ALTIOS Corporate Finance supports SUSTY WASTES SOLUTIONS in joining forces with Polmecanic Group

ALTIOS Poland’s Corporate Finance Department advised Susty Wastes Solutions on the transaction for the purchase of Polmecanic Group shares.

Why expand in the UK after Brexit?

Why should companies expand in the UK after Brexit? Discover the most recent opportunities to grow your business in the UK.

Savino Del Bene: $50M Revenue Boost from French M&A

Throughout its more than 120-year history, the family-based multinational has remained true to its origins of providing personalized solutions to meet the needs of its customers.

The five key steps to prepare your M&A operation in Germany

We give you the 5 key steps to prepare your external growth project in Germany!

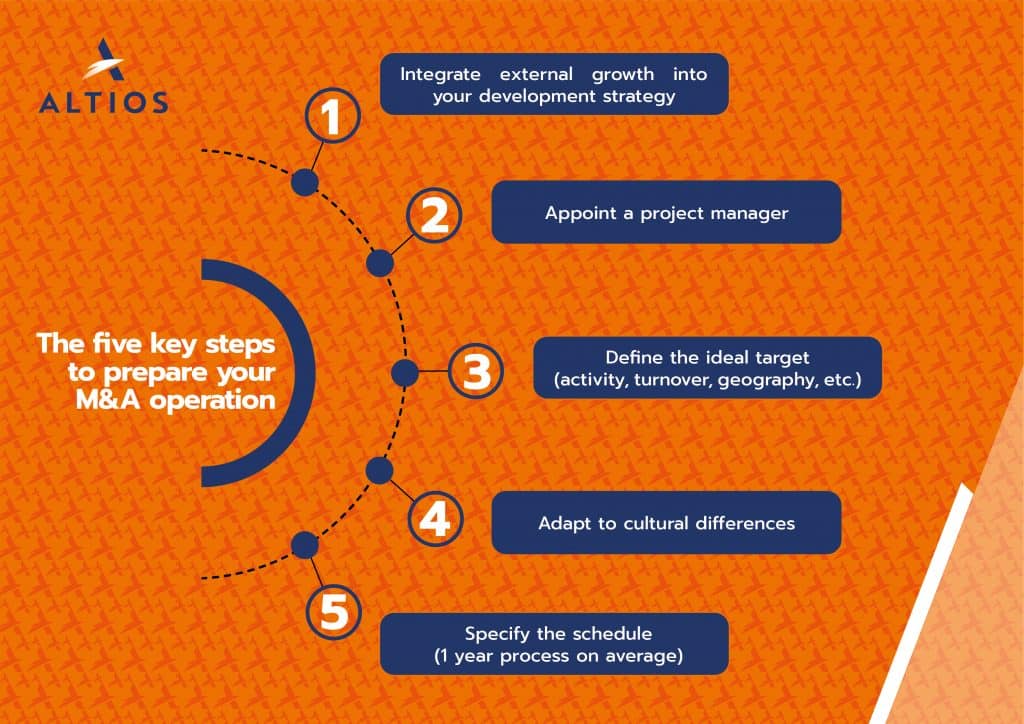

The five key steps to prepare your M&A operation

Discover our latest infographic and read our article to learn more about how to prepare an M&A operation!