In an increasingly globalized economy, businesses with cross-border operations face intricate challenges in aligning their financial transactions with international and local tax laws. In Mexico, Transfer Pricing Studies are not just a compliance requirement but a critical tool for maintaining transparency and avoiding financial penalties.

What Is a Transfer Pricing Study?

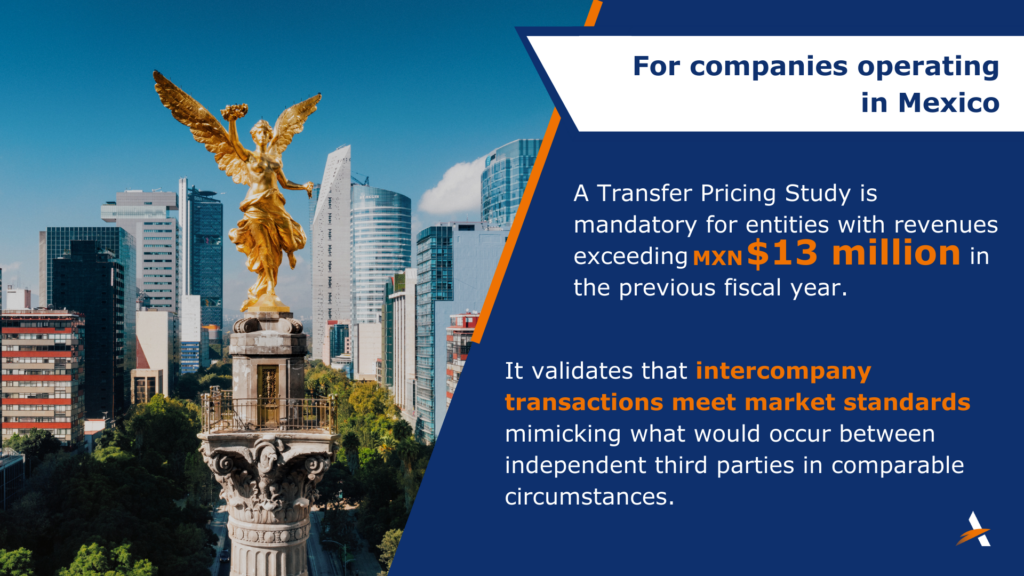

A Transfer Pricing Study evaluates transactions between related parties (whether domestic or international) to ensure they align with market prices. These transactions often include the transfer of tangible and intangible assets, such as intellectual property, technology, services, and financing agreements.

Why Is Compliance Crucial?

Failure to comply with transfer pricing regulations can lead to significant financial penalties ranging from MXN$99,590 to MXN$199,190. Beyond fines, non-compliance poses risks of double taxation and reputational damage, affecting both domestic and international operations. Mexican tax authorities have implemented rigorous standards to prevent tax evasion and ensure transparency.

Key Legal Framework

The Income Tax Law (LISR) governs transfer pricing compliance in Mexico. Articles 76 and 179 mandate taxpayers to demonstrate that intercompany transactions align with market prices. Specifically, businesses must file an annual declaration of related-party transactions. This includes detailed documentation on intercompany dealings (which is in the Annex of the MIS “Multiple Information Statement”) and must be submitted by May 15 of the year immediately following the end of the relevant fiscal year.

Documentation Requirements

Preparing a Transfer Pricing Study involves compiling:

• Financial statements and accounting records.

• Contracts and agreements between related parties.

• Detailed transaction data, including nature and value.

• The study also compares these transactions with market benchmarks to ensure compliance.

| BENEFITS OF TRANSFER PRICING STUDIES | |

| Transparency in Tax Reporting | Ensures transactions align with local and international tax regulations |

| Avoidance of Penalties | Reduces the risk of fines by adhering to compliance standards |

| Global Alignment | Supports businesses in meeting international tax obligations and avoiding double taxation |

| Audit Preparedness | Provides a robust documentation trail, ensuring readiness for tax audits |

Why Compliance in Mexico Matters for Global Business Success

Mexico’s dynamic economy and strategic position in international trade make it a vital hub for businesses operating across borders. Ensuring compliance with its robust transfer pricing regulations is essential not just for avoiding penalties but for fostering trust and transparency in a competitive market.

With its combination of local expertise and global perspective, Altios supports businesses in navigating Mexico’s complex tax landscape. From tailored Transfer Pricing Studies to strategic guidance, we help companies optimize their operations, ensure compliance, and unlock growth opportunities in Mexico and beyond.

Stay ahead in compliance and align your transfer pricing strategies with Mexico’s tax laws today!