Recruitment and Global HR Strategy

In Portugal, foreign companies can hire employees without having to set up a local company or permanent establishment, such as a branch or a representative office. To do this, the company must follow these steps:

- Register the foreign employer with the National Registry of Legal Entities (RNPC) to obtain a Portuguese Collective Entity Identification Number (NIPC).

- Appoint a fiscal representative in Portugal if the company’s headquarters are outside the EU. This is necessary for obtaining the NIPC.

- Enter into a representation agreement with the employee or a third party (such as an accounting firm) to represent the company in dealings with the Portuguese public authorities, including tax and social security agencies. The representative will be responsible for all taxes, including payroll processing, with Social Security.

The length of the procedure depends on how quickly the required documents are submitted. However, the process generally does not take much time, as the NIPC is usually issued within 5 working days.

What are the Labor Laws in Portugal?

The Portuguese Constitution (Constituição da República Portuguesa) and Labor Code (Código do Trabalho) cover the fundamental rights of workers. They regulate:

- Wages

- Working hours

- Health and safety

- Vacation allowance

- Work-life balance

- Access to equal opportunities

Employment usually begins with open-ended contracts that do not specify an end date and do not need to be in written form, with termination allowed only for reasons specified by labor laws. For temporary or specific needs, employers can use fixed-term or uncertain-term contracts, which must be written. Uncertain-term contracts, dependent on unforeseen events, can last up to four years, while fixed-term contracts can be renewed up to three times but cannot exceed two years in total. Other types of contracts, including part-time, teleworking, and those for foreign workers, also need to be written, with employers required to inform employees about relevant details, especially for work abroad.

The probation period in employment contracts allows either party to end the contract without cause. For open-ended contracts, this period can last up to 90 days, with possible extensions in specific situations. For fixed-term or uncertain-term contracts, the probation period is 15 days for contracts shorter than six months and 30 days for contracts lasting six months or more. During the probationary period, termination does not require prior notice or compensation, though employers must provide notice based on the elapsed period. Failing to provide proper notice necessitates paying the salary equivalent to the notice period.

Portugal has stringent protections for workers regarding job termination. Employees can be dismissed only if their behavior makes it impossible to continue their employment, if they are unproductive, produce low-quality work, are no longer suitable for the job, or if there is organizational restructuring.

Social security is both a right and a requirement in Portugal, with contributions from both employees and employers. Employers contribute 23.75% of an employee’s wages to payroll, while employees have 11% deducted from their paychecks for social security taxes.

Moreover, the Portuguese system has other specificities. After establishing your company and subsequently notifying the tax office of the commencement of activities, it is necessary to register the company and its managers with social security. Company managers can choose to be remunerated or not for their role. If they opt not to be remunerated, they must pay a minimum monthly social security contribution of 34.75% of the IAS (Social Support Index). In 2024, the IAS is set at €509.26, making the monthly payment €176.97. If they choose to be remunerated, they must pay a monthly social security contribution of 34.75% of their remuneration and deduct IRS (income tax) from it. If managers pay social security contributions in another country, they must ask to be exempted from payments in Portugal (whether they are remunerated or not).

To hire employees, the company must obtain workers’ compensation insurance and contract a company that provides occupational health and safety services. In addition, when hiring someone under Portuguese law, the contract must be drafted by a lawyer to prevent any potential issues.

What must be considered for foreign employees?

European Union, European Economic Area, and Swiss citizens can work freely in Portugal. Other foreigners need a work visa or residence permit for various employment types, including subordinate work, self-employment, and highly qualified activities. Work visas, including those for job seekers, are obtained before entering Portugal. A job seeker visa permits a stay of up to 180 days to find work. Residence permits, initially valid for two years and renewable for three-year periods, can lead to permanent residency after five years, provided all legal requirements are met.

Payroll in Portugal

In Portugal salaries are split into 14 payments throughout the year instead of 12 monthly salaries. Pay is doubled as Christmas and summer holiday statutory bonuses; these are the 2 extra months. This can be handled in several ways:

An employer can pay 50% of each allowance before the summer holidays (typically in June) and before Christmas, with the remainder paid out throughout the other pay periods of the year.

Alternatively, the employer can pay the subsidies in full before the holidays. The minimum wage is 820€, salaries cannot fall below this government-set national minimum, though collective agreements may set higher minimums.

Other potential payments include meal allowances and overtime. Meal allowances are not mandatory by law; however, most companies choose to provide them. Employees typically receive a meal allowance for each working day. The amount of the meal allowance is determined by the company and must be the same for all employees. The meal allowance can be paid via bank transfer, like the salary, or through a meal card. If paid via bank transfer, the current maximum non-taxable daily amount is €6.00. If paid via a meal card, the current maximum non-taxable daily amount is €9.60. These minimal amounts are not limited; the company can choose to pay higher amounts, but in that case, both the worker and the company will pay taxes on the difference.

Standard working hours in Portugal are 8 hours per day and 40 hours per week. Employees are entitled to mandatory rest periods and a weekly day off, usually Sunday. There are special laws which are in place to protect minors, parents, and informal caregivers. These protections include restrictions on overtime and night work, as well as specific conditions for dismissal.

As a rule, the normal working period cannot exceed 8 hours a day, 40 hours a week. The employer defines the work schedule providing the employees the right to:

- A rest period of at least 1 hour and no longer than 2 hours during the working day, to prevent working for more than five hours in a row;

- 11 consecutive hours of rest between two sequential working days;

- At least, one day off per week, which usually corresponds to Sunday

The mandatory weekly rest must be taken in continuity with an eleven-hour daily period of rest or by a complementary weekly rest. Some of these rules can be modified thanks to collective bargaining agreements or by individual agreements with the employees.

In Portugal, as of January 1st, employees are entitled to 22 working days of paid vacation per year, which must be used within the same calendar year. Of these, 10 days must be taken consecutively. It’s important to note that “working days” refer to Monday through Friday, unlike in some other countries where paid vacation is counted in weeks and includes Saturdays and Sundays.

There are, however, exceptions to this rule in the year in which the employee is hired, in the case of an employment agreement of up to six months and when the contract ends in the year following the hiring. There’s a 30-day limit to the vacation period in the same working year, except if agreed differently by collective bargaining agreement.

Every worker has the right to have paid vacations, which is mandatory, not replaceable for any payment. Violating this right constitutes a serious regulatory offence and can result in the payment of compensation to employees.

The national holidays in Portugal are:

- 1st of January: New Year’s Day (Ano Novo; national holiday).

- 12th of February: Carnival (Carnaval; regional holiday).

- 29th of March: Good Friday (Sexta Feira Santa; national holiday).

- 31st of March: Easter (Páscoa; national holiday).

- 1st of April: Easter Monday (Segunda-feira de Páscoa; regional holiday).

- 25th of April: Freedom Day (Dia da Liberdade; national holiday).

- 1st of May: Labor Day (Dia do Trabalhador; national holiday).

- 9th of May: Ascension Thursday (Quinta-feira da Ascensão; regional holiday).

- 30th of May: Corpus Christi (Corpo de Deus; national holiday).

- 10th of June: Portugal Day (Dia de Portugal; national holiday).

- 15th of August: Assumption Day (Assunção de Maria; national holiday).

- 5th of October: Proclamation of the Portuguese Republic (Implantação da República; national holiday).

- 1st of November: All Saints’ Day (Todos os Santos; national holiday).

- 1st of December: Restoration of Independence (Restauração da Independência; national holiday).

- 8th of December: Feast of the Immaculate Conception (Imaculada Conceição; national holiday).

- 25th of December: Christmas (Natal; national holiday).

Tax and Social Contributions in Portugal

In Portugal, the tax includes main taxes and social contributions. For example, the IRS (Imposto sobre o Rendimento das Pessoas Singulares), or the IRC (Imposto sobre o Rendimento das Pessoas Coletivas) in English means corporate income tax. For the IRS, annual income declarations must be submitted between April 1st and June 30th of the following year. This deadline may extend to December 31st for individuals with foreign income.

Who must pay these taxes?

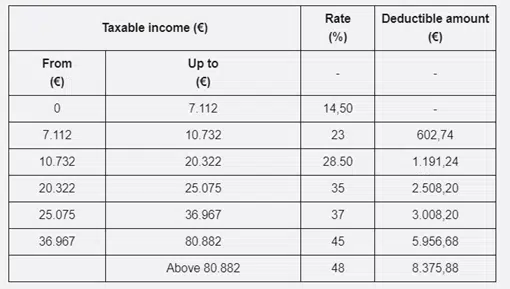

Residents in Portuguese territory must pay IRS on their worldwide income, while non-residents are taxed only on income earned within Portugal. Residency for tax purposes is determined by physical presence exceeding 183 days in any 12-month period, with partial days also considered. Alternatively, individuals with shorter stays may be considered residents if they maintain a residence in Portugal indicating an intent to make it their habitual home. The recent IRS reform in Portugal introduced the concept of partial tax residence, where an individual is deemed a tax resident from their first day of presence in Portugal and a non-resident from their last day of presence in the country. (see table for tax rate)

The deadline for filing IRC declarations is the last day of May of the following year. The ones concerned for the tax must arises from the generation of income by the respective taxpayers; mere asset ownership does not trigger IRC obligations. Resident taxpayers include public or private legal entities with headquarters or effective management in Portuguese territory. Generally, entities engaged in economic operations of a commercial nature are taxed on their worldwide profits. Non-resident entities with a permanent establishment in Portugal are also subject to IRC on income attributable to that establishment. A permanent establishment is broadly defined as a fixed place where commercial, industrial, or agricultural activities are conducted, including locations such as a management office, branch, factory, workshop, or the activities of a dependent agent in Portuguese territory. Non-resident entities without a permanent establishment are taxed solely on income sourced within Portugal.

The corporate income tax (IRC) for resident companies primarily engaged in commercial, industrial, or agricultural activities is set at a standard rate of 21%. Additionally, most municipalities can surcharge (derrama municipal) at a maximum rate of 1.5% on taxable profits. Small and medium-sized enterprises (SMEs) engaged directly and predominantly in these activities benefit from a reduced IRC rate of 17% on the first €25,000 of taxable income, with the standard rate of 21% applying to any amount exceeding this threshold.