On December 29, 2023, China announced a new amendment to its Company Law. This new regulation was directly impacting foreign companies operating within its borders.

In this article, ALTIOS’ experts answer all your questions about this new regulation.

What is the new amendment to the Company Law in China?

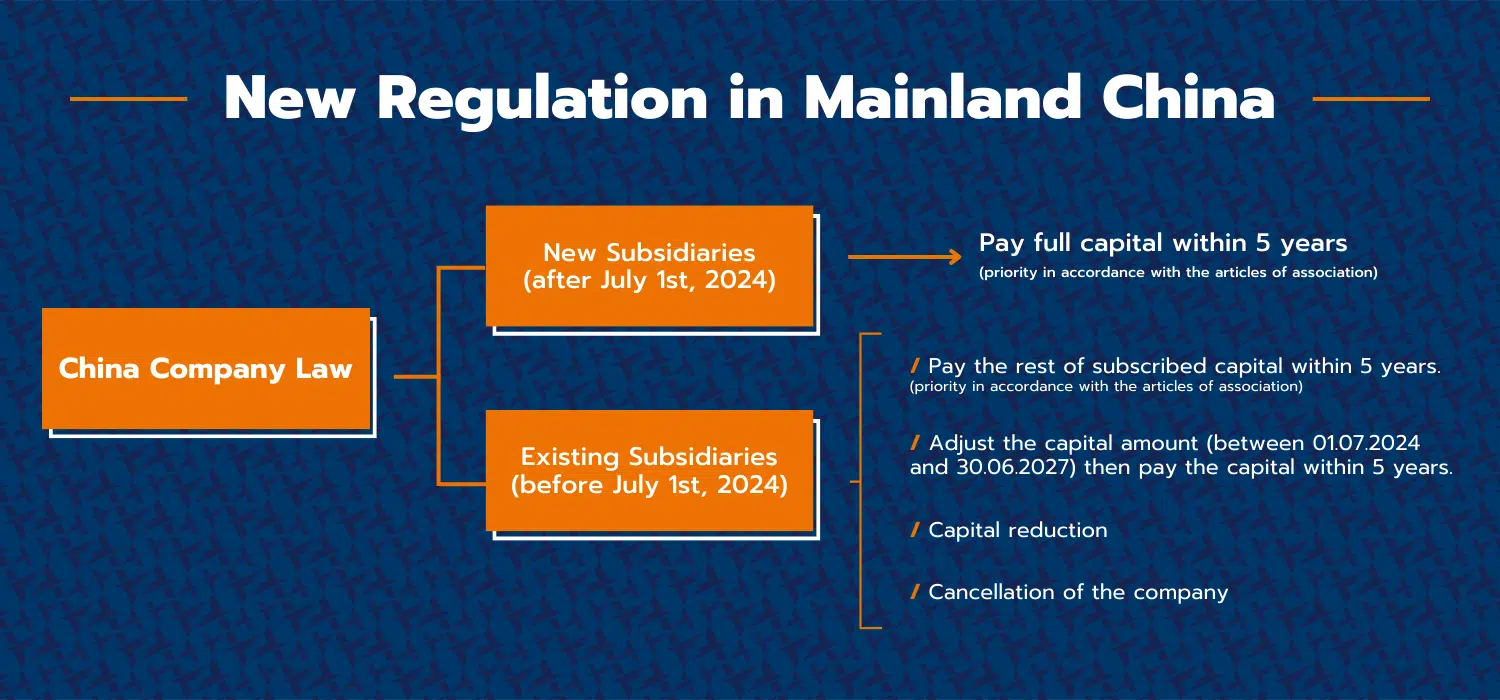

The National People’s Congress (NPC)’s Standing Committee adopted the new Amendment to China’s Company Law (applicable in Mainland China only) on December 23rd, 2023, with effect on July 1st, 2024.

This regulation has a direct impact on foreign companies operating within its borders. All private companies with the status of “Limited Liabilities Companies” (有限公司) are concerned. The companies that refuse to comply with this new amendment will receive a fine.

How did the amendment affect new entities established after July 1st, 2024, in China?

Newly established entities in China were required to comply with the new capital requirements within a 5-year timeframe starting from July 1st, 2024. They must pay their full capital during this period.

What about existing companies established before July 1st, 2024, in China?

Existing companies in China had to comply with revised time limitations for the payment of their

subscribed capital starting from July 1st, 2024. If the actual payment is not completed during the

adjustment period from July 1st,2024, to June 30th,2027, the company’s articles of association must be amended during this period. And full capital must be paid by June 30th, 2032.

Companies already established in China will have to choose between :

- paying the full capital

- adjusting the capital amount

- aligning the registered capital with what has already been delivered

- closing their companies

Is this a common problem?

Quite common. This is because any changes to business licenses need approval, and the system before meant companies may include room for ambitious expansion. Also, some foreign companies have adjusted their plans since COVID or put plans on hold without revisiting their registered capital. The new regulations mean this is the right time to address these issues.

What is the goal of this regulatory change?

This change aims to enhance transparency and integrity within the corporate sector in China, attract more mature and sustainable projects, and ensure that Directors, supervisors, and management face greater personal liability. This also enhances corporate accountability and governance standards.

How does this amendment reflect on China’s international business alignment?

The amendment signifies China’s efforts to align its business environment with international standards and best practices by enhancing transparency through improved information disclosure and ensuring the solvency of companies. This reform protects the rights of companies and creditors and fosters a conducive environment for foreign investment.

How can we help?

Our corporate services team in China can help you smoothly fix these issues or can manage all your accounting and compliance requirements, so you do not need to worry about keeping on top of issues like this.

If you need assistance with the set-up of local entities, restructuring, or the closing of companies, we’ve got you covered. Additionally, we can support you with the relaunch of activities and planning, including studies and business plans.

If you have a dormant subsidiary, we can help you close it, or we can help you consolidate your China business in an effective way to hire and manage the right team to support your suppliers and distributors across Greater China.

We can assist foreign companies already set up in China or planning to expand there in adjusting their capital or re-editing a new business license in China.