Overview of Germany’s Global Standing in the Pharmaceutical Industry

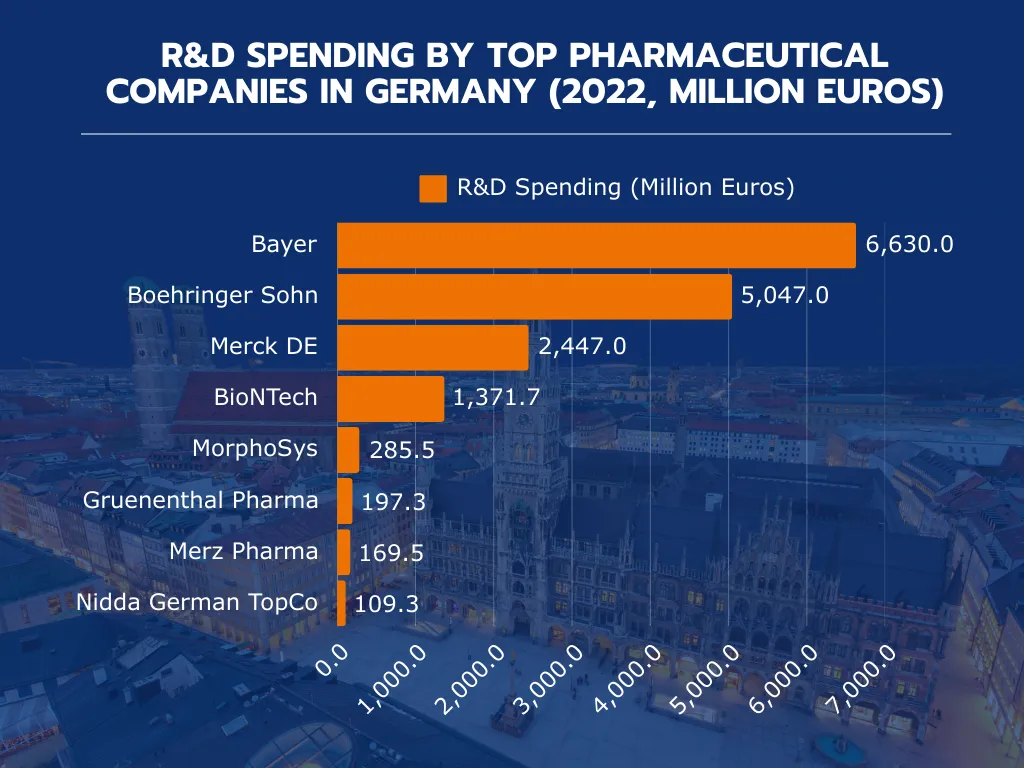

Germany is among the world’s leading pharmaceutical hubs. With a global market share of approximately 16% in research and development (R&D) and an annual export volume exceeding €90 billion euros, the country ranks at the top. Companies like Bayer, Boehringer Ingelheim, and Merck significantly contribute to innovative therapies and drugs. According to the Global Innovation Index, Germany consistently holds top positions, particularly due to its substantial R&D investments, amounting to €7.4 billion in the pharmaceutical sector in 2022.

Key Success Factors of the German Pharma Industry

Germany’s pharmaceutical success is built on several strategic pillars. First, the country benefits from advanced infrastructure, including state-of-the-art production facilities and efficient logistics, making Germany an attractive location for pharmaceutical companies. Second, it boasts a highly skilled workforce, particularly in science and technology. Third, stable regulatory frameworks and structured approval processes offer companies a secure environment. Lastly, the German government supports innovation through tax incentives and funding programs like the Central Innovation Program for SMEs (ZIM). A prime example is BioNTech’s COVID-19 vaccine development, showcasing the global relevance of German research and production capabilities.

Germany’s pharmaceutical industry stands as a global leader, defined by innovation, quality, and strategic excellence.

Key Pharmaceutical Companies Driving Innovation

Germany’s pharmaceutical sector is shaped by leading companies such as Bayer, Merck, and Boehringer Ingelheim. Bayer invests billions annually in research and development (R&D), focusing on innovations in oncology and cardiovascular health. Merck, the world’s oldest pharmaceutical company, pioneers biopharmaceutical research, particularly in immuno-oncology. Boehringer Ingelheim, a leader in animal health and respiratory diseases, underscores its global relevance through high R&D expenditures, contributing to the pharmaceutical research and development landscape. These companies are known not only for groundbreaking technologies but also for significant contributions to the export market.

The Role of the German Government in the Pharmaceutical Sector

The German government supports the pharmaceutical industry through targeted funding programs and tax incentives, fostering an environment for pharmaceutical innovation. Initiatives like the “Pharma Dialogue” foster collaboration between science, industry, and policymakers. Additionally, digital health solutions and sustainable production methods are promoted through specific government initiatives.

Impact of the European Pharmaceutical Market on Germany

As a leading force in Europe, Germany plays a critical role in shaping EU pharmaceutical regulations and trade agreements. The harmonization of approval processes within the EU and trade benefits from agreements like CETA enhance Germany’s competitiveness. Collaborative European projects, such as the EU Biomedical Innovation Fund, further bolster the innovative capacity of Germany’s pharmaceutical sector.

How Research and Development Shapes the Future of Pharma in Germany

Leading Research Projects and Innovations

Germany’s pharmaceutical industry is a global hub for groundbreaking research, particularly in the field of pharmaceutical innovation. Projects like BioNTech’s mRNA vaccine have revolutionized vaccine development worldwide, showcasing Germany as a location for pharmaceutical innovation. Partnerships with leading universities and multinational companies, such as Bayer’s collaboration with CureVac on mRNA technologies, drive innovation and reinforce Germany’s position as an engine of global pharmaceutical progress.

Statista data shows that Bayer led pharmaceutical R&D investments in Germany in 2022, spending €6.63 billion, followed by Boehringer Ingelheim at €5.05 billion. These figures demonstrate Germany’s commitment to innovation in drug development.

The Role of Biotechnology and Personalized Medicine

Germany is a pioneer in biotechnology and personalized medicine. Advances in genome research and cell therapy, spearheaded by companies like MorphoSys, enable tailored treatments that are transforming patient care. These innovations not only offer better therapeutic options but also open significant market opportunities in rapidly growing fields like immunotherapy.

The Importance of Clinical Trials in Pharmaceutical Development

Germany is among the global leaders in clinical trials. With world-class infrastructure, experienced professionals, and stringent ethical standards, the country provides ideal conditions for clinical research. Pharmaceutical companies benefit from rapid recruitment and high-quality data. International firms like Pfizer and Novartis leverage Germany’s clinical ecosystem to efficiently develop and test innovative therapies.

R&D remains the cornerstone of Germany’s future success in the pharmaceutical industry.

The Current State of the Pharmaceutical Market in Germany

Market Share and Growth Trends

The German pharmaceutical market is one of the largest in Europe, with an annual revenue exceeding €50 billion. Growth segments such as biologics and oncology dominate the market, with personalized therapies gaining increasing importance. Forecasts predict annual growth of 4–5% in the coming years. Compared to global trends, Germany leads in innovative therapies and integrating biotechnology into the pharmaceutical sector.

According to data from Statista, Germany’s pharmaceutical market revenue has been steadily increasing, reaching €59.8 billion in 2023. This trend highlights the industry’s strong growth and continued global competitiveness.

The Impact of the Chemical Industry on Pharmaceutical Production

The synergy between Germany’s chemical and pharmaceutical industries is a key success factor. Innovations in chemical processes, such as active ingredient synthesis or high-purity intermediates, enable the production of modern drugs. An example is the collaboration between BASF and Bayer, which developed advanced solutions for manufacturing new active ingredients.

Challenges and Opportunities Beyond 2025

Key challenges include rising regulatory requirements and potential disruptions in global supply chains, which are critical for the pharmaceutical business. However, digital health technologies, artificial intelligence (AI), and sustainability initiatives offer enormous potential. Companies adopting smart production technologies and sustainable business models can secure long-term competitive advantages.

Germany remains a strategically important market with promising future prospects.

How the Pharmaceutical Supply Chain Operates in Germany

Ensuring the Quality and Safety of Medicinal Products

Germany’s pharmaceutical industry adheres to the highest quality standards, particularly the EU GMP (Good Manufacturing Practices) guidelines. These stringent regulations ensure that medicines are safe, effective, and of the highest quality. Consistent compliance with these standards builds trust among global partners and strengthens Germany’s reputation as a reliable production hub.

The Role of Supply Chain Innovations

Technological advancements are revolutionizing pharmaceutical logistics in Germany. Blockchain technologies ensure transparency and traceability in the supply chain, while predictive analytics improve demand forecasting and inventory optimization. Companies like DHL and Bosch develop innovative solutions to enhance efficiency in the storage and distribution of pharmaceuticals. These technologies are essential to remain competitive in an increasingly challenging market.

Strategies for Overcoming Supply Chain Disruptions

The COVID-19 pandemic exposed vulnerabilities in global supply chains. Germany responded with strategies such as supplier diversification and promoting reshoring to reduce dependencies. Building strategic reserves and collaborating with EU partners also contributed to stabilization.

Through quality, innovation, and resilience, Germany’s supply chain remains one of the strongest in the global pharmaceutical sector.

Why Germany is a Prime Location for the Pharmaceutical Sector

Factors Making Germany a Prime Location

Germany offers numerous advantages for pharmaceutical companies. Its central location in Europe ensures quick access to key markets within and beyond the EU. The pool of highly skilled professionals in biotechnology, chemistry, and pharmacy is another crucial factor. Additionally, robust intellectual property protections provide a secure environment for innovation. Companies like Bayer and Boehringer Ingelheim deliberately chose Germany for its optimal conditions for research and production. Strategic site selection solutions, provided by specialized consulting firms such as ALTIOS, help companies identify the best opportunities for success in Germany’s pharmaceutical business.

Comparison with Other Leading Pharmaceutical Hubs

Compared to the US, Switzerland, and Singapore, Germany stands out for its excellent infrastructure and regulatory expertise. While the US leads in venture capital investments, Germany offers a stable legal framework and strong government support for companies in Germany. Against Singapore, Germany has the advantage of a larger domestic market and a diversified economy.

Future Prospects for the Pharmaceutical Industry in Germany

With growth areas such as biotechnology, artificial intelligence, and digital transformation, Germany remains competitive in the long term. Experts predict increasing investments in innovative therapies and sustainable production methods. Germany will continue to be a leading hub for pharmaceutical companies worldwide.

Strategic Takeaways for Industry Leaders

Germany combines advanced infrastructure, a highly skilled workforce, and a stable regulatory environment to strengthen the pharmaceutical sector. Industry leaders should explore strategic partnerships with German research institutions and companies to drive innovations in biotechnology and personalized medicine. Investments in digital technologies, such as AI-powered research and blockchain-enabled supply chains, are vital for staying competitive. Resilience strategies, including supply chain diversification and leveraging government programs, can help address regulatory and global challenges.

Germany’s Role in Shaping the Future of Global Pharma

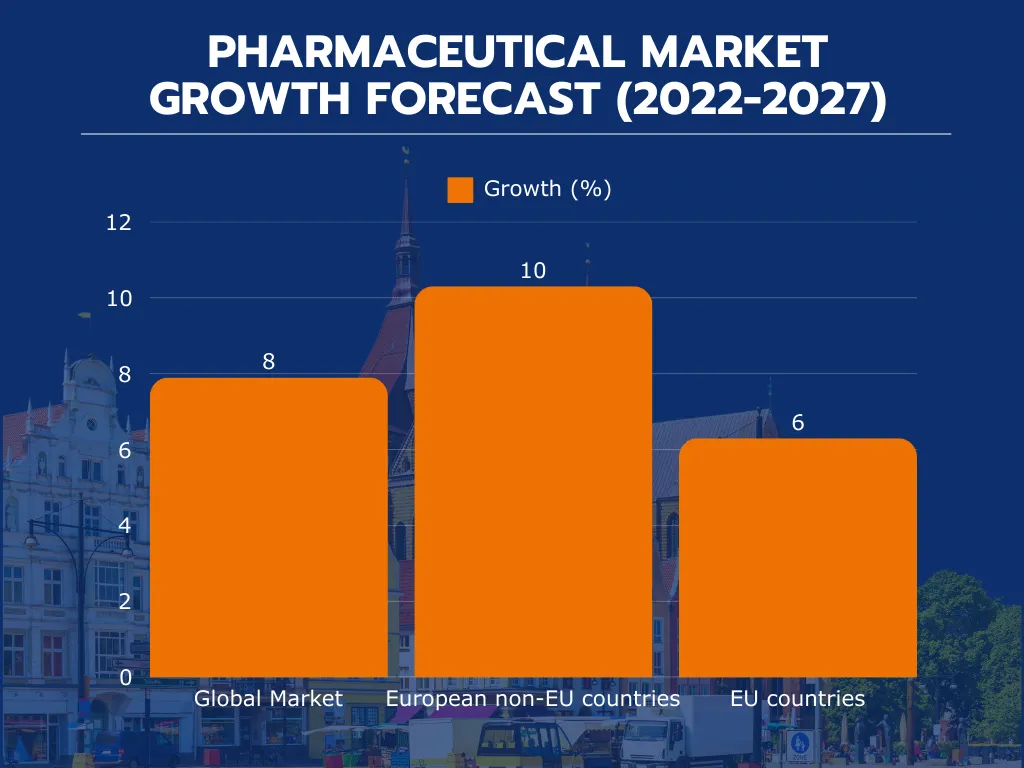

Statista reports that the global pharmaceutical market is projected to grow by 7.9% from 2022 to 2027, while European non-EU countries may reach 10.3% and EU countries 6.3%. This forecast underscores Germany’s role in shaping Europe’s pharmaceutical growth.

Germany’s leadership in research and development, combined with its strategic position in Europe, will continue to influence global pharmaceutical trends. While the global market is projected to grow at 7.9 percent from 2022 to 2027, European non-EU countries could reach 10.3 percent, and EU countries are forecast at 6.3 percent. Germany’s robust R&D ecosystem and export-driven pharmaceutical industry ensure it remains central to this growth. By spearheading cutting-edge therapies and collaborating with both EU partners and global stakeholders, Germany effectively shapes regulatory standards, innovation priorities, and market access strategies for the entire sector, reinforcing its pivotal role in shaping the future of global pharma.

Global industry leaders can leverage Germany’s strengths to secure long-term success. Germany’s contributions to the pharmaceutical industry remain essential—as a driver of innovation, an export leader, and a pioneer in sustainable and patient-centered solutions.

FAQ: Germany’s Pharmaceutical Industry

Why should pharmaceutical companies invest in Germany?

Germany is Europe’s largest pharmaceutical market and a global leader in R&D, with an annual revenue of €59.8 billion (2023) and €7.4 billion in R&D investments. The country’s advanced regulatory framework, world-class infrastructure, and access to EU markets make it a prime investment destination.

ALTIOS Advice: CEOs should consider Germany not just as a sales market but as a strategic R&D and manufacturing hub. ALTIOS helps companies with market entry, site selection, and regulatory navigation to accelerate expansion.

How does Germany’s R&D ecosystem benefit pharmaceutical innovation?

Germany’s pharmaceutical giants—Bayer, Boehringer Ingelheim, and Merck—invest billions in R&D, driving breakthroughs in oncology, personalized medicine, and immunotherapy. The country also fosters biotech startups and university partnerships, strengthening its innovation pipeline.

ALTIOS Advice: CEOs should explore joint ventures and acquisitions with German biotech firms to accelerate drug development and tap into public R&D funding. ALTIOS provides strategic partner-matching services to connect companies with the right local players.

What is the best market entry strategy for international pharmaceutical firms in Germany?

Germany offers various entry pathways, including direct investment, strategic partnerships, M&A, and R&D collaborations. The biotech and generics sectors offer high-growth potential, particularly for firms investing in personalized medicine and AI-driven drug discovery.

ALTIOS Advice: CEOs should conduct a thorough market feasibility study before entering Germany. ALTIOS provides customized entry strategies, helping companies with site selection, business incorporation, and local partnership development to ensure a successful market launch.

How much is Germany’s pharmaceutical industry worth?

As of 2023, Germany’s pharmaceutical industry is valued at €59.8 billion, reflecting a 5.7% increase from the previous year. This consistent growth highlights the country’s strong demand for pharmaceutical products, robust exports, and innovation-driven market dynamics.

ALTIOS Advice: CEOs should leverage Germany’s expanding market by establishing R&D centers, manufacturing hubs, or strategic partnerships with local pharma leaders. ALTIOS provides expert guidance on investment strategies and regulatory compliance to help businesses capitalize on this growth.

Is Germany more conservative with its pharmaceutical industry?

Germany maintains a balanced yet rigorous approach to pharmaceutical regulation. The country allows a six-month free pricing period for new drugs, enabling companies to set their own prices, but later assesses the health benefits of medications to determine long-term pricing and reimbursement policies. This ensures innovation is rewarded while maintaining cost efficiency and patient access.

ALTIOS Advice: CEOs should proactively engage with German regulatory bodies and understand market access strategies early. ALTIOS assists pharmaceutical firms in navigating Germany’s pricing regulations and optimizing market entry strategies.