The Fintech Ecosystem in Brazil is continuously expanding. With the largest financial market in Latin America, the country has became the biggest hub in this region.

In this article, ALTIOS’ experts share how foreign companies can take advantage of the Fintech Ecosystem in Brazil.

The Brazil’s Dynamic Ecosystem

Financial transformation is experiencing a global wave of growth, and Latin America is no exception in leveraging these new technologies to improve access to financial services for its population.

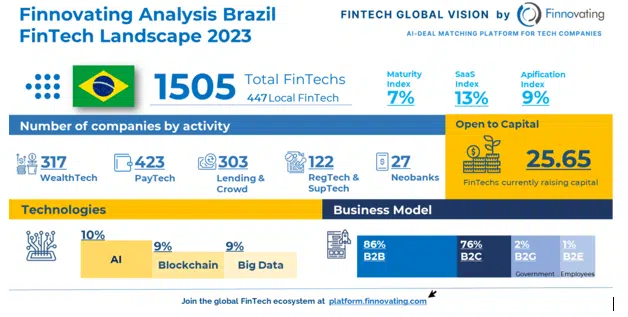

Brazil hosts a continuously expanding FinTech ecosystem with over 1500 startups. These startups encompass a wide range of areas, from digital payments to investment platforms and online lending.

In 2023, approximately 1505 fintech companies were registered, almost half being local companies (447 local fintech).

According to the International Monetary Fund, the proliferation of new financial technology and digital banks is associated with a reduction in lending spreads. Fintech companies do not just compete with banks and insurance companies; they also provide banks and insurance companies with new technologies and services. Indeed, the line between traditional financial companies and fintech companies has already begun to blur.

Source: https://finnovating.com/news/fintech_brazil_analysis_2023/

Brazil’s Fintech Dominance: Pioneering Regulation and Market Growth

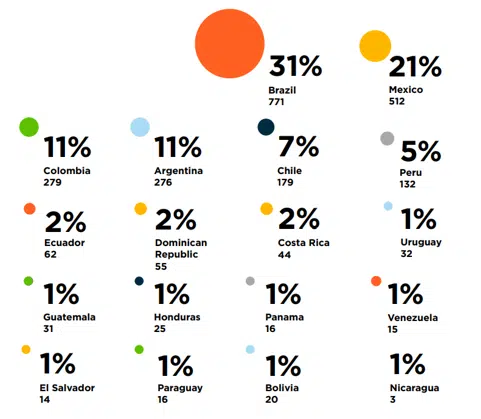

Brazil is the country with the largest number of fintechs in Latin America, representing more than 30% of the region’s total and accounting for 58% of venture capital transactions in Latin America. In addition, the largest digital bank on the continent was born in that country, Nubank, which has a valuation of more than US$50 billion and has already made its debut on the New York Stock Exchange.

Another factor that has driven the growth of the fintech sector in Brazil has been the progress in the regulation, which is characterized by encouraging and facilitating development scenarios for the industry. In 2013, regulation for payment institutions was issued to allow these entities access to the Brazilian payment system, which was only for banks.

In 2018, the Central Bank of Brazil gave the endorsement for fintechs to provide credit without requiring the intermediation of banks. It has also implemented regulations to regulate cybersecurity and crowdfunding activities. Another initiative has been the ‘open banking’ model, which allows the exchange of data between financial institutions.

The main destination countries for Brazilian startups are in Latin America and the Caribbean. According to Finnovista statistics at the end of 2022, the largest share are Mexico, with 22%; Chile, with 14%; and Colombia, with 9%. Outside the region, the country’s fintechs have expanded to the U.S. (11%), Europe (6%) and Asia (3%).

In addition, the high penetration of technology and the internet in Brazilian society has made it possible to exploit financial services through these means, encouraging customer participation and helping financial inclusion.

Fintech Regulatory Framework

Brazil and Mexico are two of the leading countries in the regulation of fintechs in Latin America. Both have taken steps to foster the growth of this industry while protecting consumers and ensuring financial stability.

In Brazil, the Central Bank has created a specific regulatory framework for fintechs with the objective of fostering innovation and growth of the industry, while ensuring compliance with international regulatory standards. The regulatory framework includes the creation of a specific registry for startups in the sector, the supervision of the activities of these companies and the implementation of security measures to protect consumers.

For its part, Mexico’s National Banking and Securities Commission (CNBV) has taken similar steps to regulate fintechs. The CNBV has established a regulatory framework for fintechs that includes the supervision of the activities of these companies, the creation of a specific registry and the implementation of security measures to protect consumers. In addition, Mexico has developed a favorable ecosystem for the growth of fintechs, with a large number of investors and a growing user base.

Ecosystem mapping in the region

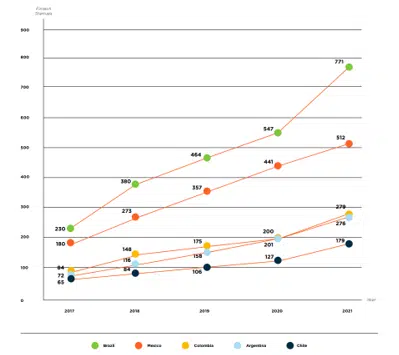

The Inter-American Development Bank (IDB) has reported that Latin America’s fintech sector grew by 112% between 2018 and 2021.

According to the IMF, three key factors seem to have fueled the fintech boom in Latin America:

- limited access to finance from banks and insufficient competition among banks

- improvements in digital infrastructure

- access to venture capital.

In this sense, some Latin American fintech sectors have all grown exponentially:

– Digital payments grew from $89 billion in 2017 to $215 billion in 2021 and the number of users of digital payment services exceeded 300 million in 2021. Digital banks had more than 30 million users in 2021, mostly concentrated in Brazil and Mexico.

– Business-to-business (B2B) fintech startups providing technological solutions to existing financial institutions on average grew annually by almost 50 percent between 2017 and 2021.

Figure: Distribution of Fintech Companies in Latin America and the Caribbean in 2021

Source: https://publications.iadb.org/en/fintech-latin-america-and-caribbean-consolidated-ecosystem-recovery

Figure: Evolution of the number of Fintech Companies in Latin America and the Caribbean (2018-2021)

Source: https://publications.iadb.org/en/fintech-latin-america-and-caribbean-consolidated-ecosystem-recovery

What are the Market Trends and Opportunities for 2024?

Growth of Digital Payments

Digital payments will continue to gain ground in Latin America. McKinsey estimates that the value of digital payments in the region will reach $2.5 trillion by 2025. This momentum is attributed to factors such as increased smartphone penetration, continued improvements in telecommunications infrastructure and the growing adoption of contactless payment solutions.

Development of Open Banking

The open banking trend is gaining momentum in Latin America. Open banking allows users to share financial data with authorized third parties, such as Fintech companies, to access new financial products and services. According to the Allied Market Research report, the open banking market is projected to reach $43.152 billion by 2026.

Rise of Cryptocurrencies

Cryptocurrencies are gaining ground in Latin America, with 46% of banked individuals willing to make payments with bitcoin. Experts highlight that cryptoasset companies are evolving into end-to-end financial technology providers, acting as one-stop shops for investors, consumers and other companies.

To sum up, the Brazilian market is considered a benchmark in the region for the Fintech industry. This is mainly due to “the size of the market” in Brazil, where 84% of the adult population in a country of 203 million inhabitants is banked.

It is also due to the fact that few banks control this large market, which generates multiple problems that entrepreneurs are trying to solve. A great example of this is NuBank, a provider of credit cards and banking solutions facilitating their use and reducing complicated bureaucratic aspects. Nubank is already considered the largest digital bank in the world outside of Asia and is the largest Fintech company in Latin America. In late 2021, it launched its IPO and went public on the New York Stock Exchange, becoming the most valuable company in Latin America.

Want to learn more?

If, like NuBank, you want to identify business needs that turn into global success, contact us or book an appointment with one of our experts! We can accompany you in your international growth project.

In addition to this article, read about the aerospace industry in Mexico.