Brazil satisfies all requirements for investments that deserve to go where foreign direct investment (FDI) wants. Its economic size, variety of industries, and suitable location attract international businesses and investors looking to take advantage of everything the country offers. This article will explain in detail why FDI in Brazil provides great promise, which sectors to focus on, and how we can help you realize your investment goals.

Reasons to Back Brazil for Foreign Investment (FDI)

All told a mix of resources, market size, and growth potential makes FDI in Brazil an extraordinary choice. Here is why:

- Unparalleled Market Access: Brazil is the economy in Latin America that serves more than 200 million consumers.

- Variety of Sectors: From agribusiness to biofuel, the country excels in a number of industries.

- Regional Influence: By virtue of being a MERCOSUR member, Brazil connects companies to important trade routes in South America.

- Investor-Friendly Policies: New reforms simplify regulatory procedures, thus increasing investor confidence.

Brazil’s membership in MERCOSUR goes beyond market access, serving as a gateway for international companies to engage in trade across South America. With preferential tariffs and streamlined logistics agreements, the bloc enhances Brazil’s position as a strategic base for regional expansion.

Brazil’s Economic Snapshot

| METRIC | VALUE | GLOBAL RANK (2024) |

| GDP | $2.1 trillion USD | 9th largest globally |

| Population | 214 million | 6th largest globally |

| FDI Inflows (2023) | $50 billion USD | Top 5 in emerging economies |

| Ease of Doing Business Rank | 124 (improving with reforms) | Focus on infrastructure & tech |

Recent policy initiatives have been pivotal in fostering economic stability and growth. Programs such as the Investment Partnership Program (PPI) have streamlined the privatization of infrastructure assets, including ports and airports, creating attractive opportunities for global investors.

Sectors with High Investment Potentials

Brazil offers fantastic opportunities in numerous hot sectors; they include:

1. Agriculture and Agribusiness: As a global agricultural powerhouse, Brazil plays central roles in food production, cosmetics, and biofuels. Investment in precision agriculture technologies, such as AI-driven crop monitoring and autonomous machinery, is transforming productivity in this sector. Brazil is also advancing in bio inputs, reducing dependency on synthetic fertilizers. Source: Brazil’s bioinputs market boasts four times global average growth, research shows | Reuters

2. Green Energy: The expansive natural resources of Brazil allow for a vast array of investments in hydropower, biofuels, and wind energy projects. With over $15 billion earmarked for offshore wind projects and green hydrogen production, Brazil is positioning itself as a future leader in renewable energy exports.

3. Technology and Innovation: An emerging digital economy and a rapidly growing startup ecosystem are gaining investor attention. Brazil’s startup sector has attracted $5.5 billion in venture capital in 2022 alone, making it a leading hub for fintech, health tech, and ed-tech innovation in Latin America.

4. Infrastructure Development: PPP in transport, logistics, and urban projects have considerable investment potential. Brazil’s infrastructure projects, particularly in port modernization and urban transit systems, align with its push for increased international trade efficiency.

5. Healthcare and Life Sciences: The burgeoning medical services and pharmaceutical demands create a good investment rationale. Brazil’s universal healthcare system opens doors for digital health solutions, telemedicine platforms, and advanced medical devices to bridge accessibility gaps.

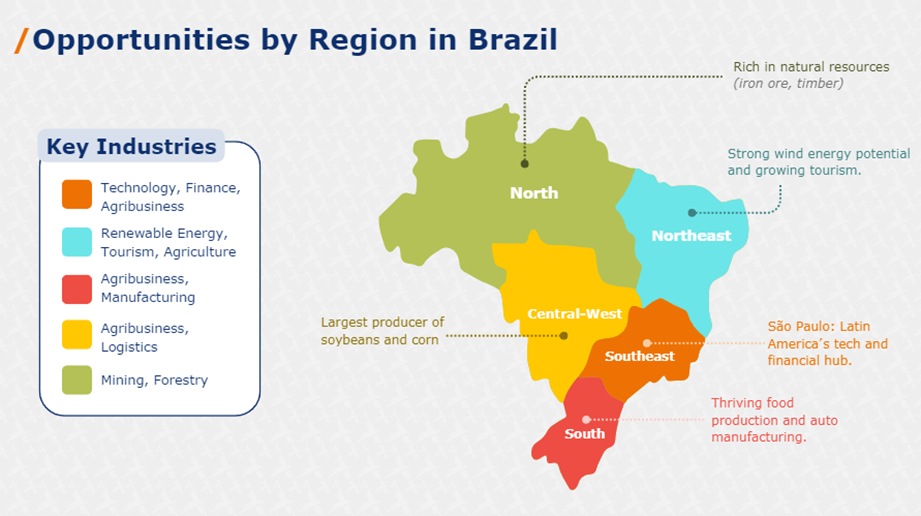

Opportunities by Region in Brazil

Brazil’s regions offer diverse investment opportunities: the Southeast leads in technology, finance, and agribusiness, with São Paulo as a tech hub. The Northeast excels in renewable energy, tourism, and agriculture. The South thrives in agribusiness and automotive manufacturing, while the Central-West dominates soybean and corn production with strong logistics. The North is rich in natural resources, driving mining and forestry industries.

FDI in Brazil risks

While Brazil offers considerable investment opportunities across a variety of sectors, it also presents unique challenges that foreign investors must carefully navigate. Below is a detailed overview of the key risks to consider, along with strategies to mitigate them effectively.

At ALTIOS, our experts understand the complexities of Brazil expansion and are here to provide you with the strategic insights and operational support necessary for success.

Currency volatility

The Brazilian real (BRL) frequently fluctuates against major global currencies such as the U.S. dollar, presenting a significant risk for foreign investors. These fluctuations can directly impact the value of returns when converted back into the investor’s home currency, introducing additional layers of uncertainty into financial planning.

Mitigation strategies

- Hedging instruments: Leveraging tools such as forward contracts or options can help protect against adverse currency movements.

- Portfolio diversification: Investing in multiple currencies and regions can balance potential losses from BRL fluctuations.

- Local financial expertise: Partnering with consultants who specialize in Brazil’s financial markets, such as ALTIOS can ensure a robust currency management strategy tailored to specific business needs

Political and economic instability

Brazil has experienced periods of political and economic fluctuations that have resulted in policy shifts, market volatility, and regulatory uncertainties. Key examples include changes in leadership and associated policy reforms, which have often brought significant adjustments to economic and environmental strategies. Instances of political unrest, such as demonstrations and government building occupations, have also affected investor confidence. These events highlight the dynamic nature of Brazil’s political environment, underscoring the need for investors to remain adaptable and informed in navigating potential challenges.

Mitigation strategies

- Political risk insurance: Consider securing insurance to safeguard investments against losses due to political events.

- Local partnerships: Working with local entities can help navigate shifts in policy and regulation, ensuring compliance and operational continuity.

Scenario planning: Incorporate potential political and economic disruptions into your long-term investment strategies to mitigate uncertainty

High interest rates

Brazil’s benchmark SELIC interest rate has consistently been among the highest in the world, significantly shaping the investment environment:

- Recent trends: In November 2024, the Central Bank of Brazil raised the SELIC rate to 11.25%, a level that far exceeds those of most developed economies.

- Historical context: Brazil’s interest rates have often reached double digits, with notable peaks such as 45% in 1999, impacting borrowing costs and the relative attractiveness of different asset classes.

Implications for investors

- Attractiveness of fixed-income investments: High interest rates often make bonds and other fixed-income assets more appealing than equities.

- Increased cost of capital: Companies operating in Brazil face higher borrowing expenses, which can affect profitability and feasibility.

Mitigation strategies

- Leverage fixed-income options: Investors can capitalize on high returns in Brazil’s bond market to balance equity risks.

- Explore alternative funding sources: International financing or joint ventures with local firms can help mitigate the burden of high domestic borrowing costs.

Regulatory complexity

Brazil’s regulatory framework is robust and multifaceted, encompassing sector-specific governance and a multi-tiered taxation system. This complexity often creates additional hurdles for foreign investors:

- Sector-specific oversight: Industries such as energy, telecommunications, and agriculture are governed by specialized bodies like ANEEL (electricity), ANP (oil and biofuels), and ANATEL (telecommunications).

- Taxation challenges: Federal, state, and municipal tax requirements necessitate meticulous due diligence and compliance planning.

- Data protection and compliance: For example, technology companies must adhere to regulations enforced by ANPD, Brazil’s data protection authority.

Mitigation strategies

- Local expertise: Partnering with consultancies such as ALTIOS, which combines global knowledge with local insights, can streamline compliance and operational efficiency.

- Tax incentives: Explore tax incentives offered by Brazil’s government to encourage foreign investment in strategic sectors such as renewable energy and technology.

- Digital solutions: Leverage compliance software to navigate Brazil’s complex tax and regulatory environment efficiently.

Key regulatory bodies

| SECTOR | REGULATOR | ROLE |

| Financial Sector | Central Bank of Brazil (BACEN) | Oversees monetary policy and financial institutions |

| Energy and Resources | National Electric Energy Agency (ANEEL) | Regulates electricity generation and tariffs |

| Technology and Telecom | National Telecommunications Agency (ANATEL) | Oversees telecommunications and broadcasting |

| Health and Safety | National Health Surveillance Agency (ANVISA) | Ensures safety in pharmaceuticals and food |

| Agriculture | Ministry of Agriculture (MAPA) | Oversees food safety and agricultural practices |

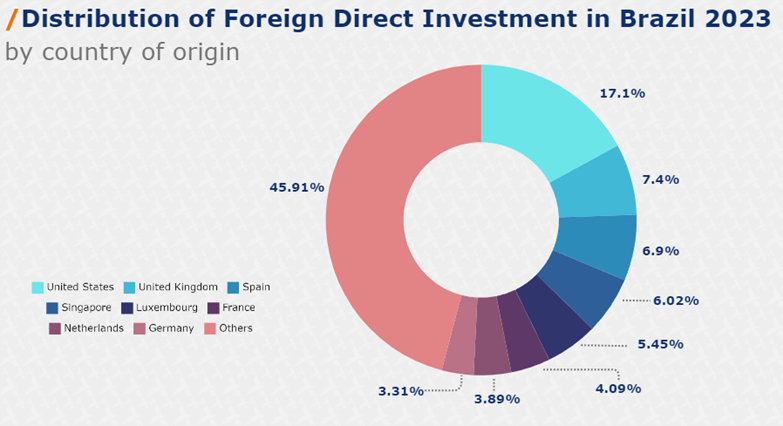

Top foreign country investors

In 2023, the United States was the largest source of FDI in Brazil, contributing 17.05% of the total. The United Kingdom followed with 7.41%, and Spain accounted for 6.87%. Singapore represented 6.02%, while Luxembourg (5.45%), France (4.09%), and the Netherlands (3.89%) also made notable contributions. Germany contributed 3.31%, and the “Other” category comprised 45.91%, reflecting investments from a wide range of smaller contributors.

Success story: Lehning

Lehning Laboratories, a French pharmaceutical company specializing in homeopathy and phytotherapy, successfully navigated the Brazilian market with the support of ALTIOS. The company sought to expand its operations to meet growing demand for natural healthcare solutions in Latin America.

Key achievements:

- Market entry strategy: ALTIOS provided tailored market research and identified the most effective entry strategy for Lehning.

- Regulatory navigation: Leveraging its expertise, ALTIOS facilitated compliance with Brazil’s stringent pharmaceutical regulations, including ANVISA approvals.

- Operational setup: From logistics to HR, ALTIOS supported the establishment of Lehning’s local operations, enabling the company to launch efficiently.

This collaboration underscores the value of working with experienced partners to mitigate risks and unlock growth opportunities in Brazil’s complex market.

Why Brazil remains a strong investment destination ?

Despite these challenges, Brazil’s size, diverse economy, and long-term growth potential position it as one of the most attractive FDI destinations globally. Its vast natural resources, expanding consumer market, and strategic role in global trade through MERCOSUR create significant opportunities for forward-thinking investors.

ALTIOS, with its global expertise and deep local knowledge, helps businesses navigate Brazil’s unique landscape, providing tailored solutions that maximize growth potential while mitigating risks.