External growth is one of the quickest ways, for SMEs to grow their business and expand their operations (activities, services, clients) abroad. However, a Merger & Acquisition process faces many challenges, especially in an international context.

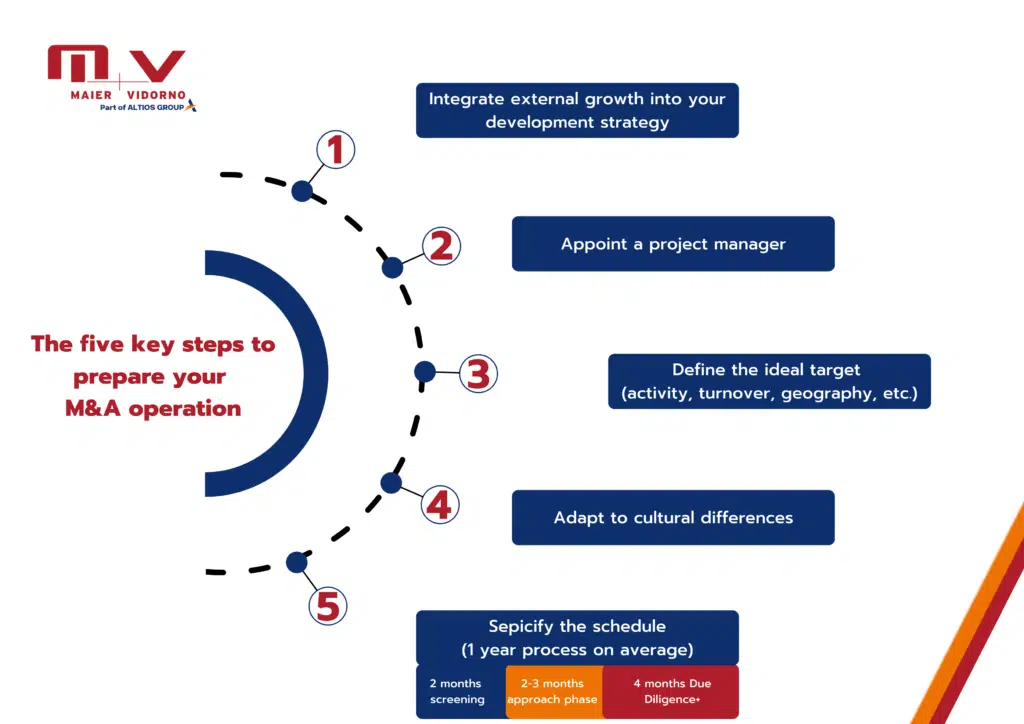

5 prerequisites are critical, before beginning your M&A operation in Germany.

1. Integrate external growth into your development strategy

/ External VS Organic growth: Define the best way to enter a new country, new market. External growth strategies (M&A or Strategic alliances), can be quicker in most cases, but preliminary analysis is mandatory before launching a full process. It can lead to value loss if not done correctly.

/ Verify your financing capacity (level of Enterprise Value) to assess the size of the target you can aim for.

2. Appoint a Project Manager

/ Name a Project Manager within your organization that will be the link between all the parties involved in the M&A operation (advisors, targets, banks, etc.)

/ Depending on the size of the project, define the scope of responsibilities of each member involved in the project.

In Germany: It may take some time to get initial feedback from the German targets, but once the interest of a target has been validated, it is important to be reactive and to be able to introduce the same people to the Germans, to ensure a good follow-up throughout the mission.

3. Define the ideal target

/ Define the company size (employee, revenue/EBITDA, balance sheet.)

/ Define the activity / services / products / sectors / clients

/ Define the geographical scope (region, country)

/ Define the other criteria (type of ownership, type of acquisition, type of clients, management team, etc.)

4. Adapt to cultural differences

/ Approach the potential targets: The first approach in the M&A operation is always complicated as we do not know if the targets are ready to sell their companies or open to sharing information. The idea is to create the opportunity. Each approach must adapt to cultural specificities to maximize the chances of opening the door and getting information.

In Germany: Our local teams approach the targets directly by phone and organize the first meeting in German to discuss your company and your objectives and those of the targets. The first approach in German allows to reassure the interlocutors a little and allows first fluid exchanges.

/ Negotiation phase and the M&A process: Adapting to cultural differences is key: respect the agenda/calendar, communicate clearly, do not rush, and communicate in advance, if changes any.

In Germany especially: Your presentations and arguments have to be explicit. well-founded, short, straight to the point, instructive and technical during exchanges. The relationship is not limited to meetings: make sure you stick to the schedule and if you have to cancel or postpone a meeting or a call, let your contact know well in advance and agree on a new date.

/ In the post-deal integration: Put in place a planning and a project manager to run properly the integration. Decide to change branding (depending on the market), decide to mutualize tools (IT, finance, HR, etc.).

5. Specify the schedule & prepare your documents

/ Define the planning of the M&A operation for the main steps: Duration of each step (2 months for the screening, 2-3 months for the approach phase, 4 months for Due Diligence, etc.). It’s mandatory to be structured and plan.

/ Adapt to the agenda/calendar of each target (might be quicker than expected if the target is in an active sale process/longer if the target is initially not ready to sell).

/ A M&A operation requires a large number of documents. You need to prepare the following:

- The Letter of Intent (LOI): A document outlining an agreement between two or more parties before the agreement is finalized.

- Data rooms (online data room): running a data room process requires gathering confidential documents that third parties (lawyers, investment banks, chartered accountants, etc.) may then access more easily during the process

- Due diligence: the process through which a potential acquirer evaluates a target company or its assets for an acquisition. The relevant areas of concern may include the financial, legal, labor, tax, IT, environment, and market/commercial situation of the company.

- After due diligence is completed, the parties may proceed to draw up a Definitive Agreement, known as a “merger

agreement,” “share purchase agreement” or “asset purchase agreement” depending on the structure of the transaction.

Looking to move into Germany?