicated local teams are devoted to release your company’s staff from administrative constraints, including:

- Tax declarations, preparation and filing of the returns

- Reconciliation with the parent company according to the reporting schedule defined at the launch of the project (income statement, balance sheets, receivables, etc.)

- Edition of the general balance, income statement, general ledger

- Keeping and monitoring Intercompany balance and transactions

From Risk to Opportunity: How to Turn PE Challenges Into Growth

Managing Permanent Establishment (PE) isn’t just about compliance—it’s a strategic opportunity to streamline global operations, minimize tax exposure, and build resilience. Companies that adopt a proactive approach can turn PE risks into a competitive advantage.

Leadership Action Plan: Transforming Risks into Strategy

- Comprehensive Operational Audit

Assess current and future market activities to identify inadvertent PE triggers.

Impact: Early identification reduces potential penalties by 20–30% (Source: Deloitte Tax Avoidance Study, 2021). - Tailored Compliance Frameworks

Create customized guidelines for foreign operations to ensure alignment with local regulations.

Impact: Reduces compliance costs by an average of $250K annually (Source: PwC Global Tax Optimization Report, 2020). - Strategic Partnerships

Collaborate with global tax and legal experts to gain actionable insights and effectively mitigate risks.

Impact: Expert-driven strategies can save businesses 10–15% in global tax exposure (Source: McKinsey Global Tax Strategy Analysis, 2022). - Stakeholder Alignment

Engage boards, investors, and key stakeholders to reinforce PE compliance as a cornerstone of corporate governance.

Impact: Strengthens trust and promotes transparency in global operations. - Dynamic Monitoring

Implement real-time tracking systems to monitor cross-border activities and address potential risks proactively.

Impact: Prevents losses of $500K–$1M annually from non-compliance risks (Source: Ernst & Young Compliance Risk Study, 2021).

Turning Compliance Into Competitive Advantage

PE risks are inevitable in today’s interconnected global economy. But for businesses that approach them strategically, these challenges become opportunities to optimize operations, enhance governance, and support sustainable growth.

- Assess proactively: Begin with a comprehensive review of your global operations to identify and address potential PE risks.

- Invest strategically: Leverage tools, frameworks, and partnerships to turn compliance into a driver of efficiency.

- Lead with resilience: Build a tax strategy that aligns with your long-term goals and global expansion plans.

The future of global business success lies not in avoiding tax risks, but in embracing them as opportunities for resilience and growth. Companies that proactively manage PE challenges will transform compliance into a competitive advantage—positioning themselves to survive and thrive in an evolving global marketplace.

FAQ: Navigating Permanent Establishment (PE)

What is a Permanent Establishment (PE)?

A Permanent Establishment (PE) is a taxable business presence in a foreign country. It typically refers to a fixed place of business—such as an office, factory, or branch—where substantial business activities are conducted. PE can also include activities of dependent agents or long-term projects that create a significant economic presence.

ALTIOS Advice: Understanding PE rules is crucial for managing global tax obligations and avoiding penalties. Always assess whether your operations in a foreign jurisdiction meet the criteria for a PE.

What is the most common mistake companies make regarding Permanent Establishment?

The most common mistake is underestimating the scope of activities that can trigger a PE. Many businesses assume that only physical offices or factories count as PE, while in reality, activities like long-term service provision, dependent agent negotiations, and even digital operations can establish taxable presence. A lack of proactive monitoring and poor documentation further amplifies the risk.

ALTIOS Advice: To avoid this, conduct regular audits of your global operations, especially when entering new markets or deploying cross-border teams. Map your activities against local tax regulations to ensure compliance and mitigate surprises.

How can companies mitigate double taxation risks?

Double taxation occurs when income is taxed in both the country where the PE operates and the home jurisdiction. While tax treaties often provide relief, businesses must actively manage profit allocation to avoid disputes.

ALTIOS Advice: To mitigate double taxation:

1.Use tax treaties to claim credits for taxes paid in foreign jurisdictions.

2.Ensure accurate profit attribution by maintaining robust documentation of intercompany transactions.

3.Seek expert guidance to navigate complex transfer pricing rules and avoid tax disputes.

When is it worth consulting a professional advisor for PE compliance?

The moment you consider entering a new market, scaling operations, or deploying employees internationally, consulting a professional advisor is essential. Tax laws differ significantly across jurisdictions, and even minor oversights can result in substantial penalties or reputational damage.

ALTIOS Advice: Treat professional tax and legal advice as a strategic investment. Experienced advisors can provide:

1. Country-specific insights into PE triggers and exemptions.

2. Guidance on compliance frameworks tailored to your operations.

3. Support for tax optimization, ensuring profitability as your business expands globally.

Is a branch considered a Permanent Establishment?

Yes, a branch is generally considered a Permanent Establishment (PE) because it serves as a fixed place of business where substantive activities occur. However, if the branch only conducts auxiliary or preparatory activities (e.g., storage or information gathering), it may not qualify as a PE under certain tax treaties.

ALTIOS Advice: Treat branches as PEs for compliance purposes and leverage tax treaties to mitigate double taxation risks.

Is a subsidiary a Permanent Establishment ?

Not necessarily. A subsidiary is a separate legal entity from its parent company, and its activities are generally taxed independently in the jurisdiction where it operates. However, a subsidiary could create a PE for the parent company if it acts as a dependent agent—e.g., negotiating or concluding contracts on behalf of the parent.

ALTIOS Advice: To avoid PE risks, ensure the subsidiary operates autonomously and does not perform activities that could be attributed to the parent company under local tax laws.

How do I determine if my company has a PE risk?

Your company has a PE risk if it operates in a foreign country through a fixed place of business, dependent agents, long-term service contracts, or significant digital activities. Key indicators include employees concluding contracts, managing operations, or staying in a jurisdiction beyond local time thresholds.

ALTIOS Advice: Conduct a PE risk assessment with expert guidance to map exposure across markets. Implement compliance frameworks to monitor activities and prevent unexpected tax liabilities.

What’s the impact of PE on remote work policies?

Employees working remotely from a foreign country for extended periods can trigger a PE, subjecting the company to corporate taxes, payroll obligations, and social security contributions in that jurisdiction. Some countries have tightened PE rules post-COVID to capture remote work as a taxable presence.

ALTIOS Advice: Establish clear policies on remote work locations, track employee movements, and assess tax implications before allowing cross-border remote work arrangements.

How can I legally minimize PE exposure?

To reduce PE risk, companies should limit employees’ authority to negotiate contracts, maintain clear operational independence for foreign subsidiaries, and track business activities across jurisdictions.

ALTIOS Advice: Implement internal governance, use compliance checklists, and seek expert tax planning to align operations with local regulations while optimizing tax efficiency.