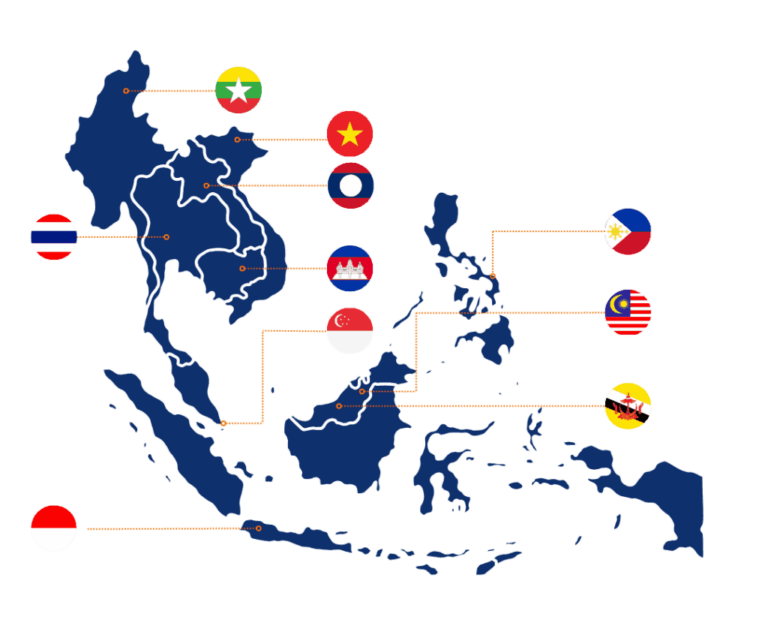

As global markets continue to evolve, businesses are seeking to diversify their investments and mitigate risks. Southeast Asia has emerged as a hotspot for Greenfield investments, thanks to its strong economic growth, strategic location and favorable investment climate. Coupled with the increasing adoption of the China +1 strategy, SEA is on the way to become a central hub for manufacturing and R&D in various sectors, including Electrical and Electronics (E&E).

What are the biggest industries in ASEAN?

1) Electronics

SEA is experiencing an accelerating digital transformation across industries. This transformation is driven by artificial intelligence (AI), the Internet of Things (IoT), augmented & virtual reality (AR/VR), quantum computing and autonomous machines, which creates plenty of opportunities for the semiconstructor industry.

With its low labour costs, enhanced manufacturing capabilities and trade agreements, the region is very attractive for E&E manufacturing. Many foreign companies are actively seeking alternative supply markets to China, and they can take advantage of this diversification by establishing production facilities in SEA.

Key Players

2) Agriculture

The agriculture industry in Southeast Asia plays a vital role in the ASEAN region’s economic productivity. Notable exports include palm oil, rubber, rice, seafood, and fruits. Despite its pivotal role, the industry faces some challenges including the adverse effects of climate change, overfishing and unsustainable agricultural practices, threatening its long-term sustainability.

However, the technological progress offer transformative opportunities for the sector. Innovative solutions can significantly reduce acquisition costs, gather valuable data through sophisticated farm monitoring systems, and simplify administrative processes. Thus, it promotes more sustainable and efficient agricultural production.

Moreover, Thailand, Malaysia, the Philippines and Vietnam offer favorable conditions for the development of large-scale agrifood technology manufacturing. These countries are also well-positioned to become leaders in integrating advanced technologies into their agricultural practices , driving both economic growth and environmental sustainability in the region.

The China +1 Strategy in ASEAN

What is the C+1 Strategy?

The China +1 Strategy is a business approach that aims to minimize supply chain dependancy on China by diversifiying manufacturing and sourcing operations into other countries. This strategy is designed to mitigate risks associated with over-reliance on a single country (political instability, trade tensions, rising labor costs …).

By adopting the China Plus One strategy, companies will benefit from :

- Supply chain resilience enhancement

- Costs savings – explore competitive labour costs, favourable exchange rates, and tax incentives in different countries

- the access to new markets, and the opportunity to learn their target audience more directly

The ASEAN Plan of Action for Energy Cooperation (APAEC)

The APAEC aims to enhance energy security, sustainability, and resilience in the region through collaborative efforts and shared goals. This plan is structured in phases, with each phase focusing on specific objectives and initiatives to address the region’s energy challenges and opportunities.

The Phase I (2016-2020) was focused on « the short to medium-term strategies required to achieve energy security cooperation and move towards greater connectivity and integration. »

With the Phase II (2021-2025),the region is committed to achieving Renewable Energy targets by 2025:

- 23% in Total Primary Energy Supply (TPES)

- 35% share in installed power

Significant initiatives will be taken to advance Southeast Asia towards a sustainable energy future. One key initiative is the creation of an ASEAN power grid, aimed at :

- expanding regional multilateral electricity trading

- strengthening grid resilience and modernization

- promoting the integration of clean and renewable energy sources

Another priority is also on promoting energy efficiency and conservation, with an ambitious goal to reduce energy intensity by 32% by 2025 based on 2005 levels. These efforts are particularly targeted at the transport and industry sectors, which are major energy consumers.

In addition, advancing energy policy and planning is necessary to accelerate the region’s energy transition and enhance its resilience.