India is the world’s fifth-largest economy and is projected to become the third largest by 2030, according to the International Monetary Fund (IMF). With a population of 1.4 billion and one of the youngest labour forces globally, the country offers a large, fast-growing market with strong government support for foreign investment. For foreign mid-cap firms, the upcoming years present a unique opportunity to tap into India’s economic transformation across its top-performing sectors.

The Top Industries in India where foreign firms can enter or expand successfully via greenfield projects, joint ventures, or acquisitions are as follows:

1. Information Technology and Digital Services

Global Capability Centers (GCCs) in India are offshore units of multinational companies that handle critical business functions like IT, finance, and R&D. They are vital for India’s economy, driving innovation, employment, and making India a global hub for digital and operational excellence.

India is becoming a preferred destination for GCCs. More than 1500+ foreign mid cap firms are using India as their primary destination for GCCs. The country produces 2 – 2.5 million STEM (Science, Technology, Engineering, and Mathematics) graduates annually, making it a global hub for software development, product design, and digital innovation.

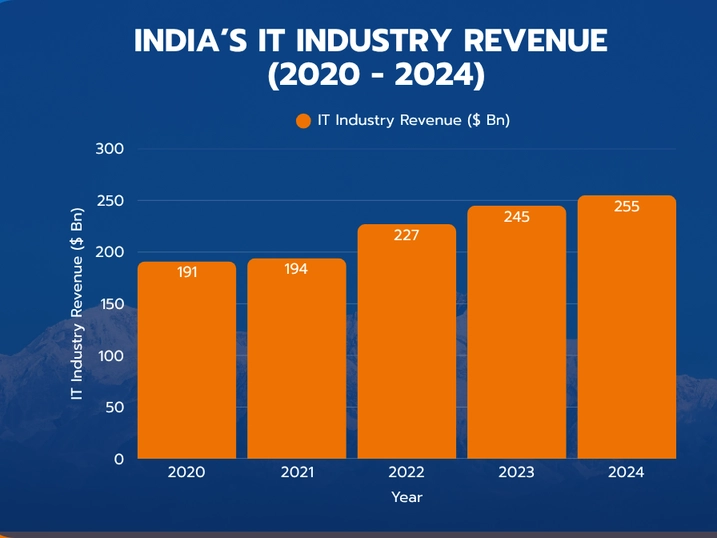

Source: India Brand Equity Foundation (IBEF) – The Information Technology Industry in India is a significant contributor to the GDP and is part of the fastest growing sectors.

By 2025-26, India will have close to 1 billion internet users. The Engineering Research & Development (ER&D) outsourcing market is expected to reach $130–170 billion by 2030, especially in fields like automotive software, semiconductor design, and fintech.

The Indian government allows 100% Foreign Direct Investment (FDI) in IT services under the automatic route. Programs like “Digital India” are making it easier to set up operations and access a massive digital consumer base. Mid-sized foreign firms can gain scale, speed, and cost advantages by establishing tech partnerships or innovation hubs here.

To know more about India’s IT sector click here.

2. Electronics Manufacturing and Semiconductors

India aims to grow its electronics manufacturing output to $300 billion by 2025–26. Exports to the U.S. are expected to jump from $10 billion today to $80 billion by 2030.

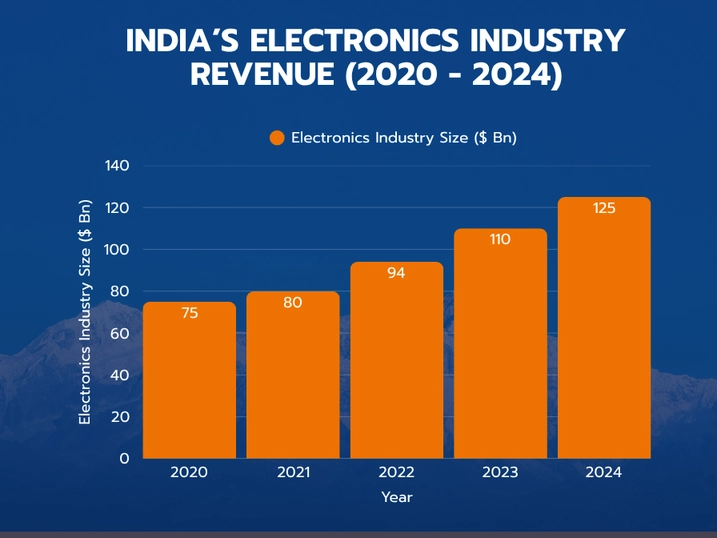

Source: Ministry of Finance. (2024). Economic Survey 2023–24. Government of India. https://www.indiabudget.gov.in/budget2024-25/economicsurvey/doc/echapter.pdf

The Production-Linked Incentive (PLI) scheme (an Indian government initiative that rewards manufacturers for meeting output targets) has attracted major players in smartphones, hardware, and chip design. Foreign mid cap firms benefit from reduced setup costs and faster Return on Investment (ROI).

India is a part of the Asia Diversification strategy or part of China+1 strategy, where global companies diversify supply chains into India to reduce geopolitical risk. The Indian Semiconductor Mission provides financial support for building chip factories and packaging plants, making this an ideal time for foreign mid-cap firms in electronics to invest.

To know more about India’s electronic industry, click here.

3. Automotive and Electric Vehicles (EVs)

India is now the fourth-largest automobile market globally and is experiencing a surge in electric mobility. The EV sector is growing at an astonishing 49% annually, expected to reach 10 million EVs sold per year by 2030.

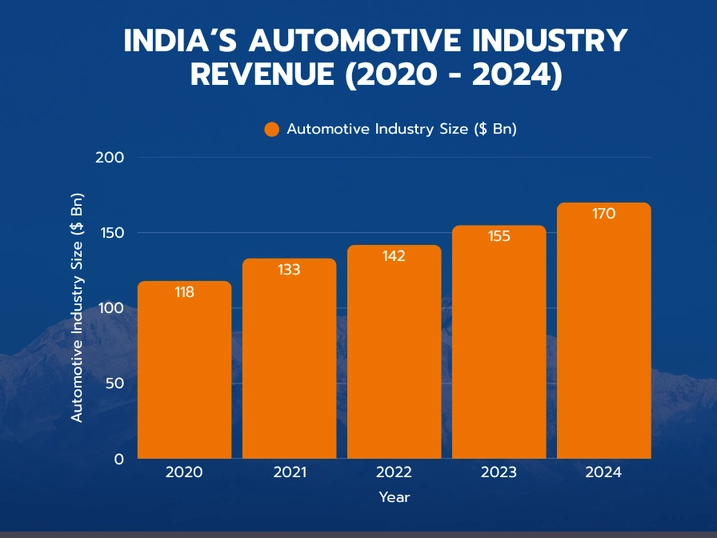

Source: Society of Indian Automobile Manufacturers. (2024). Automobile industry statistics.

https://www.siam.in/statistics.aspx?mpgid=8&pgidtrail=13

Over $40 billion has already been committed in EV-related investments, with an upper potential of $500 billion by decade’s end. Many Foreign mid-cap firms especially from Germany & France are forming joint ventures in EV components, battery technology, and power electronics. Recently, Routematic, an AI-driven corporate transport service that secured $40 million in Series C funding, was supported by M+V Altios in conducting its due diligence, reflecting growing investor confidence and the role of strategic advisory in India’s mobility and EV ecosystem.

Incentives such as the:

- FAME II program (Faster Adoption and Manufacturing of Electric Vehicles in India)

- PLI scheme for EVs and batteries

make India a fertile ground for EV innovation. Now is the time for global auto-tech players to secure their position in this evolving market.

4. Renewable Energy and Clean Technology

India is the third-largest renewable energy producer and expanding heavily specially in Northern part of India also targeting 500 GW of non-fossil fuel capacity by 2030, of which 450 GW will be solar, wind, or hydro.

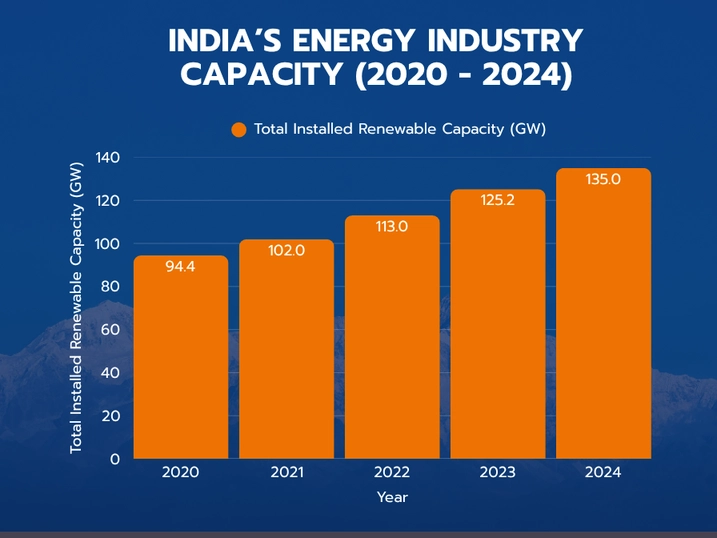

Source: Central Electricity Authority (CEA), Ministry of Power, Government of India https://www.cea.nic.in

This energy shift requires over $11 billion in new equity investment every year. Global firms like BP, TotalEnergies, and Brookfield are already investing in Indian clean energy ventures. Foreign mid-cap firms are entering through equity partnerships, acquisitions, and greenfield solar/wind projects.

India permits 100% FDI in the renewable sector. The government’s PLI scheme for solar manufacturing and the National Green Hydrogen Mission (a $2.3 billion program promoting hydrogen from clean sources) add further value. India’s green transition presents a long-term, stable opportunity for foreign investors.

To know more about India’s energy industry, click here.

5. Pharmaceuticals and Healthcare

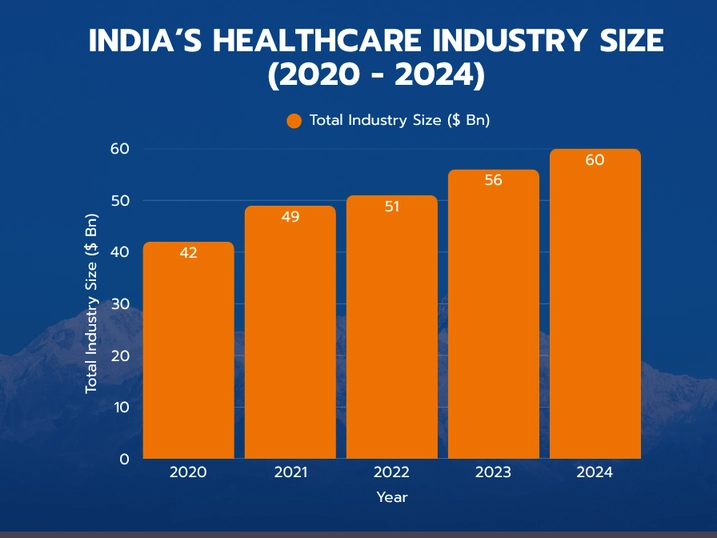

India’s pharmaceutical market is valued at $50–60 billion today and is projected to grow to $130 billion by 2030, bolstering the economy of India. The country already supplies 20% of the world’s generic medicines and is a key global player in vaccine production and contract research.

Source: India Brand Equity Foundation (IBEF) – https://www.ibef.org/industry/healthcare-india

The sector offers 100% FDI in new pharma ventures and relaxed clinical trial regulations, contributing to the growth of the manufacturing sector in India. India also benefits from a large, cost-effective skilled workforce in pharma manufacturing and healthcare services.

Foreign mid cap firms are entering through:

- Joint ventures

- Contract manufacturing

- Acquisitions.

In addition to drug production, India’s hospital infrastructure, diagnostics, and medical devices industries are expanding rapidly, offering scalable investment opportunities.

To know more about the healthcare industry, click here.

6. Chemicals and Petrochemicals

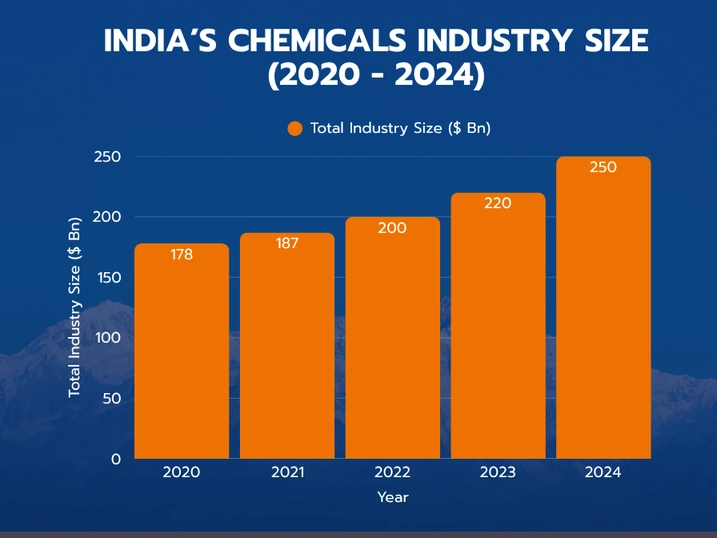

India’s chemicals industry is valued at $250 billion and is expected to grow to $300 billion by 2025. The country is becoming a preferred hub for specialty chemicals, as global firms diversify.

Source: Department of Chemicals and Petrochemicals, Ministry of Chemicals and Fertilizers.

https://chemicals.gov.in/annual-reports

Foreign mid cap companies from Germany, Japan, and the U.S. are investing in India for Research and Development (R&D), low-cost manufacturing, and exports. India offers incentives such as the RoDTEP scheme, which refunds duties on exported products, and upcoming PLIs for the sector.

Indian cities that are into Chemicals and petrochemicals manufacturing are:

- Gujarat: The city is known as chemical industry hub, Companies like Gujarat Alkalies & Chemicals Ltd (GACL), ONGC Petro Additions Ltd (OPaL) are present here

- Maharashtra: The state has been a traditional base for chemical and pharmaceutical companies. Companies like Reliance Industries, Pidilite, Tata Chemicals, and several specialty chemical exporters are present here

With port-based chemical clusters, dedicated petrochemical zones, and regulatory support for green chemistry, India is building a modern chemicals ecosystem ideal for mid-cap foreign entrants.

7. Infrastructure and Logistics

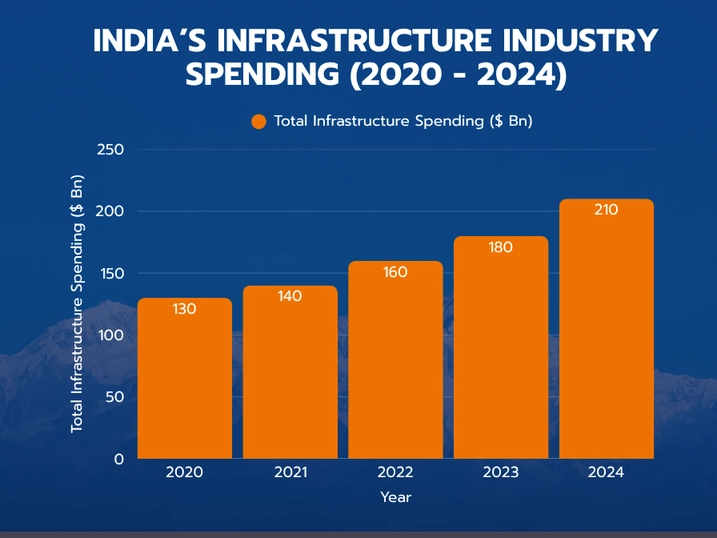

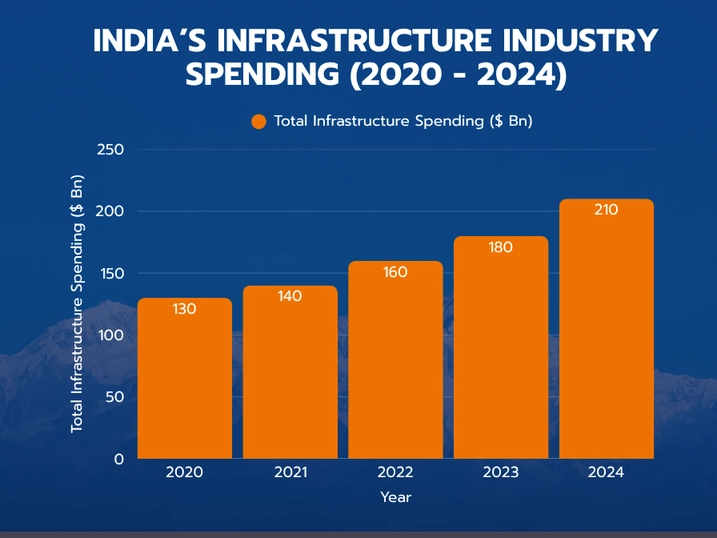

India plans to invest $1.8 trillion in infrastructure projects by 2025. This includes roads, airports, metro systems, and utilities. Programs like the National Infrastructure Pipeline and Gati Shakti (a central government initiative to unify transport planning) are streamlining project execution.

Source: Ministry of Finance, Government of India. https://www.indiabudget.gov.in/

Foreign mid cap companies are participating through public-private partnerships (PPP), asset monetization programs, and Infrastructure Investment Trusts (InvITs), which provide long-term, tax-efficient returns.

Major players like Zurich Airport, DP World, and Brookfield are active in Indian infrastructure. With liberal FDI rules and increasing demand for modern logistics, warehousing, and urban transit, the sector is ripe for foreign mid-cap participation.

To know more about the Infrastructure industry, click here.

8. Financial Services and FinTech

India’s financial services sector is undergoing major reform and expansion. The insurance FDI cap has been raised to 74%, and private banks allow foreign ownership up to 74% as well. Major investors like GIC and Temasek already hold stakes in Indian financial firms.

Source: Ministry of Finance, Government of India. https://www.indiabudget.gov.in/

India had the third-highest fintech funding globally in Q1 2025. The “India Stack,” a national digital identity and payments system, supports a rapidly expanding digital financial ecosystem.

The Gujarat International Finance Tec-City (GIFT City) offers a tax-neutral base for foreign asset managers, while crypto and digital currency regulations are evolving in a business-friendly direction. The financial sector is a future-ready space for foreign firms seeking a trillion-dollar opportunity.

9. Retail and E-commerce

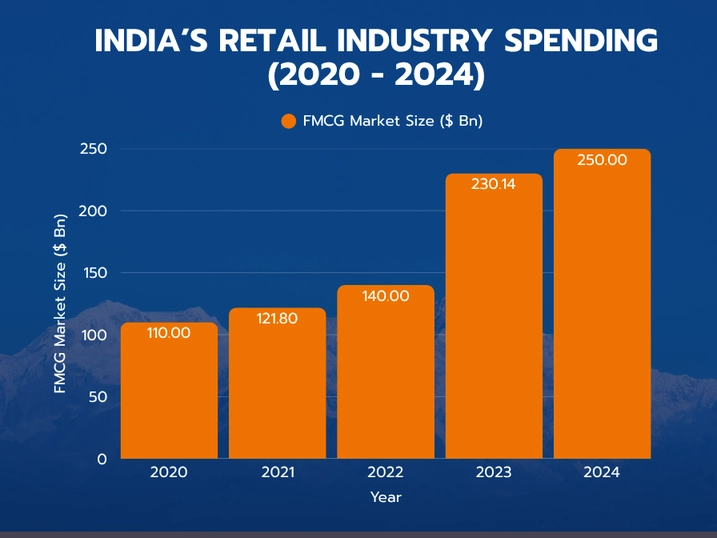

India’s retail and e-commerce markets are expanding at double-digit rates. By 2030, e-commerce alone is expected to be worth $325 billion, growing at a 21% CAGR. Millions of new online shoppers are entering the market each year, driving growth in the consumer goods sector.

Source: Ministry of Food Processing Industries, Government of India.

https://mofpi.gov.in/en/documents/reports/annual-report

The government allows 100% FDI in single-brand retail and e-commerce marketplaces. While multi-brand retail remains partly restricted, companies can enter via joint ventures, M&A, or through online platforms.

The Open Network for Digital Commerce (ONDC) a government-backed initiative is creating an open, neutral platform for digital trade across India. Global companies like Amazon, Apple, and IKEA are already investing. Mid-cap firms can build scalable consumer businesses by tapping into India’s rising middle class and digital-savvy buyers.

To know more about the retail industry, click here.

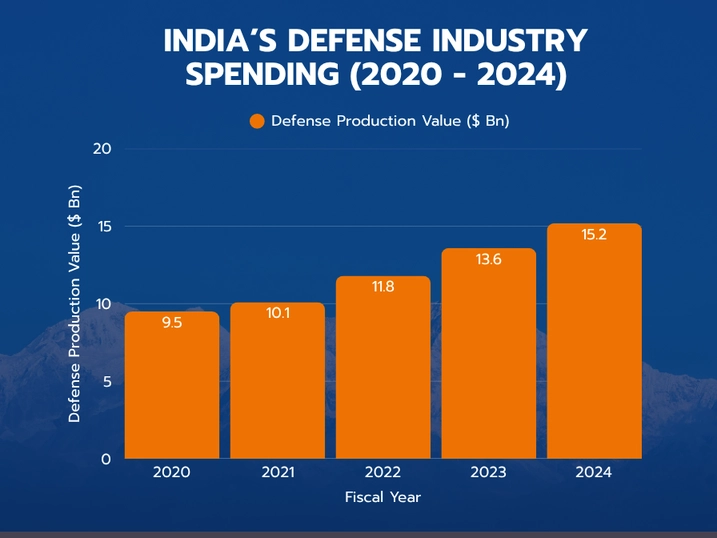

10. Defense and Aerospace

India’s defense spending exceeds $75 billion annually, with over $15 billion reserved for local procurement. The government now allows up to 74% FDI in defense manufacturing via the automatic route, and 100% with approval.

Source: Ministry of Defence, Government of India.

https://mod.gov.in/sites/default/files/2020-2021_Annual+Report.pdf

Projects like the Airbus-Tata C-295 aircraft and Lockheed Martin’s partnerships in fighter components highlight India’s shift toward self-reliant defense production. Defense Industrial Corridors in states like Uttar Pradesh and Tamil Nadu are being developed to support foreign OEMs.

India is also opening civil aviation and space sectors, including Maintenance, Repair, and Overhaul (MRO) services and satellite manufacturing. With strong export ambitions and government support, defense and aerospace offer high-potential, strategic entry points.

Partner with ALTIOS International to Navigate India’s High-Growth Sectors with Confidence

India’s rapid growth across sectors like IT, clean energy, electric vehicles, semiconductors, and healthcare offers exceptional opportunities for international companies. But capturing this potential requires more than just market intelligence, it demands trusted local guidance, end-to-end execution, and long-term operational support.

That’s where ALTIOS International comes in.

With a direct presence in seven major Indian cities and over 250 in-country experts, ALTIOS International is embedded in the local ecosystem. We’ve supported over 150 foreign mid-cap firms to:

- Enter the Indian market through greenfield setup, acquisitions, or partnerships

- Secure funding and incentives, including navigating India’s Production Linked Incentive (PLI) schemes

- Recruit executive and operational talent via our Global HR Solutions platform

- Comply with regulatory and tax requirements under India’s dynamic business laws

- Establish and manage subsidiaries, including complete back-office operations

Whether you’re setting up a semiconductor unit in Gujarat, forming a JV in the EV ecosystem, or launching a digital services hub in Bengaluru, we deliver proven, scalable solutions tailored to your goals.

Clients like Mayr Power Transmission, GAZC, and Heraeus have trusted us to manage complex expansions—from legal setup to operational readiness.

Partner with ALTIOS International to enter the Indian market with confidence, scale with precision, and succeed with local insight.

Contact our team today to begin your India expansion journey.