Poland has been gaining popularity as a destination for foreign investment for years, particularly among EU member states. It is a country with one of the strongest and fastest growing economies in Central and Eastern Europe. A large domestic market of 38 million consumers and access to another 500 million in the European Union, macroeconomic stability, still competitive employment costs and a strategic location attract foreign investors. According to the EY Attractiveness Survey Europe June 2024 report, Poland is the number one destination for foreign investment in CEE, and ranks a high sixth in Europe behind France, the UK, Germany, Turkey and Spain.

Poland: A Leading Destination for New Foreign Investment

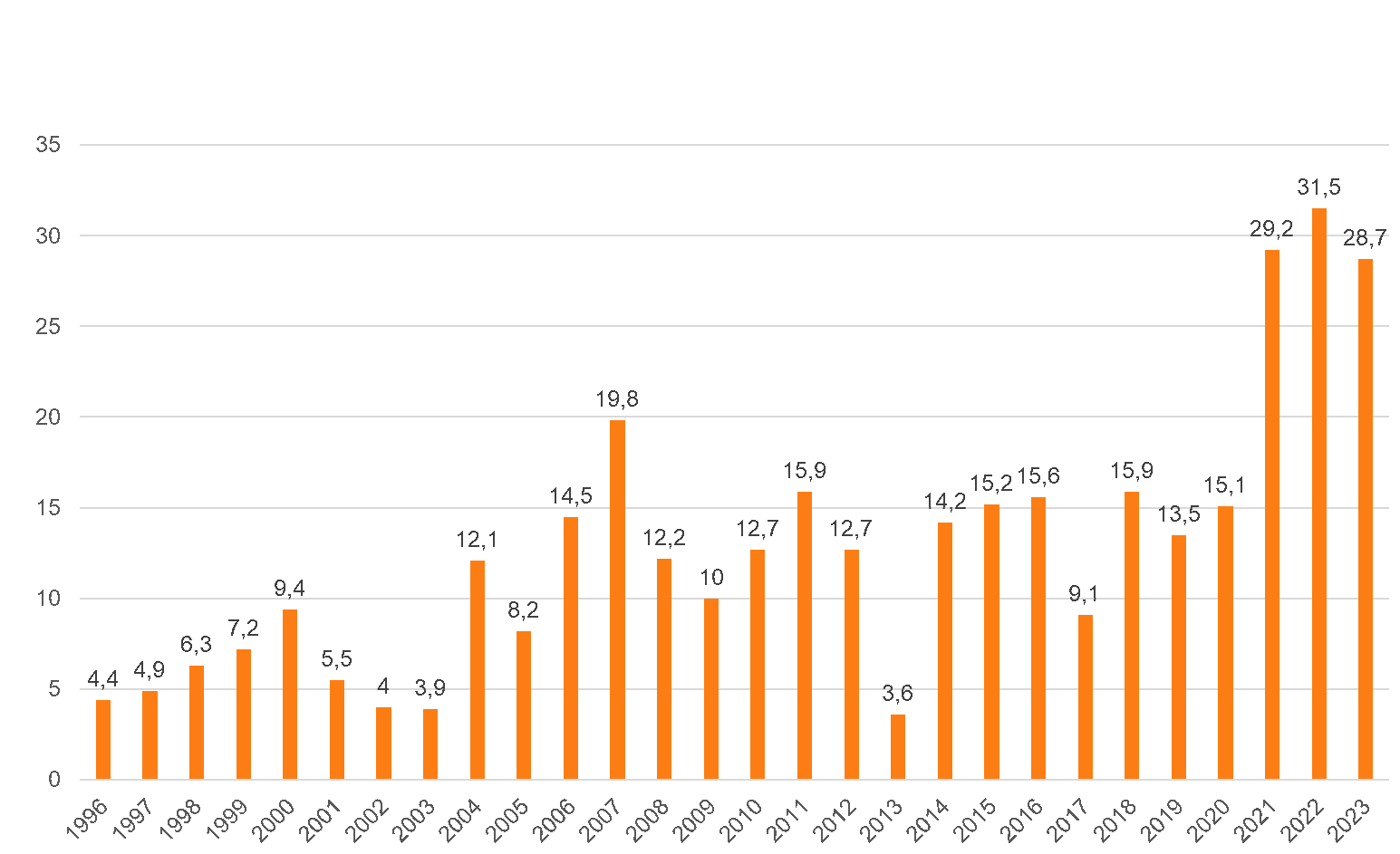

Despite weaker global investment flows, the value of FDI in Poland reached USD 28.6 billion in 2023, and the country attracted 229 FDIs during this period, reinforcing its status as a key player for investors in Poland. This represents a decrease of 3% y-o-y, but the dynamics are still one of the most favourable in Europe, for example Germany recorded a 12% decrease.

Chart: Value of foreign investment flowing into Poland between 1996 and 2023 (USD billion)

Source SGH Report – Foreign Direct Investment (FDI) in Poland

Key Sources of Foreign Investment

A report by the National Bank of Poland indicates that the largest amount of foreign capital flows into Poland from the Netherlands, Germany, Luxembourg, France, Spain, and the UK, highlighting the interest of European countries to invest in Poland.

Nearshoring: A Key Driver for FDI in Poland

In turn, according to a report by the Warsaw School of Economics (SGH), ‘Foreign direct investments in Poland’, foreign companies account for only one per cent of all enterprises operating in Poland, but they are responsible for 40 per cent of the added value generated in the Polish economy.

One of the key trends driving foreign investment in Poland is nearshoring, a business strategy that involves moving part of production or services to countries that are geographically and politically close. According to the Nearshoring 2024 Index developed by Savills, Poland ranks third among the classified 26 countries.

Savills Nearshoring Index 2024 edition:

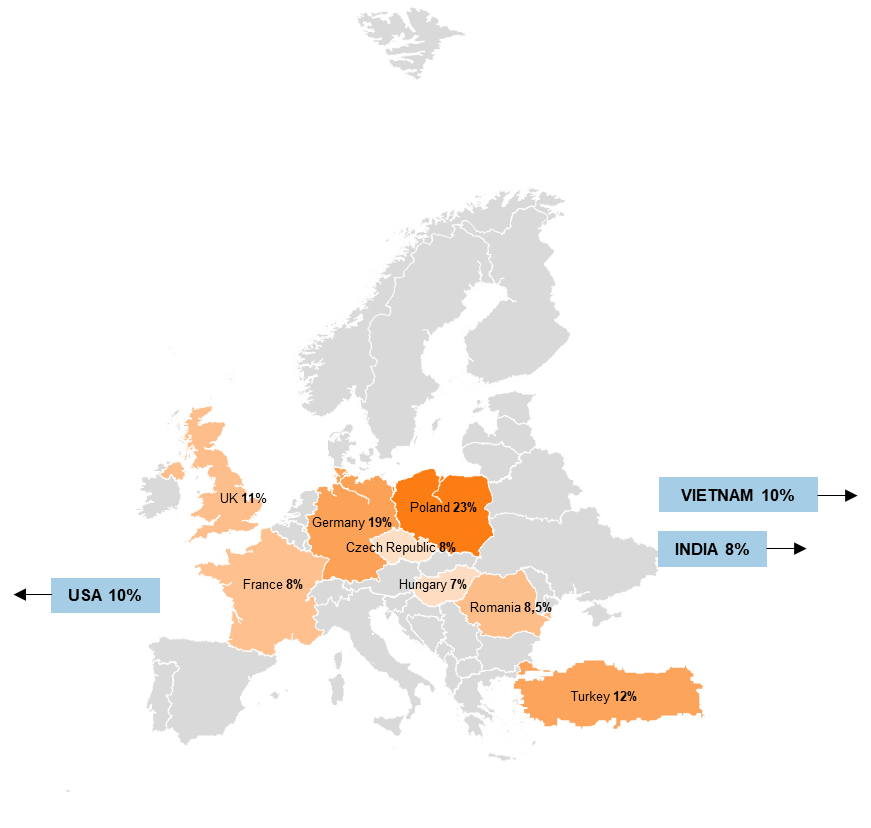

In turn, according to a survey conducted by Reuters and Maersk, Poland (chosen by 23% of respondents) and Germany (19% of respondents) are considered attractive locations for the nearshoring of advanced manufacturing processes.

The most popular sourcing and reshoring locations for European companies.

Source: Investment in Poland KPMG 2024 edition – 23% of respondents identified Poland as an attractive location for the nearshoring of advanced manufacturing processes.

Examples of Recent Investments

The current trend of nearshoring development in Poland is favoured by its advantageous location, as well as a well-developed transport and logistics infrastructure allowing shortening the supply chain, which reduces the risk of disruptions and delays in deliveries, better risk management, while geographical proximity affects lower transport costs and reduces carbon dioxide emissions into the environment – an aspect increasingly important for international companies pursuing sustainable development goals. Certainly, access to a skilled and well-educated workforce in Poland cannot be overestimated either for attracting new foreign investment.

An example of recent large investments in Poland is Danone, which opened a Planning Centre in Katowice creating 250 jobs, showcasing the potential for new investments. The value of the investment is more than EUR 20 M. Another example is the acquisition in 2024 by Drosed, a local company of the French poultry tycoon LDC, of the Polish company Indykpol with a turnover of nearly EUR 300 M and a plant from the Konspol group.

Denmark’s confectionery market leader Toms Group has also recently decided to relocate the majority of its production to Poland, contributing to the growing trend of new foreign direct investment. The factory in Nowa Sól will become the central production centre for the entire group. The completion of the ‘nine-figure’ investment is planned for 2028.

Challenges and Future Outlook for Foreign Investors

FDI performance in 2024 may be weaker compared to 2023 not only internationally, but also in Poland. This is due to several factors – the record level of FDI in previous years related to the post-pandemic rebound, which is now being corrected, the very weak condition of the European automotive industry, of which Poland is a very important component, and the stagnant state of the German economy and Germany is the most important economic partner for Poland.

Nevertheless, these adjustments will not affect Poland’s attractiveness for new foreign investors in the long term. On the one hand, nearshoring will continue to have its effect, while on the other, the country will continue to attract shared services centres, R&D and IT, thanks to its pool of educated workers, enhancing the Polish investment landscape. There will be some shifts within sectors, e.g. the automotive sector is already seeing more investment in electromobility. Investment will also be fuelled by Poland’s huge needs in terms of energy transition, including infrastructure, or the current need for armaments. A permanent magnet will certainly be the large consumer market, which will attract investments in the production of consumer goods, including in the agri-food processing sector, one of the most important in the Polish economy. A supporting factor already in the short term will be the large inflow of European funds under the National Reconstruction Plan. We should also not forget the huge reconstruction needs that Poland’s neighbour Ukraine will have.

In summary, despite unfavourable external factors, weaker global investment capital flows, Poland still attracts a relatively large amount of investment and should remain a very attractive destination for international capital in the near future, helped by numerous subsidies, tax breaks and a generally positive climate for FDI.

Altios, a consultancy with more than 30 years’ experience in international development support services for SMEs, is ready to support companies in selecting the most promising markets.

You are welcome to contact the Altios team for insights on how to invest in Poland.

Marta Tchorzewska

VP Development and Advisory m.tchorzewska@altios.com