Why Global Manufacturers Are Turning to India

In today’s evolving global manufacturing landscape, India, with its powerful combination of cost advantages, skilled manpower, digital readiness, and a reform-oriented government, has emerged as a top manufacturing destination.

It is backed by national initiatives like Make in India, Gati Shakti, and targeted Production Linked Incentive (PLI) schemes, India has successfully attracted major global players such as Apple, Samsung, Boeing, Siemens, and Hyundai. These companies are leveraging India not only for its cost-effective production capabilities but also for market access to over 1.4 billion people.

Why India Offers a Strategic Advantage for Manufacturers?

A Competitive Cost Structure

Labor costs in India remain competitive. The average monthly wage for contract manufacturing labour is €125 – €200 in India. Coupled with low corporate taxes (as low as 17% for new manufacturers) and subsidies, India provides a substantial cost edge.

A Highly Skilled and Abundant Talent Pool

India produces over 1.5 million engineers annually, and 85% of its population is under 55. The country also ranks among the top globally in science and engineering graduates.

Abundant Natural Resources

India holds the world’s 3rd largest reserves of iron ore, fourth largest of coal, and is rich in copper, manganese, and bauxite, key inputs for manufacturing industries. Sourcing raw or semi-finished materials within the country reduces import dependency.

A Growing Domestic Market

Manufacturing in India also opens doors to a rapidly expanding middle-class consumer base. The middle class is expected to comprise 63% of India’s population by 2047. Manufacturing locally gives firms a significant edge in understanding and entering this promising market.

Government Support and Infrastructure

Massive infrastructure upgrades under Gati Shakti, investment in industrial corridors, and a shift to digital platforms for approvals and licenses signal the government’s commitment. Industrial parks, SEZs, and logistics networks make India production ready.

To know more about why you should expand in India in 2025, check out article Why expand your business in India in 2025 for foreign companies

Execution Plan for Setting Up Manufacturing in India

1. Choose the Right Business Structure

Timeline: 4–6 weeks

Start with the legal entity. Most companies choose:

- Private Limited Company (recommended for full control)

- Limited Liability Partnership (LLP)

- Joint Venture (JV) with an Indian partner

A wholly owned subsidiary gives foreign companies maximum control over contracts, taxation, and banking.

2. Select the Ideal Location

Timeline: 6–8 weeks

Companies can conduct a tailored location analysis factoring in:

- Sector focus (e.g., auto, electronics, green tech)

- Proximity to suppliers and customers

- Labor availability and cost

- Infrastructure: ports, roads, power, water

- Incentives offered by state governments

Top states for industry include:

- Tamil Nadu (automotive, textiles)

- Maharashtra (chemicals, food processing)

- Gujarat (semiconductors, engineering)

- Telangana & Karnataka (electronics, aerospace)

3. Acquire Land and Obtain Industrial Approvals

Timeline: 12–20 weeks

Options include:

- Government Industrial Parks: Offer plug-and-play infrastructure

- Special Economic Zones (SEZs): Export-friendly tax benefits

- Private Land: Greater flexibility, but due diligence is critical

Mandatory approvals:

- Land use and zoning clearance

- Environmental and Pollution Control Board approval

- Building plans and fire safety certification

- Factory License (Factories Act, 1948)

Local advisors like Altios International can help to validate legal titles and permits.

4. Register for Tax and Business Compliance

Timeline: 3–4 weeks

Required registrations:

- PAN (Permanent Account Number) and TAN (Tax Deduction and Collection Account Number) for tax deduction

- GST for goods/services taxation

- Import Export Code (IEC) for cross-border trade

- Shops and Establishments Registration (state-specific)

- Employee Provident Fund (EPF) and ESIC for staff welfare

India’s compliance environment demands monthly filings for GST, TDS, PF/ESIC, and annual financial audits.

5. Recruit and Manage Talent

Timeline: 4–8 weeks

Staffing models:

- Direct employment typical for long-term control

- Employer of Record: useful during setup or for temporary teams

- Wage and Working Conditions Code

- Industrial Relations Code

- Factories Act safety norms

Local nuances matter, regional languages, payroll systems, and statutory benefits can be complex. Working with an experienced HR consultant or partnering with a local expert like Altios International helps ensure seamless onboarding.

6. Access Central and State Incentives

Timeline: Ongoing – requires early application

Central Schemes:

- PLI Schemes in 14 sectors, e.g., electronics, solar, auto, pharma

- SEZ benefits: No GST, reduced corporate tax, duty-free import of capital goods

State Schemes:

- Capital and employment-linked subsidies

- Stamp duty and electricity duty waivers

- Fast-track approvals

7. Design for Sustainability and ESG

Timeline: Parallel to plant design

International clients increasingly expect suppliers to meet ESG standards. Build your factory with:

- Renewable energy integration (solar rooftops, PPA models)

- Wastewater recycling, air emission controls

- Worker welfare infrastructure (housing, healthcare access)

- Local community engagement (CSR initiatives)

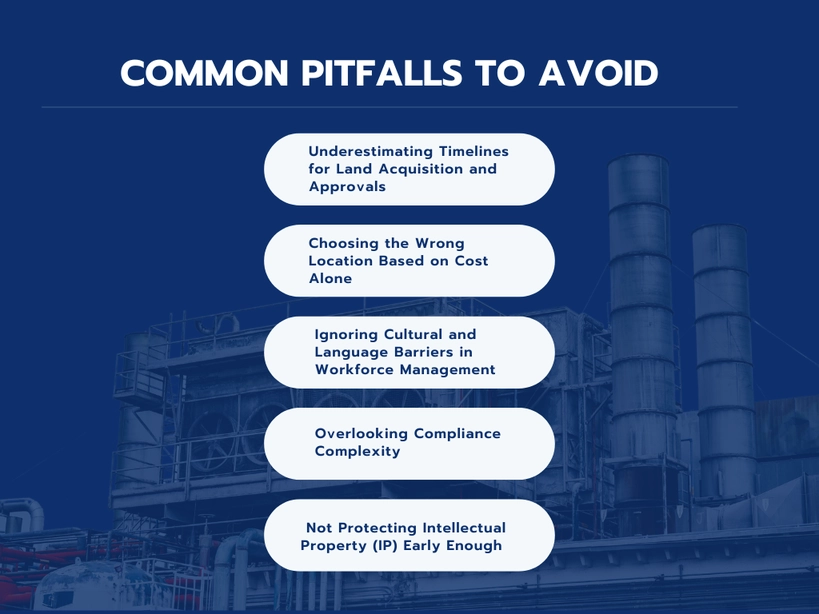

Common Pitfalls to Avoid When Setting Up Manufacturing in India

Even though India offers a wealth of opportunity, manufacturers frequently encounter setbacks that delay timelines and increase costs. Here are some common mistakes and how to avoid them:

1. Underestimating Timelines for Land Acquisition and Approvals: Government processes in India involve navigating multiple agencies. Clearance for zoning, environmental approvals, utilities, and licensing can take months. Many foreign mid cap companies assume these steps are quick and fail to build in contingency time.

2. Choosing the Wrong Location Based on Cost Alone: Low land prices may come with poor connectivity, unreliable utilities, or labour shortages. Companies often regret not conducting comprehensive location due diligence.

3. Ignoring Cultural and Language Barriers in Workforce Management: India’s labour laws, workplace culture, and regional languages can complicate onboarding and operations. Misalignment between corporate HQ and local teams is common.

4. Overlooking Compliance Complexity: Monthly tax filings, labour law reporting, and environmental compliance involve more steps than many expect. A missed registration or delayed submission can trigger penalties.

5. Not Protecting Intellectual Property (IP) Early Enough: IP laws in India are evolving. Companies often share sensitive designs or technology with local partners without sufficient safeguards.

Set Up Your Manufacturing Operations in India with Confidence, Partner with ALTIOS International

India’s manufacturing sector is expanding rapidly, driven by strong demand, government incentives, and a growing domestic market. Sectors such as electronics, electric vehicles, renewable energy, semiconductors, and healthcare manufacturing offer compelling opportunities for international companies. But to succeed, foreign mid cap firms need more than just market research, they need trusted local support, flawless execution, and long-term operational guidance.

That’s where ALTIOS International comes in.

With a presence in seven major Indian cities (Delhi, Gurugram, Bangalore, Mumbai, Hyderabad, Pune, Chennai) ALTIOS International is deeply rooted in India’s industrial ecosystem. We have helped more than 150 foreign mid-sized companies to:

- Launch manufacturing operations through greenfield projects, acquisitions, or joint ventures

- Secure government incentives and funding, including support for India’s Production Linked Incentive (PLI) schemes

- Recruit factory and leadership talent through our Global HR Solutions platform

- Ensure compliance with India’s dynamic tax, labour, and regulatory frameworks

- Manage end-to-end setup—from site selection and legal incorporation to back-office operations and supply chain support

Whether you’re building an EV component plant in Tamil Nadu, setting up a solar panel unit in Rajasthan, or starting a medical device facility in Maharashtra, ALTIOS International delivers customized, scalable solutions aligned with your manufacturing goals.

Global clients such as SCM have trusted us to handle complex manufacturing setups—from feasibility studies and regulatory approvals to operational go-live.

FAQ

How do I avoid delays or hidden costs when acquiring land in India?

Start with the basics: confirm the land has a clean title, no disputes, and clear mutation records. Use government sources like the Bhoomi portal or local land departments. Don’t skip due diligence—fixing title issues later is costly and painful.

Consent-based acquisition (when possible) can cut red tape. Understand what compensation is legally due under the Right to Fair Compensation Act—so you’re not blindsided later.

What licenses do I need to run a manufacturing plant in India, and how long does it take?

At a minimum, expect:

Factory License (Factories Act, 1948) – needed if you hire 10+ workers with power or 20+ without. Includes site layout, NOCs (fire, water, pollution). Timeline: 30–60 days.

Pollution control (Consent to Establish/Operate) – 15–30 days depending on the state.

Fire NOC / Boiler License – faster in single-window states (7–10 days in places like Telangana).

Bottom line: With a good file and proactive follow-up, expect 1–3 months for full compliance.

How do I choose the best Indian state for manufacturing?

Follow the data—not assumptions. Key performers:

Gujarat: Logistics strength + sector diversity (textiles, pharma, petrochem).

Karnataka: High innovation, strong in electronics and aerospace.

Tamil Nadu: Auto and electronics hub with excellent infrastructure.

Maharashtra: Strong FDI, financial center, and a broad industrial base.

What matters most is alignment with your sector, talent needs, and logistics chain.

Can I start hiring before my factory is registered?

No. It’s non-compliant and risky.

Without registration, you can’t legally hire, pay salaries, or open PF/ESI accounts. The Factories Act requires formal notification and licensing before operations. Penalties can reach ₹200,000, with added daily fines and even imprisonment.

Build your team—but time it right.

What’s the timeline to set up a manufacturing plant?

A typical schedule:

Company formation + site selection: 1–1.5 months

Land + layout + NOCs: 1–2 months

Factory/pollution licenses: 1–2 months

Construction + commissioning: 12–36 months (based on plant size)

With local support, phases can overlap and move faster. But plan for 18–24 months end-to-end.

How can I avoid tax or compliance surprises?

Register correctly (GST, PAN, TAN).

Use reliable accounting tools—track invoices, credits, returns.

Run internal audits quarterly.

Stay on top of rule changes—India updates often.

Work with on-the-ground experts. Firms like Altios spot issues early and keep you compliant from day one.

What’s the smart way to build a local team in India?

Stay compliant: Register on the Shram Suvidha portal. Follow new labour codes and state-specific rules.

Set clear HR policies: Localised, legally sound, and culturally aligned.

Don’t go it alone: Use local HR partners (recruitment, payroll, contracts). It’s faster, safer, and cheaper in the long run.

Am I missing government incentives?

Possibly. Central and state schemes vary—but here’s where to look:

Central: M-SIPS (electronics), Start-up India, Stand-up India.

State: Odisha, Andhra Pradesh, and others offer CAPEX support, tax breaks, and stamp duty waivers.

The key is to align your setup with eligible criteria—and file correctly. That’s where expert support pays off.