The re-election of Donald Trump “Trump 2.0” as U.S. President in 2024 has ignited significant reactions across global markets, prompting concerns about the future of international trade and economic policies. His renewed focus on protectionist measures, including the potential reintroduction of tariffs on imports from countries like China and Mexico, has raised alarms among businesses worldwide. The strengthening of the U.S. dollar and the prospect of renegotiating international agreements such as the United States-Mexico-Canada Agreement (USMCA) add to the uncertainty. As global supply chains and investment strategies are poised for potential disruptions, understanding these developments is crucial for businesses aiming to navigate the evolving economic landscape.

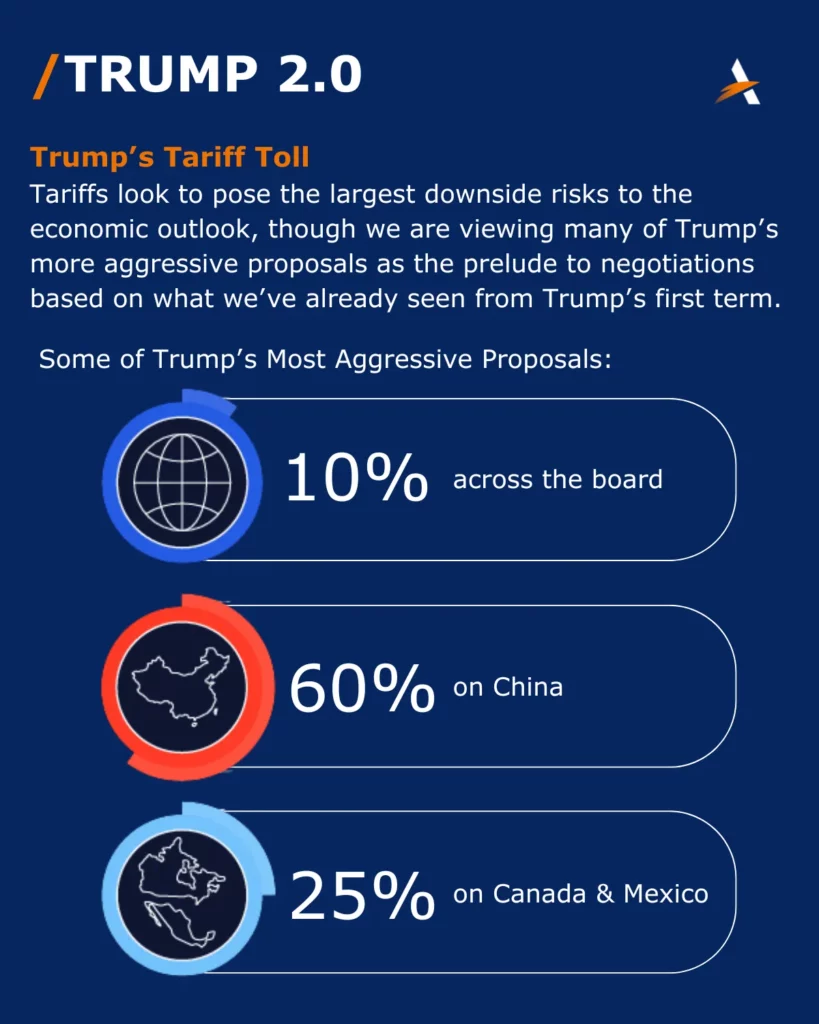

What to Expect from Trump 2.0 Tariffs

The second wave of Trump tariffs could further reshape the landscape of global business. While the previous administration mainly targeted China, Trump 2.0 could introduce new tariffs, potentially on strategic allies like Mexico and Canada. These adjustments will present both challenges and opportunities that companies must navigate carefully, especially as the dynamics of international trade continue to shift.

Impact on Global Business

One of the most immediate effects of Trump 2.0 tariffs will be felt in global supply chains. Companies will need to reassess their strategies to account for rising costs on imported goods. For U.S.-based businesses, this may involve renegotiating existing trade agreements or adjusting production methods to maintain efficiency and minimize the impact of increased tariff rates.

Trade Wars & Supply Chain Shifts

The trade wars triggered by tariffs disrupt supply chains, often raising the costs of raw materials and intermediate products. For industries like automotive manufacturing, oil production, and agriculture, this could mean higher operational expenses and the need for supply chain diversification.

U.S.-Mexico Trade Relations

The relationship between the U.S. and Mexico is especially significant. The implementation of the USMCA agreement, which replaced NAFTA, will be under scrutiny as these new tariffs are introduced. Mexico’s importance as a trading partner means that any shifts in tariffs could significantly affect sectors like automotive and agriculture, with smaller U.S. companies particularly vulnerable.

Economic Implications & Investment Considerations

Trump 2.0 tariffs will influence not only global trade but also domestic economic policies and market conditions. Investors will need to factor in these changes when formulating their investment strategies. The tariffs will impact various sectors in different ways, from the stock market and the S&P 500 to labor rights and the technology sector.

Stock Market Reactions & Investment Strategy

As tariff policies evolve, stock market volatility is expected to increase. Companies will need to assess the risk exposure of their portfolios, particularly in sectors that are sensitive to tariff fluctuations, such as technology, energy, and agriculture. A cautious investment approach may be prudent as businesses brace for further economic shifts.

The Tech Sector and Tax Policy Adjustments

The ongoing trade dispute could impact the tech sector, a major driver of U.S. economic growth, particularly if tariffs are imposed on critical tech components sourced internationally. Moreover, these tariffs will have broader implications on fiscal policy, as the U.S. government may aim to reduce trade deficits by imposing tariffs on goods from key trading partners.

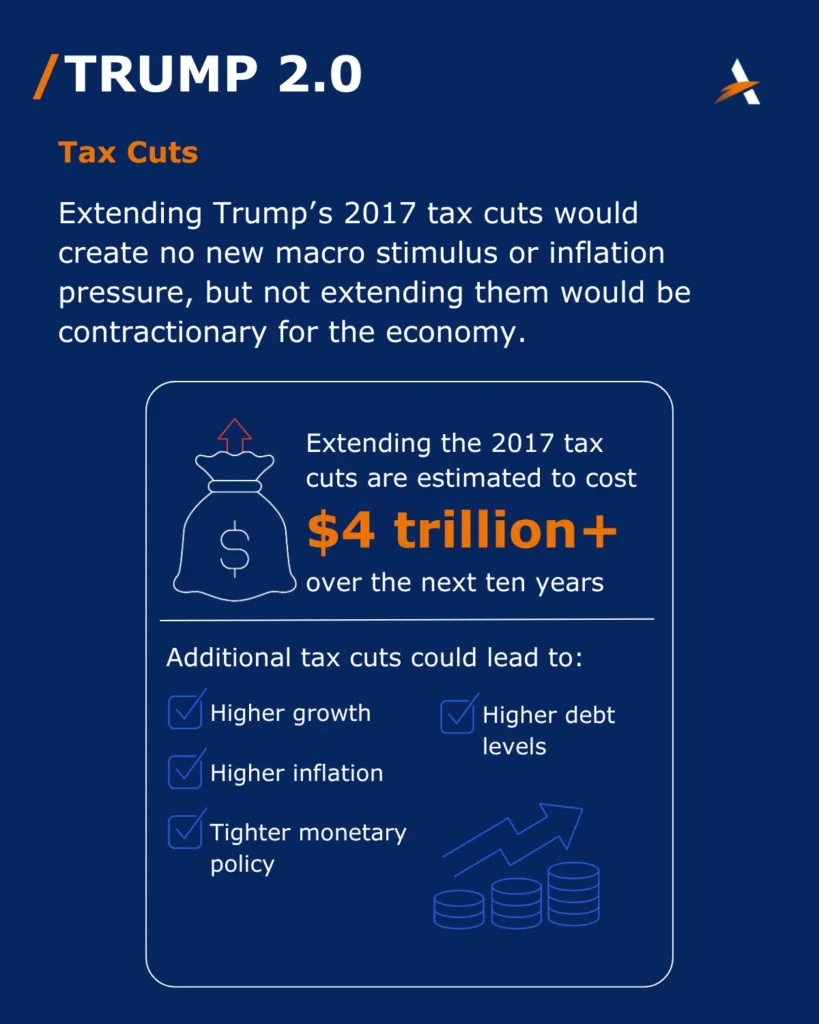

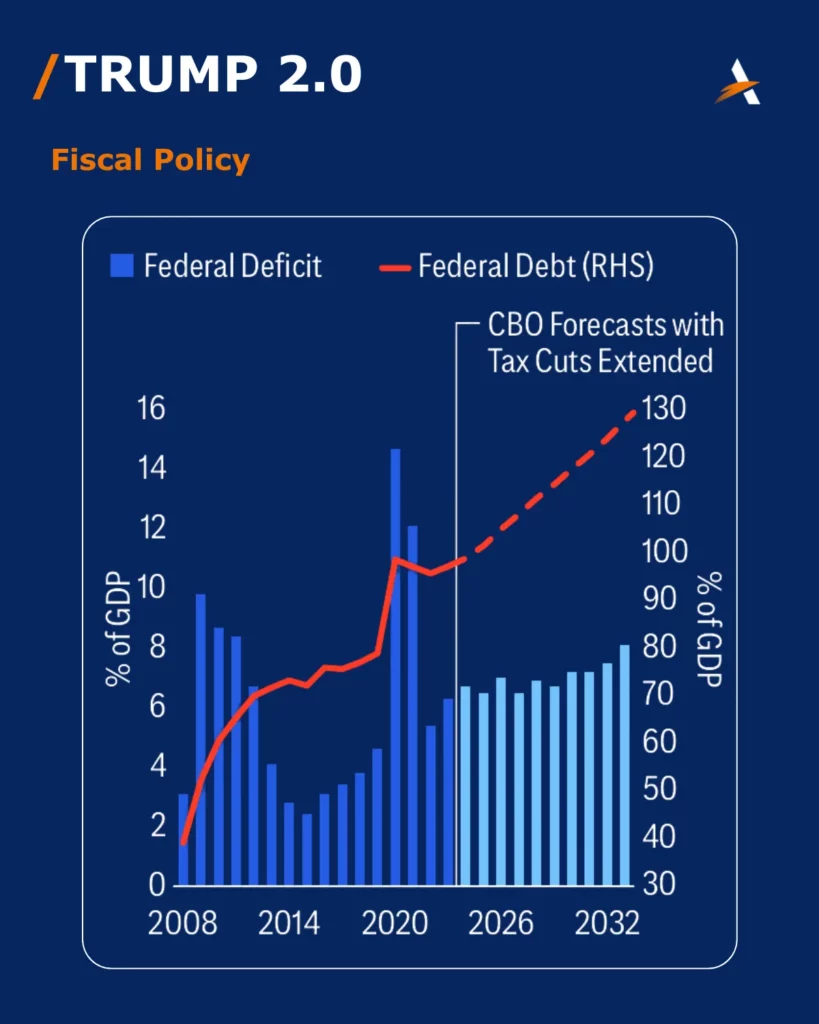

Fiscal Policy

Federal deficits could be 6%+ of GDP if Trump’s tax cuts are extended. Some of these costs will be offset with savings elsewhere but deficits are still likely to stay historically large.

Seizing Opportunities Amidst Challenges

While the Trump 2.0 tariffs present numerous challenges, they also create unique opportunities for businesses that are ready to adapt and innovate. For U.S. companies, these shifts in trade policy could open doors to new markets, alternative sourcing strategies, and a more robust approach to risk management.

Trump 2.0 Baseline Scenario for 2025

| Effects on U.S. Economy | |||||

| Policy Areas | Description | Pressure on Real GDP | Pressure on Prices | Additional Details | Effects on RoW |

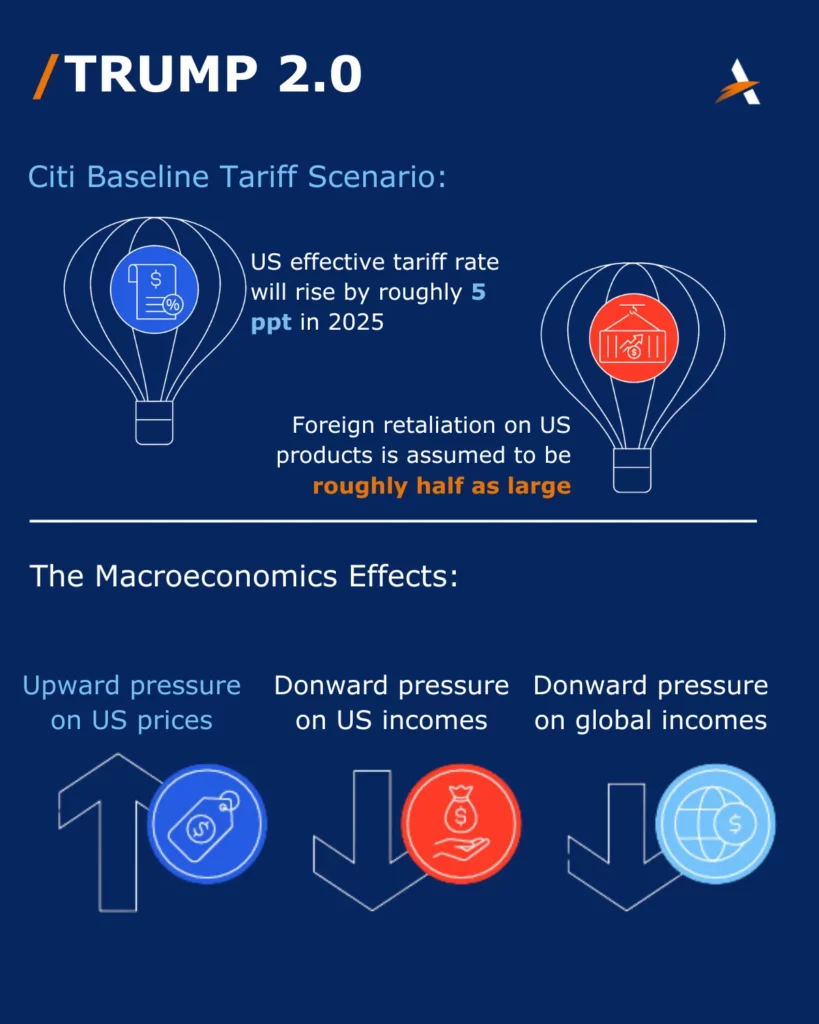

| 1. Tariff Hikes | U.S. effective tariff rate will rise by 5 ppt in 2025, including 10-15 ppt increase in tariffs on China | Downward | Upward | Acts like an adverse supply shock | Adverse demand shock: downward pressure on foreign incomes |

| Foreign Retaliation | Major trading partners retaliate with tariffs on U.S. exports that are roughly half as large | Downward | Downward | Acts like an adverse demand shock | Adverse supply shock |

| 2. Tax Cuts | 2017 tax cuts are extended in first year of President Trump’s term | Negligible | Negligible | 2017 tax cuts are extended in the first year of President Trump’s term | Negligible |

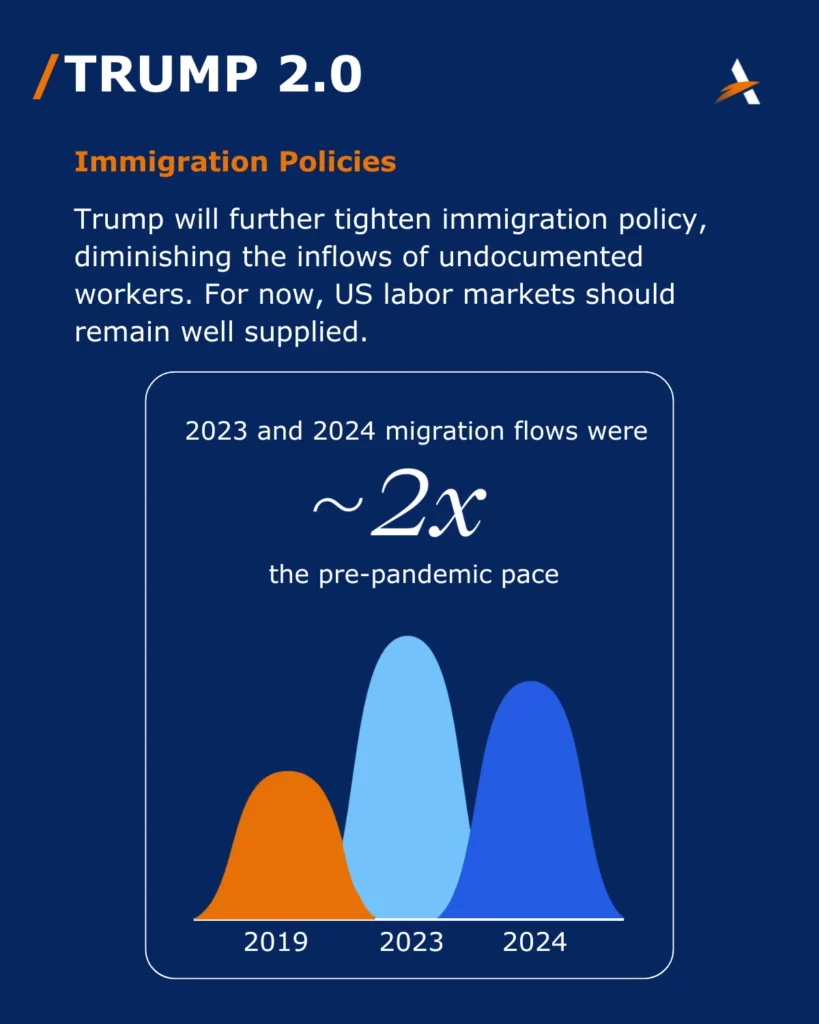

| 3. Immigration Policies | Tighten undocumented crossings at southern border, which causes labor market to gradually tighten | Negligible | Negligible | Economic effects in the first few years should be minimal as labor demand is currently satiated, with firms digesting recent hiring and many recently arrived migrants still entering the labor market | Reduced migration outflows |

| 4. Deregulation | Executive orders rolling back swathes of regulation put in place by Biden | Upward | Downward | Difficult to assess effects of deregulation, but likely a boost to growth and downward pressure on inflation in the near-term with longer- term effects more uncertain | Depends on specifics of the policies |

| 5. Spirits | Consumer and business sentiment look to have improved on expectations that Trump will boost the economy | Upward | Upward | Will it last and translate into higher investment, hiring, and spending? | Trump’s policies threaten to weaken confidence abroad |

Source: Citi Research

Expanded Investment Strategies & Risk Management Tactics

In light of Trump 2.0 tariffs, businesses must revise their investment strategies and risk management approaches to ensure they remain resilient in the face of uncertainty. Here are some actionable tactics for mitigating risks and capitalizing on opportunities:

- Supply Chain Diversification: Mitigate tariff risks by diversifying supply chains to reduce dependence on specific regions. Consider alternative suppliers or regional hubs to minimize trade route disruptions, and explore automation or reshoring to reduce vulnerability.

- Currency Hedging: Use hedging instruments to protect against currency fluctuations, especially in industries like technology and energy. This helps stabilize finances by securing fixed exchange rates and avoiding sudden cost increases due to tariff-induced exchange rate volatility.

- Targeting Non-Tariffed Markets: Focus on regions and industries less impacted by tariffs, such as emerging markets or those with favorable trade agreements (e.g., USMCA). This strategic pivot can help reduce tariff exposure and unlock new growth opportunities.

- Operational Efficiency: Enhance internal efficiency by investing in technology, automation, and optimized supply chains. Negotiating better supplier terms can help offset rising input costs, maintaining profit margins despite external challenges.

- Flexible Investment Strategy: Maintain an agile investment approach, ready to adapt to changing tariff conditions. This flexibility enables businesses to adjust their portfolios, whether by reducing international expansion or investing in sectors that may benefit from tariffs.

A Strategic Opportunity for U.S. Businesses

Despite the complexities brought about by Trump 2.0 tariffs, the U.S. continues to be a pivotal force in global trade, with abundant opportunities for businesses willing to embrace change. The U.S. economy’s sheer size, diverse industries, and integral role in international trade provide a strong foundation for long-term growth. Whether in technology, agriculture, or automotive manufacturing, businesses have the chance to adapt, innovate, and expand their position within global supply chains.

At Altios, our extensive global expertise and in-depth understanding of the U.S. market help businesses manage the shifting landscape of tariffs. By developing customized strategies, we support companies in maximizing growth potential, mitigating risks, and seizing new opportunities in this evolving global trade environment.