Executive Summary: Why Mid-Cap Companies Should Enter the Indian Market

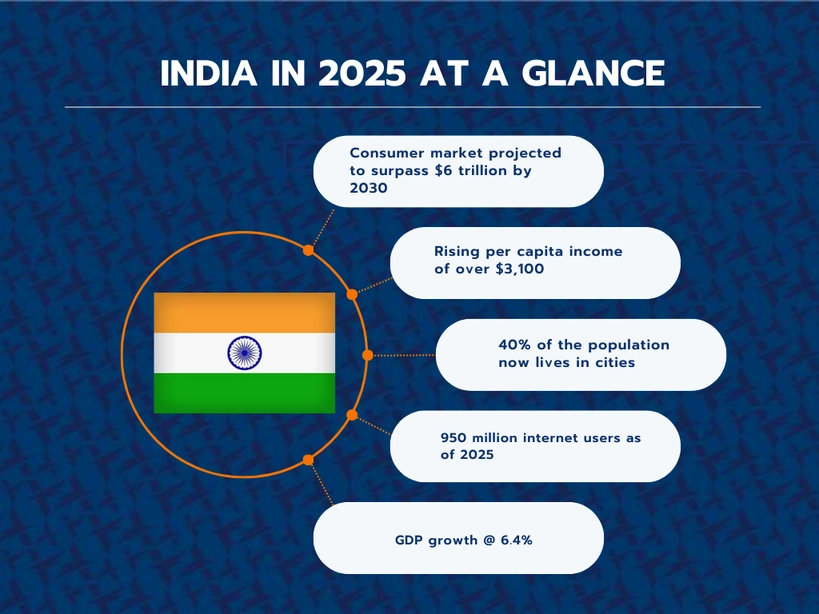

In 2025, India offers mid-cap companies a strategic growth engine combining economic scale, policy stability, cost advantages, and deep talent pools. With 8.2% GDP growth, a projected $6 trillion consumer economy by 2030, and geopolitical neutrality, India provides both market opportunity and operational resilience. Companies benefit from over 1.5 million annual engineering graduates, 1,700+ Global Capability Centers, competitive labor costs, and state-specific incentives across manufacturing, technology, and services sectors. The modernized GST regime, updated labor codes, and digital infrastructure further support simplified market entry, with EOR solutions enabling rapid deployment without immediate legal entity establishment.

India as a Strategic Business Destination: Hedging Against Global Uncertainty

India has become a vital pillar in corporate expansion strategies. It offers growth, operational stability, supply chain diversification, and geopolitical risk management. American and European mid-cap firms are adopting Asia Diversification strategies—expanding their business into India and other Asian countries like Vietnam and the Philippines to reduce their dependency on any one country. India is a preferred choice due to easier access to Research & Development talent, stable policy environment, and strong institutional frameworks.

India’s neutrality in global political tensions, its diplomatic relations with major powers, and its independent foreign policy reduce exposure to Global political unrest, making it a reliable partner for long-term growth.

Board-Level Growth Strategy: Expansion into India’s Growing Economy

India is emerging as a key growth market for foreign mid-cap companies, offering opportunities to boost competitiveness, strengthen resilience, and build long-term value. India offers unmatched scale in customers, supply chains, talent, and digital capability. Companies now set clear goals for their work in India and use the results to stay flexible and grow in the global market.

Senior executives and board members see India as a critical piece in their risk management strategy and as an innovation base. It is no longer about entering a new market—it is about creating a second pillar of operations.

Case in Point: TLT-Turbo partnered with M+V Altios for regulatory compliance, financial planning, and back-office support to establish a profitable subsidiary. This enabled TLT-Turbo to quickly build a strong sales and service team, exemplifying how board-driven strategies and local expertise ensure scalable, sustainable growth

Cost Efficiency with Strategic Depth: The Indian Market Advantage

India offers more than just cost savings, it provides room for strategic growth. Employment costs in India are now competitive with America and Europe, providing a favorable environment for foreign business expansion. Cities like Bengaluru, Delhi, Chennai, Mumbai, and Pune (ALTIOS branch offices are present) serve as global delivery hubs due to the presence of global tech companies, startups, service providers, and academic institutions that make collaboration and innovation easier.

Real estate and utilities remain affordable, especially outside Tier 1 cities. India also offers tax incentives and production-linked subsidies in electronics, EVs, pharmaceuticals, and renewable energy—creating business opportunities for mid-cap firms to establish sustainable operations in a growing economy.

Case in Point: Rothenberger faced high costs and stagnant sales in India. With M+V Altios’ intervention-recruitment, pricing adjustments, and operational streamlining-the subsidiary matched its prior annual turnover in just five months, transforming from loss-making to profitable and proving the strategic cost advantages of the Indian market

Talent Strategy: Building Capability in India’s Large Consumer Market

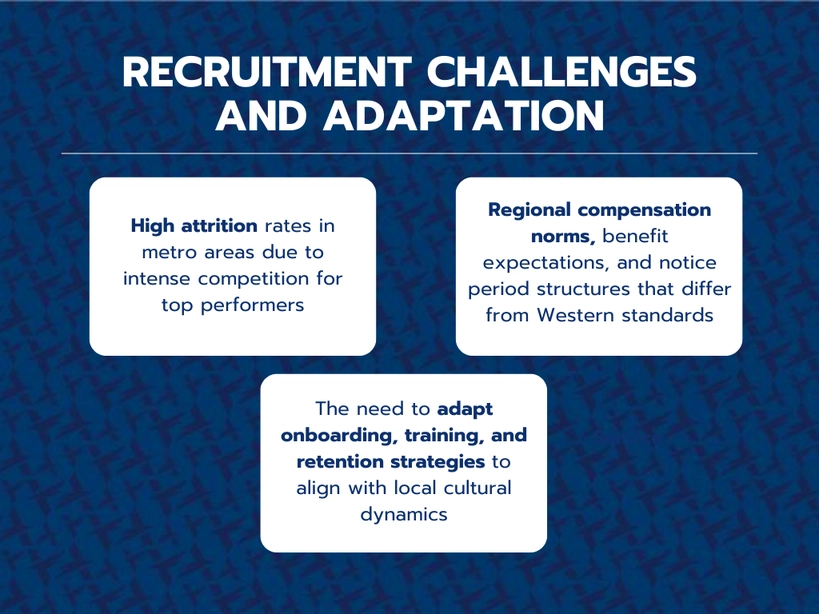

Foreign mid-cap companies expanding to India now focus more on skills than size, they are looking for strong leadership, expertise, and global execution to grow sustainably.

India’s workforce offers global-ready leadership and digital talent. With over 700 million in working-age population and strong output in STEM disciplines, firms can tap into engineering, AI, analytics, and finance talent. However, successful hiring needs local adaptation to handle attrition, compensation differences, and cultural onboarding for sustained talent engagement and retention.

India is home to over 1.5 million engineering graduates every year, one of the largest globally. Mid-cap companies can tap into this vast pool for both technical and managerial roles. Moreover, India’s Tier 1 cities offer a concentration of highly educated, English-speaking professionals familiar with global work cultures.

Global Capability Centres (GCCs) are a growing trend. Over 1,700 are operational in India, with expectations to reach 2,500 by 2030. Mid-sized European companies are setting up engineering, R&D, and customer support hubs to gain better efficiency, resilience, and innovation control.

Case in Point: Lemken leveraged M+V Altios to set up manufacturing operations and recruit skilled local talent in India. This ensured rapid scaling and strong leadership, underlining the importance of local adaptation and expert support in building high-performing teams

Tapping India’s Business Ecosystem: Beyond Consumer Opportunities

India is a hub for co-creation and innovation. With over 41% of the Indian population being middle class, 899 million+ mobile users, and an ecosystem of R&D, Global Capability Centres (GCCs), and startups, India enables global firms to develop, test, and scale next-generation solutions.

India’s position as a hub for Global Capability Centres is solidifying. What started as a back-office trend has evolved into full-scale innovation management. Today, over 1,700 GCCs include not just large MNCs but an increasing number of mid-sized European and American firms.

Unlike outsourcing, these GCCs are owned, branded, and embedded in the parent company’s strategic framework. With lower R&D costs, time zone alignment with Europe, and favourable IP regulations, mid-cap firms can own the full value chain of innovation from India.

India’s Software as a Service (SaaS) sector, Artificial Intelligence (AI) talent pool, and startup accelerators are helping mid-cap firms across Europe collaborate with Indian partners to co-develop and pilot products for global use. India also provides access to local and regional markets via Tier 2 and Tier 3 cities.

“Make in India” as an Export Platform: Business Expansion Strategy

The Make in India initiative was designed to boost domestic manufacturing and reduce import dependency, aligning with the goals of the government of India. Now, it’s increasingly being used for export-led growth—especially to Africa, the Middle East, and Southeast Asia. This makes India both a consumption market and a manufacturing and logistics hub for broader regions.

Foreign mid-cap firms are using India to supply the local market and have turned it into a regional export hub. By leveraging Special Economic Zones (SEZs), Free Trade Zones, coastal industrial clusters, and India’s Free Trade Agreements (FTAs) with ASEAN and other regions, firms can efficiently access and expand into broader Asian and global markets.

India’s Export Performance (2024-25): Market Potential

| Sector | Export Value (USD Billion) | Notes |

|---|---|---|

| Engineering Goods | 67.49 | Includes machinery, transport equipment, and industrial components. |

| Electronics | 19.07 | Significant growth driven by mobile phone exports, especially iPhones. |

| Services (Total) | 216.3 | Strong performance in IT and business services. |

| Textiles & Apparel | 34.0 | Major exports to the US and EU markets. |

| Iron & Steel | – | Decline due to weak global demand and oversupply. |

| Agricultural Products | 27.84 | Includes rice, spices, tea, and marine products. |

| Chemicals | 14.11 | Organic and inorganic chemicals. |

| Pharmaceuticals | 27.8 | Strong global demand for generic drugs and vaccines. |

| Gems & Jewellery | 40.0 | Significant exports of diamonds and gold jewellery. |

Source: Ministry of Commerce & Industry, Government of India

India’s Import Performance (2024-25): Industry Opportunities

| Sector | Import Value (USD Billion) | Notes |

|---|---|---|

| Electronics & Components | 113.5 | Includes semiconductors, mobile phones, and computer hardware. |

| Mineral Fuels & Oils | – | Largest import category due to energy needs. |

| Gold & Precious Metals | 55.8 | High demand for jewellery and investment purposes. |

| Machinery | 40.0 | Industrial and manufacturing machinery. |

| Chemicals | 30.0 | Raw materials for pharmaceuticals and other industries. |

| Coal | 25.0 | For energy production and steel manufacturing. |

| Fertilizers | 15.0 | Essential for the agriculture sector. |

| Iron & Steel | 10.0 | For construction and manufacturing. |

Source: Ministry of Commerce & Industry, Government of India.

Case in Point: Voestalpine, a leading manufacturer, partnered with M+V Altios to navigate India’s Bureau of Indian Standards (BIS) product registration. This enabled seamless compliance and efficient export operations, illustrating how expert local guidance can turn India into a regional export hub.

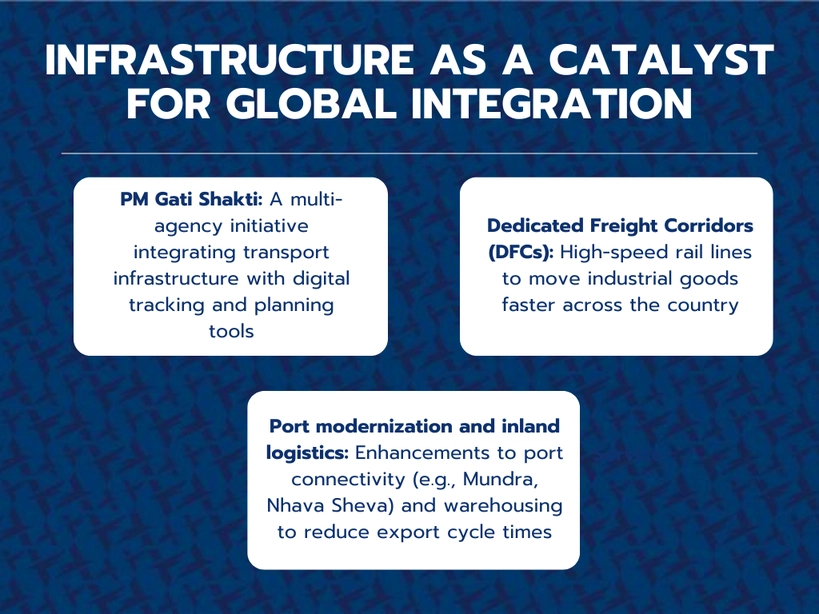

Strategic Business Expansion: India as a Node in Global Supply Networks

India is emerging as a production base and as a strategic logistics and export hub. India’s infrastructure push through PM Gati Shakti, the National Infrastructure Pipeline (₹111 lakh crore), Dedicated SEZs, and port modernization is transforming it into a global logistics hub. Enhanced connectivity and supply chain predictability now support export manufacturing, regional distribution, and global sourcing. India is ranked among the top 40 in the Logistics Performance Index.

Infrastructure investment in India is not limited to roads or railways. It is a nation-wide transformation agenda. The PM Gati Shakti program integrates 16 ministries and is creating end-to-end logistics efficiency through multimodal transport.

Smart cities like Pune (Maharashtra), Surat (Gujarat), and Kochi (Kerala) are investing in mobility, water, and energy systems. For mid-cap firms in HVAC, urban tech, green construction, and smart metering, these cities represent scalable opportunities.

Additionally, India’s digital infrastructure is a key enabler. Over 99% of villages are connected via Fiber-optic networks under BharatNet, allowing distributed workforces and rural service delivery models.

With ₹11.11 lakh crore allocated in the 2024–25 Union Budget for capital investment, sectors like transportation, logistics, energy, and urban development are seeing strong growth. This boosts demand for automation, construction materials, and energy systems which are opening opportunities for industrial foreign mid-cap firms to supply or partner in these projects.

State-Led Industrial Strategies: A Portfolio of Entry Points

Choosing the right state in India can make or break your market entry. While national policy offers the framework, states implement, regulate, and incentivize, States like Tamil Nadu (Southern India), Uttar Pradesh (Central India), Telangana (south-central India), and Gujarat (Western India) offer sector-specific infrastructure and incentives:

- Tamil Nadu: Focused on electric vehicles, electronics, and batteries.

- Uttar Pradesh: Building SEZs and corridors for defence and electronics.

- Telangana: Leading in life sciences, pharma, and biotech innovation.

- Gujarat: Strengths in auto components, renewable energy, logistics, and infrastructure.

Companies in India adopt a “localization” strategy—launching in priority states, collaborating with local government bodies and agencies, and customizing operations to regional regulations. This approach lowers risks, speeds up market entry, and builds stronger local ties.

GIFT City: Financial Gateway for Business Expansion in India

GIFT City (Gujarat International Finance Tec-City), located in Gandhinagar, is India’s first International Financial Services Centre (IFSC). Designed to consolidate offshore services under Indian jurisdiction, it focuses on:

- Banking

- Capital Markets

- Insurance

- Alternative Investment Funds (AIFs)

- Aircraft Leasing

- Fintech

Over 80 Alternative Investment Funds (AIFs) and global reinsurers are registered. The city offers a 10-year tax holiday, no GST on offshore transactions, and 24/7 international operations.

Aircraft leasing has become a major area of growth. India, the world’s third-largest aviation market, leases most aircraft from abroad. GIFT City enables onshore leasing—cutting costs and improving control.

GIFT City supports India’s ambition to be a self-reliant, globally integrated financial centre—and a strong entry point for foreign mid-cap firms in finance, aviation, and fintech.

Resilient Compliance: Business Structure and Regulatory Considerations

India’s regulatory landscape combines federal laws with state-level execution. Key areas include:

- GST compliance and filings

- Import/export compliance (e.g., AD code, IEC registration) is crucial for businesses looking to expand their business in India.

- Labor laws and new codes on wages, safety, and industrial relations

- Data privacy via the Digital Personal Data Protection Act (DPDPA)

- ESG regulations aligned with global frameworks

India’s legal framework is increasingly becoming business friendly, but nuances persist. For instance, while the GST regime has simplified indirect taxation, filing frequency and input credit tracking require reliable back-office systems.

The four new labour codes—Wages, Social Security, Industrial Relations, and Occupational Safety, are streamlining over 40 older laws. However, compliance during the transition period requires clear audits and communication with local labour departments.

Moreover, India’s Digital Personal Data Protection Act, 2023 (DPDPA) now mandates data localization for certain categories and requires that consent and processing be explicitly tracked.

Firms that embed compliance into their entry model see better results—fewer legal issues, faster setup times, and stronger relationships with local partners and regulators.

Using Employer of Record (EOR) to Launch Without a Legal Entity

To launch quickly, many companies use Employer of Record (EOR) or Professional Employer Organization (PEO) models, to hire locally without setting up a legal entity. EORs/PEOs offer compliance, HR, and operational support—ideal for testing the market.

This model allows mid-cap firms to:

- Deploy sourcing or sales teams immediately

- Ensure legal payroll and HR processes

- Maintain flexibility while evaluating long-term opportunities

Altios provides integrated EOR and incubation platforms across its Indian offices in Bengaluru, Delhi, Chennai, Mumbai, and Pune.

PESTEL Analysis for Foreign Businesses Planning to Enter the Indian Market

When expanding into a large, complex economy like India, foreign mid-cap firms must evaluate macro-environmental factors using a structured approach to maximize market potential. The PESTEL framework—Political, Economic, Social, Technological, Environmental, and Legal—helps decision-makers build informed strategies.

| Factor | Key Features |

|---|---|

| Political | Stable democracy, policy-led governance, liberal FDI, and a push for self-reliance through Make in India. |

| Economic | 6.5–7% GDP growth, cost-effective talent, favourable inflation and interest rates, growing middle class. |

| Social | Young population (median age is 28), 40% urbanized, regional language diversity, high digital use. |

| Technological | Advanced IT backbone, strong digital ecosystem, AI adoption, improving IP protections. |

| Environmental | Green energy initiatives, ESG focus, climate action goals. |

| Legal | Unified Goods and Service Tax (GST) regime, reformed labour codes, evolving data protection, and improving investor safeguards. |

Political: India remains one of the most politically stable democracies in Asia. The continuity in leadership and a reform-focused government have resulted in a high rank in the World Bank’s Ease of Doing Business Index. Key FDI policy relaxations have encouraged 100% ownership in several sectors including manufacturing, services, and infrastructure. This gives foreign mid-cap firms confidence that investments are protected under bilateral treaties and dispute resolution frameworks.

Economic: With a projected GDP growth rate between 6.5% and 7% in 2024–25, India is one of the top five fastest-growing large economies globally. Inflation has been controlled within the 5–6% range, and interest rates have remained stable, helping create a predictable investment climate. The middle-class population is expected to cross 500 million by 2030 which makes it a demand engine. Foreign mid-cap companies can leverage this with differentiated pricing strategies and product localization.

Social: India’s median age is 28.4 years. This youthful demographic supports long-term labour availability, consumption, and innovation. Digital literacy is rising in rural and semi-urban areas, driven by affordable smartphones and internet plans. Foreign mid cap companies launching in India often develop separate go-to-market strategies for urban vs. rural markets, as consumer preferences and purchasing power vary significantly.

Technological: India ranks among the top three countries globally in digital payments volume and internet usage, highlighting its consumer market potential. Over 950 million internet users are expected by the end of 2025. The government’s Digital India initiative continues to invest in AI, quantum computing, and cloud infrastructure. Altios International has supported mid-cap SaaS and MedTech companies launching R&D pilots and innovation centres in India to benefit from this high-tech environment.

Environmental: India has committed to 50% renewable energy capacity by 2030 and aims to achieve net-zero emissions by 2070. Green hydrogen, EVs, solar parks, and sustainable packaging are sectors receiving policy and capital incentives. Foreign mid-cap firms entering India must consider Environmental, Social, and Governance (ESG) readiness as part of vendor evaluation and factory setup, especially if they are reporting sustainability metrics to European or U.S.-based stakeholders.

Legal: India’s Goods and Service Tax (GST) implementation has replaced multiple state-level taxes with a single framework, reducing cascading tax burdens. Labor laws are being consolidated for easier compliance, facilitating business expansion. Foreign mid-cap companies still face challenges in areas like land acquisition and local sourcing mandates, impacting their business operations as they attempt to expand business into India. Having a partner like Altios International who understands state-specific procedures ensures faster setup and ongoing compliance.

India’s Foreign Direct Investment Inflows (2019–2024): Business Confidence Indicators

| Fiscal Year | FDI Equity Inflows ($Billion) | Key Sectors Attracting FDI |

|---|---|---|

| 2019-2020 | 49.98 | Services, Computer Software & Hardware, Telecommunications |

| 2020-2021 | 59.64 | Computer Software & Hardware, Construction (Infrastructure), Services |

| 2021-2022 | 58.77 | Computer Software & Hardware, Services, Automobile Industry |

| 2022-2023 | 46.03 | Computer Software & Hardware, Services, Trading, Pharmaceuticals |

| 2023-2024 | 44.42 | Construction, Development, Power Sectors |

Source: Open Government Data (OGD) Platform India.

India GDP from 2019-2024: Economic Growth Trends

| Fiscal Year | GDP Growth Rate (%) | Notes |

|---|---|---|

| 2019–20 | 3.9% | Pre-pandemic slowdown due to various economic factors. |

| 2020–21 | -5.8% | Contraction due to the COVID-19 pandemic’s impact on economic activities. |

| 2021–22 | 9.1% | Strong recovery post-pandemic with resurgence in economic activities. |

| 2022–23 | 6.9% | Continued growth driven by investments and service sector performance, bolstering the Indian economy. |

| 2023–24 | 8.2% | Robust growth attributed to infrastructure investments and resilient services sector. |

Source: Statista. “GDP of India 1987-2029.”

Conclusion: India as a Strategic Choice for Business Expansion

India is a strategic response to global challenges like cost, supply chain fragility, and talent gaps. Success requires local insight, compliance, and agility.

With 30+ years of experience and having supported 150+ international companies, ALTIOS International helps mid-cap companies expand into India with precision—from market entry to growth.

Altios International operates in 24+ countries, including offices in Bengaluru, Delhi, Chennai, Mumbai, and Pune.

Our support includes:

- Market Entry & Strategy: Feasibility studies, go-to-market planning, and partner identification.

- Entity Setup & Compliance: Company registration, legal, tax, and regulatory services.

- HR & EOR: Staff hiring and management, without the need for a local entity.

- Operational Support: Incubation spaces, IOR services, and local office management are essential for facilitating business expansion in India.

The question isn’t if you should expand—it’s how and with whom.