Amidst a global awakening to environmental imperatives, the European Union has launched a major initiative: the European Green Deal. Recognizing the pressing challenges of climate change, biodiversity loss, and resource depletion, the Green Deal stands as a resolute commitment to reshape the trajectory of the European economy.

What is the EU Green Deal?

Since the Paris Agreement, the European Union has been committed to achieving carbon neutrality by 2050 to reduce climate change. The European Green Deal represents a series of measures to guide the European Union towards an ecological transition. Launched in December 2019 by the European Commission, the Pact aims to outline a roadmap (set by the IPCC) to avoid exceeding the 2°C warming limit (compared to the pre-industrial era). Thus, two main axes have been identified:

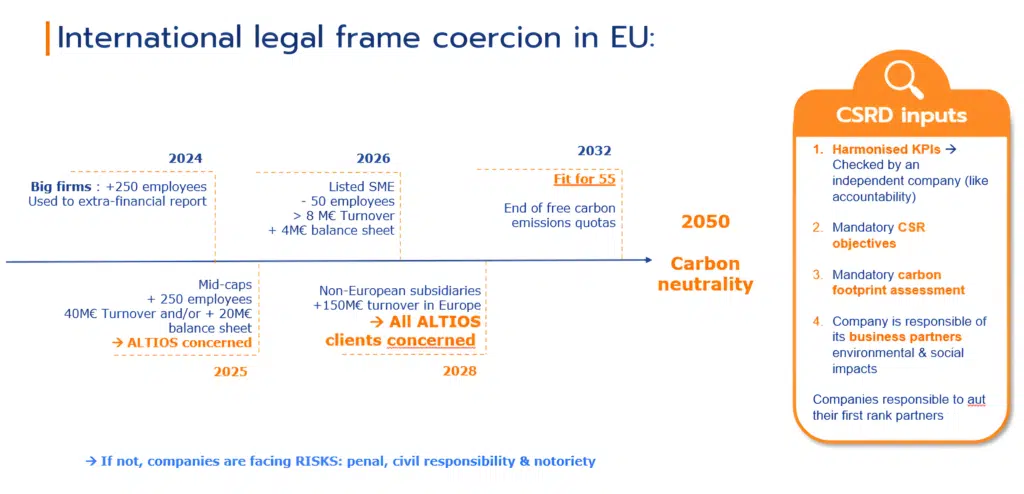

- The financing of the environmental transition is supported by robust investment plans. These plans involve investment funds such as Invest EU, operating with a financing structure shared between the public and private sectors, each contributing 50%. To further facilitate private investments, mechanisms such as taxonomy, which includes a carbon tax on New Carbon Forest Agreements (NACF) are implemented. Moreover, the Non-Financial Reporting Directive (NFRD) will progressively be succeeded and replaced by the Corporate Sustainability Reporting Directive (CSRD).

- The operational transposition of the Green Deal, with the establishment of new policies (agricultural, energy…) or customs procedures. In addition, it plans to end carbon quotas by 2032-2034 and initiate the CBAM (Carbon Border Adjustment Mechanism), incorporating a new carbon tax at the borders for raw materials and semi-finished products that are most polluting and produced abroad.

The European Green Deal’s transformative impact extends beyond environmental protection, offering considerable potential for economic growth, job creation, and technological advancement. The integration of key policies like the Farm to Fork Strategy and the New Action Plan for the Circular Economy underscores the deal’s commitment to creating a more sustainable Europe.

What is the aim of this initiative?

Europe is firmly committed to a circular economy to adopt a sustainable model. Its main objectives by 2030 are to:

- Tackle Climate Change: Reduce greenhouse gas emissions by at least 55% (compared to 1990 levels) and become the first climate-neutral continent by 2050.

- Protect the Earth’s resources: Preserve and restore ecosystems and biodiversity

- Develop a clean and sustainable economy: Mobilize industry and provide clean, affordable, and secure energy (Circular Economy Action Plan)

- Invest 1 trillion € in clean energy investments

- Reduce energy consumption by 32%

What impacts on Businesses?

The European Green Deal will introduce stricter social and environmental sustainability requirements for primary and industrial production. SMEs from third countries will need to provide more detailed information on products they export to Europe. Production and export costs may increase in the short term, but it will also enhance competitiveness in a sustainable global market in the long term.

Companies will also be encouraged, or even required, to adopt cleaner sources of energy. This could involve switching to renewable energy, improving operational energy efficiency, and investing in more environmentally friendly technologies.

The CSRD Directive will be a turning point for corporate transparency. Implemented on January 5th, 2023, it aims to :

- standardize sustainability reporting for companies and enhance the availability and quality of the disclosed data.

- strengthens the actions of economic actors (develop a CSR policy to reduce negative impacts and anticipate risks for companies)

- foster more sustainable finance

Consequently, a broader set of companies will now have to comply with mandatory European sustainability reporting standards and provide detailed information regarding their risks, opportunities, and material impacts associated with social, environmental, and governance considerations. They will be responsible for measuring their impact and auditing their first-tier partners in France and abroad.

According to their measured impacts, they may access financing at preferential rates. Thus, financial institutions will no longer fund companies or projects generating excessively negative impacts. Companies already subject to the NFRD will be the first ones to publish their reports (2025) according to these new rules.

Want to learn more?

ALTIOS’ teams can help you succeed in your internationalization strategy: improve your global performance by combining growth and environmental responsibility. Contact us or book an appointment with one of our Experts for more information.