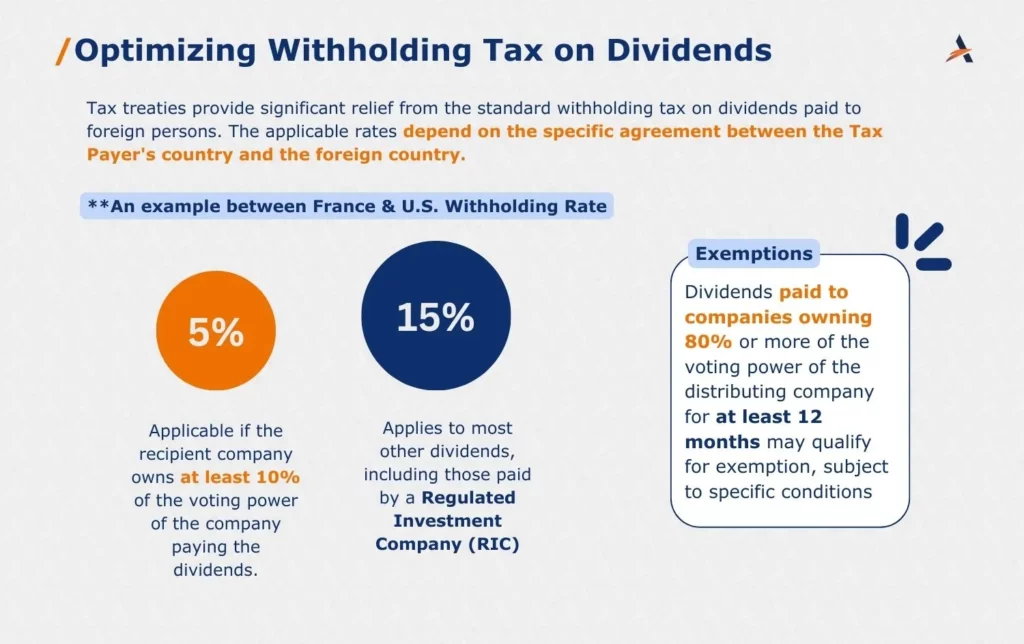

Navigating global tax obligations could pose a challenge, however, analyzing tax treaties presents significant opportunities to optimize withholding tax rates imposed on dividends and royalties. By leveraging these provisions, businesses can improve financial efficiency while ensuring compliance with tax regulations

Dividends Paid to Taxpayers

Dividends from foreign entities may benefit from a reduced withholding tax rate, provided the recipient is the beneficial owner and meets treaty requirements.

Qualified Dividends for Taxpayers

For taxpayers, dividends received from foreign companies may qualify as “qualified dividends,” granting preferential tax treatment under U.S. law. This preferential treatment reduces the effective tax rate significantly compared to ordinary income rates, underscoring the importance of proper categorization and compliance.

Understanding Royalty Withholding Tax

Royalties paid across borders enjoy favorable treaty provisions, streamlining international intellectual property transactions. The usual withholding tax rates depend on the country. Certain exemptions apply to payments for the use of intangible property such as patents, trademarks, and copyrights.

This framework fosters innovation and collaboration by reducing tax barriers for intellectual property exchanges, further enhancing bilateral economic ties.

Common Challenges and Solutions in Applying the Tax Treaty

| Investment Type | Tax Treaty Benefits | Strategic Opportunity |

| Private Equity | Reduced withholding on dividends and interest | Optimize returns through strategic structuring |

| Real Estate Investments | Capital gains are taxed only in the country of location | Maximize returns by proper tax planning |

| Technology Licensing | Royalty tax rates depend on the country | Expand without incurring unnecessary tax burdens |

| Franchising | Treaty clauses reduce withholding on franchise fees | Facilitate international franchising |

| Joint Ventures | Access to reduced rates for dividends and royalties | Build cross-border partnerships effectively |

| Export-Import Activities | Reduced taxation on profits related to traded goods | Optimize trade strategies for better profitability |

| Pension Fund Investments | Exemptions for certain pension funds | Enhance fund performance by minimizing taxation |

Success Story: Groupe Norac’s Expansion

Groupe Norac, one of the leading players in the food manufacturing industry in France, had plans to enter the U.S. market. Such a complex maneuver demanded in-depth knowledge of global taxation agreements and corporate configurations to maximally leverage benefits while remaining compliant.

Key Achievements

- Tax Optimization: With the implementation of the U.S.-France Tax Treaty, Altios helped Groupe Norac to apply lower withholding tax rates on cross-border dividends and royalty payments.

- Regulatory Compliance: The company skillfully navigated the complex U.S. tax regulations, facilitated by Altios’ customized advice on treaty benefits and documentation requirements.

- Smooth Market Entry: With the help of Altios’ know-how in international business strategy and subsidiary management, Groupe Norac was able to set itself up for success in the U.S.

This case study demonstrates the importance of understanding tax treaties and making use of them. The company maintained not just regulatory compliance but also minimized its tax liabilities enabling sustainable growth in a competitive market.

Why Expertise is Key for Simplifying Compliance

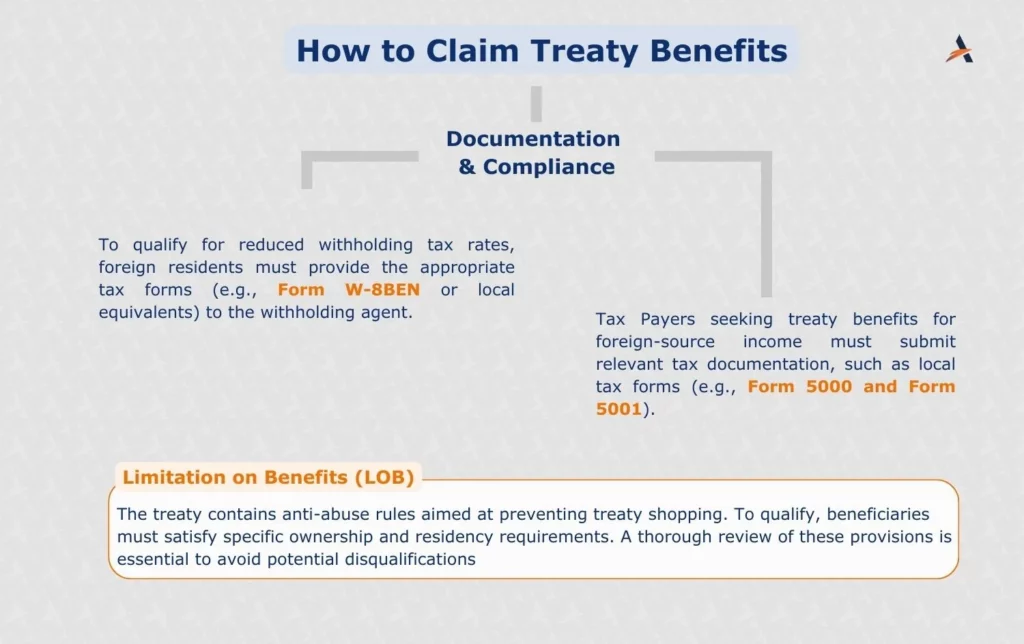

Tax treaties provide several advantages for businesses to reduce withholding taxes on dividends and royalties. However, they also pose challenges that require a thorough understanding of treaty provisions, documentation requirements, and compliance with international tax rules.

Altios, being a global tax advisor with a strong local presence, offers services to help companies deal with the complexities of cross-border tax compliance, treaty optimization, and compliance while coming up with solutions that are suitable for the client’s needs. From handling withholding taxes to supporting market access, Altios enables companies to succeed in their international expansion strategies.