Poland invests a lot in healthcare innovation, presenting a wealth of opportunities for international companies seeking to expand their businesses into this dynamic market. With a growing demand for medical services, increasing expenditure, and a strong focus on innovation, Poland is about to become a major hub for the Central and Eastern European (CEE) region.

In this article, ALTIOS’ experts share how foreign companies can take advantage from the healthcare sector in Poland.

What to know about the healthcare system in Poland

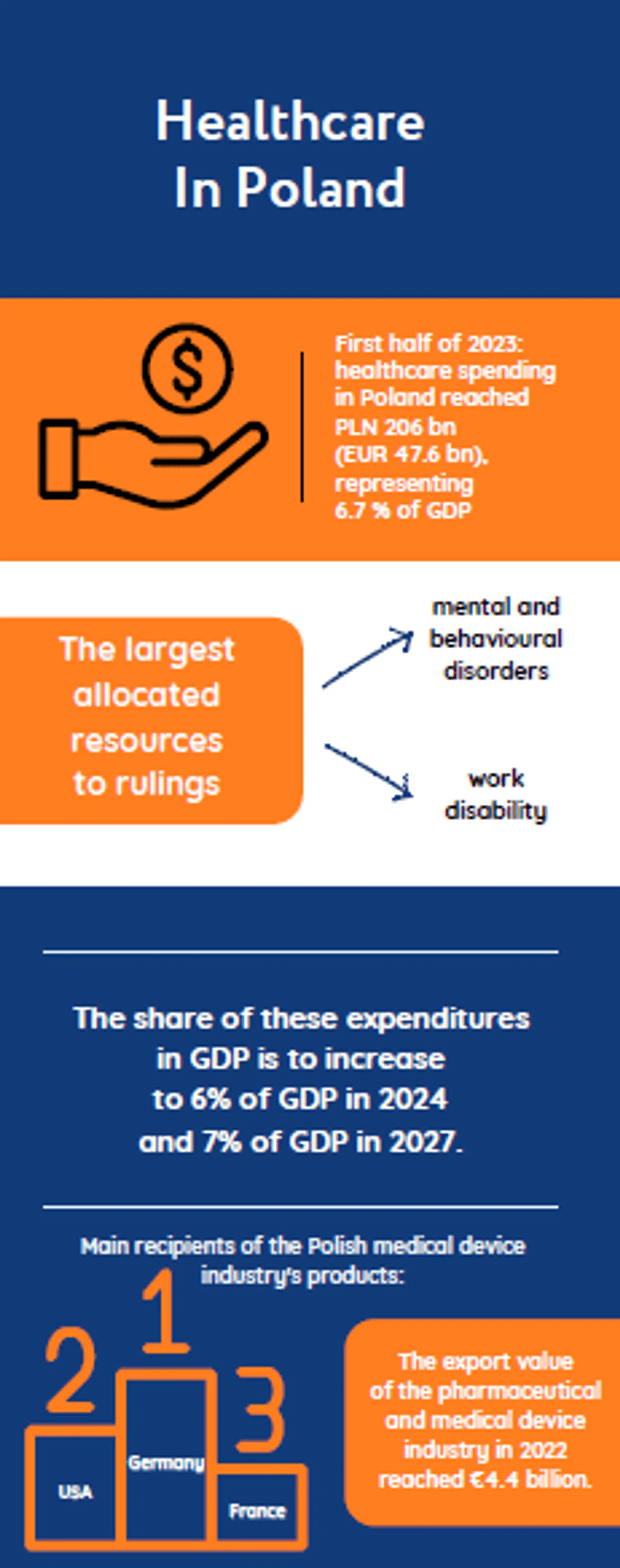

The Polish healthcare system is rapidly evolving, marked by significant developments in both the public and private sectors. Public expenditure on healthcare innovation is expected to reach 196 billion PLN (43.5 billion euros) in 2024, representing around 6.2% of the GDP. The projection for 2027 anticipates a further increase to 7%, reflecting the government’s commitment to improving healthcare access and quality.

The private healthcare market is also experiencing notable growth; expenditure on private medical services including spending on drugs and non-drug services exceeded 70 billion PLN (15.5 billion euros) in 2022. Between 2023 and 2028, it is expected to grow at an annual rate of 7%, as more and more Polish turn to private providers for faster and more personalized care. In the third quarter of 2023, around 4.7 million Polish opted for private health insurance, marking a 15% year-on-year increase. Health packages, a popular employee benefit, are a major driver of the subscription and medical insurance market, generating substantial revenues of 6.9 billion PLN (1.5 billion euros), with expectations of 15-20% annual growth until 2026.

Poland’s commercial clinical trials market is also thriving, valued at over $1.4 billion as of 2022. This segment represents about 15% of the country’s Research and Development (R&D) spending and has captured the attention of both foreign and domestic investors. Several acquisitions have been made in recent years, indicating the strong growth potential of this market.

Emerging trends in the Polish healthcare sector include a focus on cancer therapies, particularly on fast-track treatments for cancer patients. Additionally, there is a growing awareness of well-being topics, encompassing physical and mental health, in corporate and private contexts.

Healthcare innovation in Poland: What are the advantages?

The healthcare industry is progressively embracing digital solutions to enhance the efficiency of patient appointments and treatment processes. Since 2019, the country has mandated the use of electronic medical records (EMRs) and e-referrals, solidifying the sector’s commitment to digitalization. This digital transformation, however, needs robust cybersecurity solutions tailored specifically for the healthcare sector.

In addition to this keen appetite for new technologies, there is a high demand for medical services and growing expenditure on health. The sector is experiencing progressive consolidation, with major players such as LuxMed, Medicoer, and PZU leading the way.

The Polish healthcare sector has emerged as a leader in startup financing rounds in Poland, accounting for a significant 15% share of all startup transactions between 2020 and 2021. Top medical and healthcare startups include DEBN, StethoMe, and DocPlanner.

What challenges to face when exploring the Polish healthcare industry?

The Polish healthcare market is dynamic and growing, but it also presents challenges for global expansion.

- One of the significant challenges in the Polish healthcare industry is the severe shortage of professionals, including doctors, nurses, and also specialized fields such as psychiatrists, geriatricians, and pediatricians. This scarcity poses a considerable barrier to recruitment efforts. Within the next decade, the number of nurses could potentially decrease by 80,000, significantly reducing the potential of the group by ¼. Also, although the number of places in medical faculties is rising by 7% each year, the number of places in specialized medical programs is not increasing.

- The Polish healthcare system is also complex. It bifurcates into two distinct paths: the National Health Fund (NFZ) and private medical care. Private medical care offers faster and more comprehensive care, but it is paid for by the patient. The NFZ provides access to healthcare for all, but waiting times are often extended, and the system of refunds from public sources is very complicated and unclear.

Would you like to develop your business in Poland?

If you are interested in more insights on the Polish market, read our last article IT sector in Poland 2023: what opportunities for international companies or reach out to our experts.